Question: can u please answer question 3 ) 90% 1 % O Fri 03:46 a E Preview File Edit View Go Tools Window Help Final exam

can u please answer question 3

can u please answer question 3

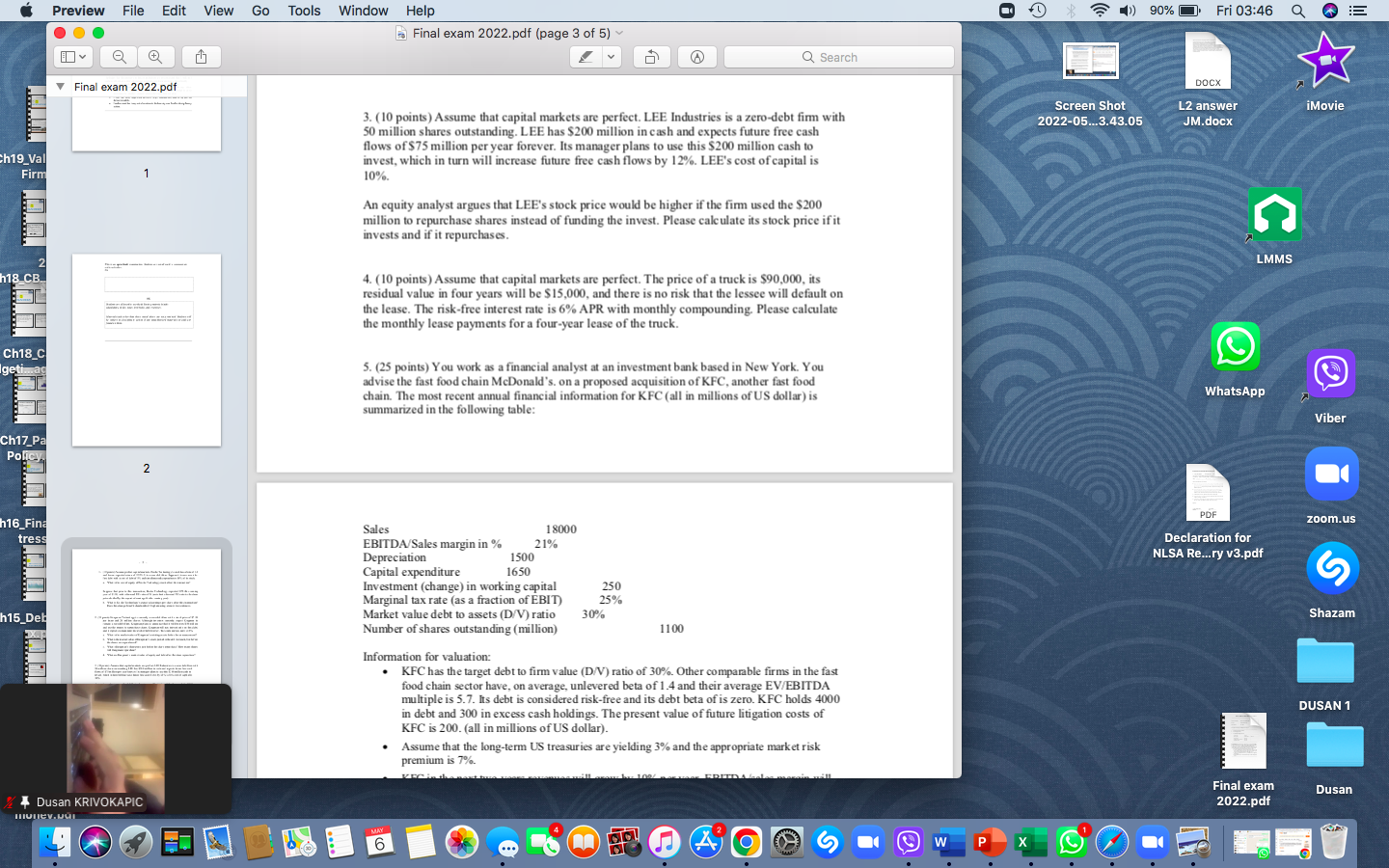

) 90% 1 % O Fri 03:46 a E Preview File Edit View Go Tools Window Help Final exam 2022.pdf (page 3 of 5) V Q Search Final exam 2022.pdf DOCX iMovie Screen Shot 2022-05...3.43.05 L2 answer JM.docx 3. (10 points) Assume that capital markets are perfect. LEE Industries is a zero-debt firm with 50 million shares outstanding. LEE has $200 million in cash and expects future free cash flows of $75 million per year forever. Its manager plans to use this $200 million cash to invest, which in turn will increase future free cash flows by 12%. LEE's cost of capital is 10% Ch19 Val Firm 1 1 An equity analyst argues that LEE's stock price would be higher if the firm used the $200 million to repurchase shares instead of funding the invest. Please calculate its stock price if it invests and if it repurchases. LMMS 2 h18 CB 4. (10 points) Assume that capital markets are perfect. The price of a truck is $90,000, its residual value in four years will be $15,000, and there is no risk that the lessee will default on the lease. The risk-free interest rate is 6% APR with monthly compounding. Please calculate the monthly lease payments for a four-year lease of the truck. Ch18_C Igeti...a 5. (25 points) You work as a financial analyst at an investment bank based in New York. You advise the fast food chain McDonald's, on a proposed acquisition of KFC, another fast food chain. The most recent annual financial information for KFC (all in millions of US dollar) is summarized in the following table: WhatsApp Viber Ch17 Pa Policy 2 PDF zoom.us h16_Find tress Declaration for NLSA Re...ry v3.pdf DI Sales 18000 EBITDA Sales margin in % 21% Depreciation 1500 Capital expenditure 1650 Investment (change) in working capital 250 Marginal tax rate (as a fraction of EBIT) 25% Market value debt to assets (D/V) ratio 30% % Number of shares outstanding (million) h15 Del Shazam 1100 Information for valuation: KFC has the target debt to firm value (D/V) ratio of 30%. Other comparable firms in the fast food chain sector have, on average, unlevered beta of 1.4 and their average EV/EBITDA multiple is 5.7. Its debt is considered risk-free and its debt beta of is zero. KFC holds 4000 in debt and 300 in excess cash holdings. The present value of future litigation costs of KFC is 200. (all in millions of US dollar). Assume that the long-term US treasuries are yielding 3% and the appropriate market risk premium is 7%. DUSAN 1 VRC Final exam 2022.pdf Dusan Dusan KRIVOKAPIC HUUev.ua MAY J 6 4 w P X

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts