Question: Please answer question 3 and 4: Question 3: 6 points 1. Assume inflation goes up in Mexico compared to the US: a. Will the supply

Please answer question 3 and 4:

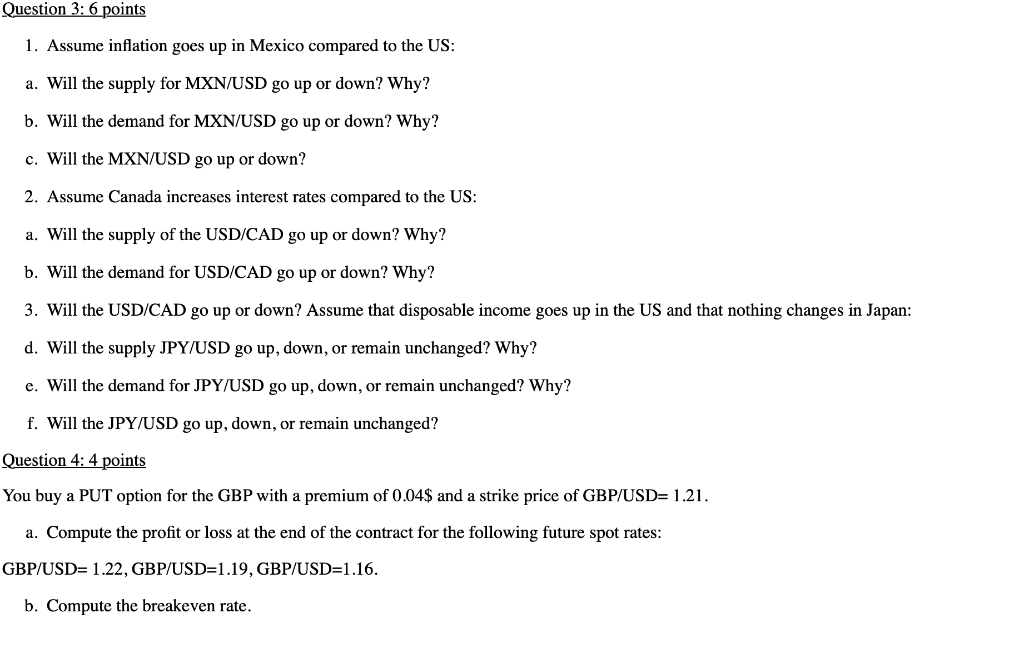

Question 3: 6 points 1. Assume inflation goes up in Mexico compared to the US: a. Will the supply for MXN/USD go up or down? Why? b. Will the demand for MXN/USD go up or down? Why? c. Will the MXN/USD go up or down? 2. Assume Canada increases interest rates compared to the US: a. Will the supply of the USD/CAD go up or down? Why? b. Will the demand for USD/CAD go up or down? Why? 3. Will the USD/CAD go up or down? Assume that disposable income goes up in the US and that nothing changes in Japan: d. Will the supply JPY/USD go up, down, or remain unchanged? Why? e. Will the demand for JPY/USD go up, down, or remain unchanged? Why? f. Will the JPY/USD go up, down, or remain unchanged? Question 4: 4 points You buy a PUT option for the GBP with a premium of 0.04$ and a strike price of GBP/USD= 1.21. a. Compute the profit or loss at the end of the contract for the following future spot rates: GBP/USD= 1.22, GBP/USD=1.19, GBP/USD=1.16. b. Compute the breakeven rate. Question 3: 6 points 1. Assume inflation goes up in Mexico compared to the US: a. Will the supply for MXN/USD go up or down? Why? b. Will the demand for MXN/USD go up or down? Why? c. Will the MXN/USD go up or down? 2. Assume Canada increases interest rates compared to the US: a. Will the supply of the USD/CAD go up or down? Why? b. Will the demand for USD/CAD go up or down? Why? 3. Will the USD/CAD go up or down? Assume that disposable income goes up in the US and that nothing changes in Japan: d. Will the supply JPY/USD go up, down, or remain unchanged? Why? e. Will the demand for JPY/USD go up, down, or remain unchanged? Why? f. Will the JPY/USD go up, down, or remain unchanged? Question 4: 4 points You buy a PUT option for the GBP with a premium of 0.04$ and a strike price of GBP/USD= 1.21. a. Compute the profit or loss at the end of the contract for the following future spot rates: GBP/USD= 1.22, GBP/USD=1.19, GBP/USD=1.16. b. Compute the breakeven rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts