Question: please answer question 3 and 4 and so i can write it out. Question 3: As an independent public company, the Bauxite Division will have

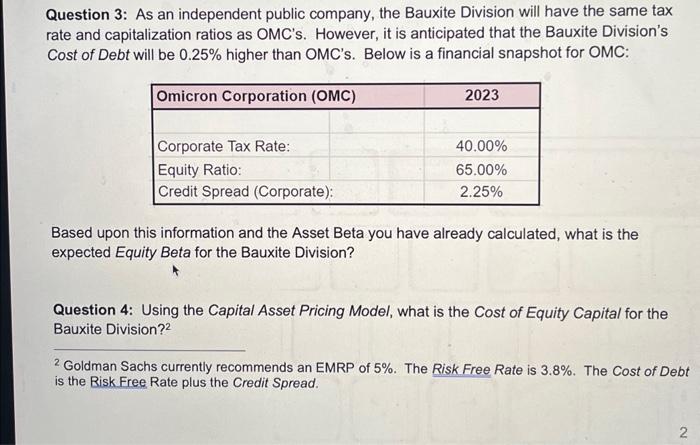

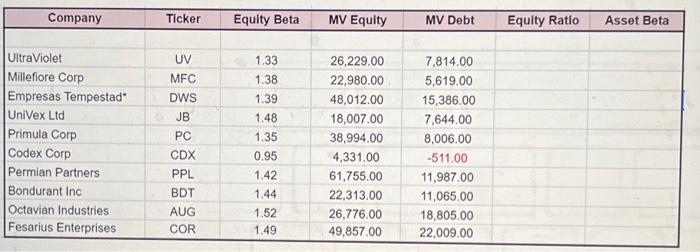

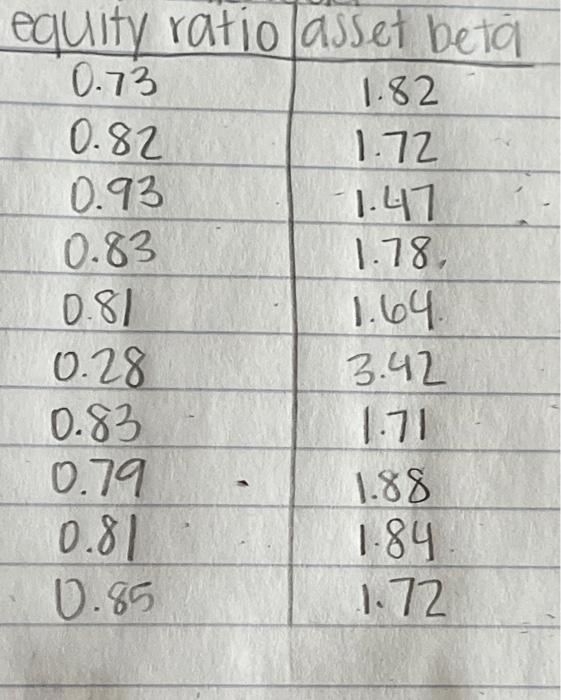

Question 3: As an independent public company, the Bauxite Division will have the same tax rate and capitalization ratios as OMC's. However, it is anticipated that the Bauxite Division's Cost of Debt will be 0.25% higher than OMC's. Below is a financial snapshot for OMC: Based upon this information and the Asset Beta you have already calculated, what is the expected Equity Beta for the Bauxite Division? Question 4: Using the Capital Asset Pricing Model, what is the Cost of Equity Capital for the Bauxite Division?? 2 Goldman Sachs currently recommends an EMRP of 5%. The Risk Free Rate is 3.8%. The Cost of Deb is the Risk Free Rate plus the Credit Spread. \begin{tabular}{c|c} equity ratio & asset beta \\ \hline 0.73 & 1.82 \\ 0.82 & 1.72 \\ 0.93 & 1.47 \\ 0.83 & 1.78 \\ 0.81 & 1.64 \\ 0.28 & 3.42 \\ 0.83 & 1.71 \\ 0.79 & 1.88 \\ 0.81 & 1.84 \\ 0.85 & 1.72 \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts