Question: please answer question 3, based on question 2, attached below. 2. You are_an_employee_of_Uniyersity C_onsultants, Ltd., and have been given the following assignment, You_are to present_an_inyestment_analysisis

please answer question 3, based on question 2, attached below.

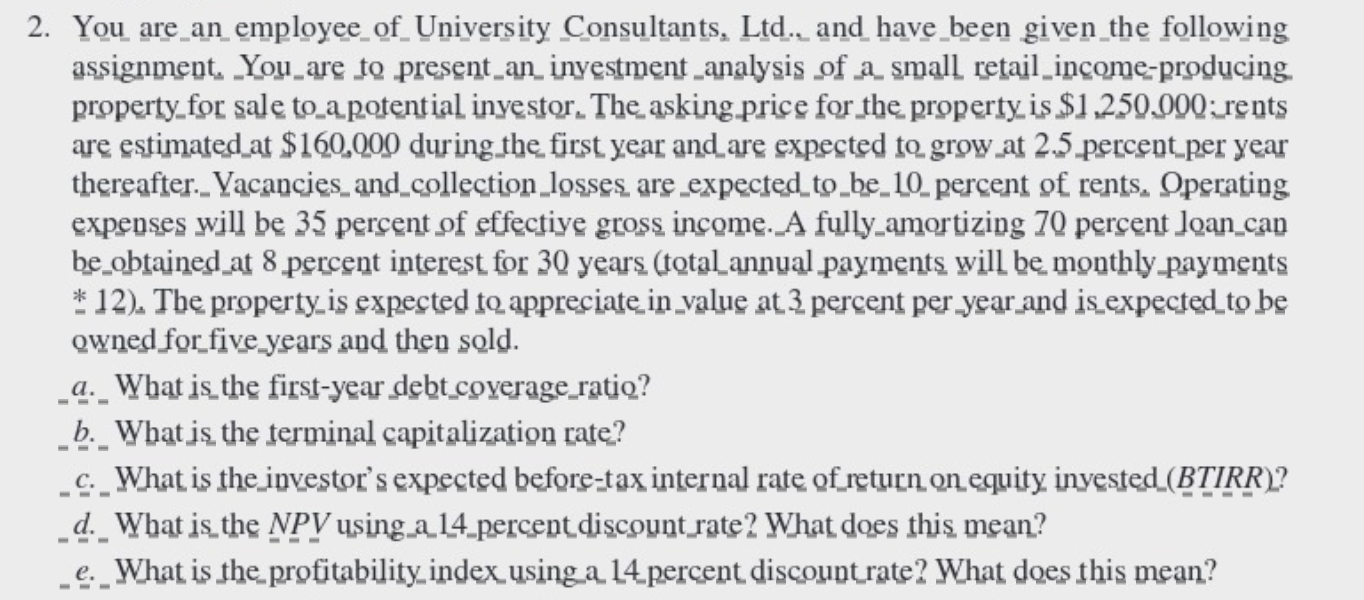

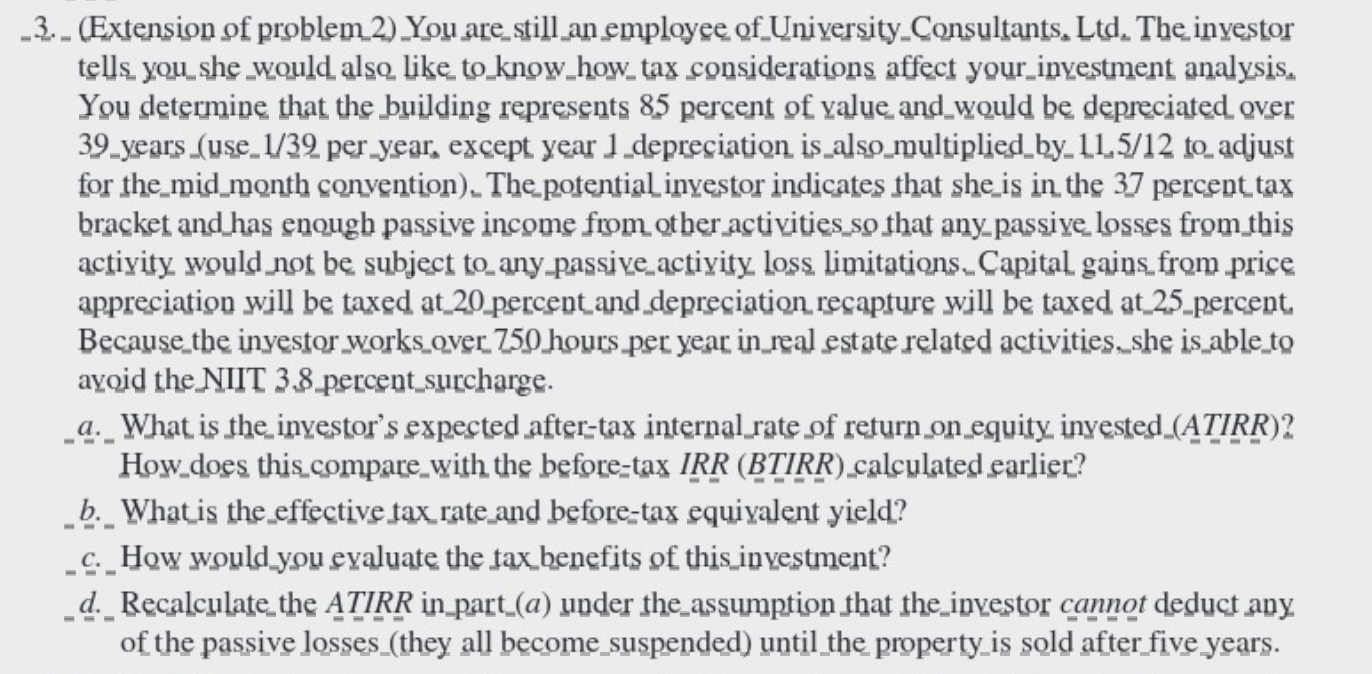

2. You are_an_employee_of_Uniyersity C_onsultants, Ltd., and have been given the following assignment, You_are to present_an_inyestment_analysisis of a_ small retail_income-prodcing. property_for sale to_a potential inyestor. The asking price for the property is $1,250,000; rents are estimated_at $160,000 during_the first year and_are expected to grow_at 2.5 percent_per year thereafter._ Vcancies_and_collection_losseses are_expected_to_be_10_percent of rents. Operating expenses will be 35 percent of effectiye gross income. A fully_amortizing 70 percent loan_can be_obtained_at 8 percent interest for 30 years (total_annual payments will be monthly_payments * 12). The property_is expected to appreciate in value at 3 percent per_year_and is_expected_to be ownned for five_years and then sold. _ a. What is the first-year debt_coverage_ratio? _- . What is the terminal capitalization rate? _c. What is the investor's expected before-tax internal rate of return on equity inyested_(BTIRR)? _d. W What is_the NPV using_a_14_percentdiscount rate? What does this mean? _e._What is the profitability index usinga 14 percent discount rate? What does this mean? 3. _ (Extension of problem_2)_You are_still_an employee of_University_Consultants, Ltd. The investor tells_you_she_would also like_to_know_how_tax considerations affect your_inzestment analysis. You determmine that the building represenents 85 percent of of value and_would be be depereciated_ over 39_years__use_1/39 per_year_, except year 1_depreciation is_also_multiplied_by_11_5/12 to_adjust for the_mid_month conyention)_The_potential_investor indicates that she_is in the 37 percent tax bracket and_has enougb passive income from_otber_activities_so that any_passive_losses from_this activity would_not be subject to_any_passive_activity loss limitations_Capital gains_from price appreciation will be taxed at_20_percent_and_depreciation_recapture will be taxed at_25_percent. Because_the inyestor_works_over_750_hours per year in_real estate related activities,_she is_able_to avoid the NIIT 3.8_percent_surcharge. _a. What is the inyestor's expected after_-tax internal_rate of return_on_equity inyested_(ATIRR)? How_does this_compare_with the before-tax IRRR(BTIRR )_calculated earlier? _ b. - What is the_effective tax_rate_and before-tax equivalent yield? _c. How would_you eyaluate the taxbbenefits of this_investment? _d._ Recalculate_the ATIRR in_part_(a) under the_assumption that the investor cannot deduct any of the passive losses_(they all become_suspended) until the property_is sold after five years. 2. You are_an_employee_of_Uniyersity C_onsultants, Ltd., and have been given the following assignment, You_are to present_an_inyestment_analysisis of a_ small retail_income-prodcing. property_for sale to_a potential inyestor. The asking price for the property is $1,250,000; rents are estimated_at $160,000 during_the first year and_are expected to grow_at 2.5 percent_per year thereafter._ Vcancies_and_collection_losseses are_expected_to_be_10_percent of rents. Operating expenses will be 35 percent of effectiye gross income. A fully_amortizing 70 percent loan_can be_obtained_at 8 percent interest for 30 years (total_annual payments will be monthly_payments * 12). The property_is expected to appreciate in value at 3 percent per_year_and is_expected_to be ownned for five_years and then sold. _ a. What is the first-year debt_coverage_ratio? _- . What is the terminal capitalization rate? _c. What is the investor's expected before-tax internal rate of return on equity inyested_(BTIRR)? _d. W What is_the NPV using_a_14_percentdiscount rate? What does this mean? _e._What is the profitability index usinga 14 percent discount rate? What does this mean? 3. _ (Extension of problem_2)_You are_still_an employee of_University_Consultants, Ltd. The investor tells_you_she_would also like_to_know_how_tax considerations affect your_inzestment analysis. You determmine that the building represenents 85 percent of of value and_would be be depereciated_ over 39_years__use_1/39 per_year_, except year 1_depreciation is_also_multiplied_by_11_5/12 to_adjust for the_mid_month conyention)_The_potential_investor indicates that she_is in the 37 percent tax bracket and_has enougb passive income from_otber_activities_so that any_passive_losses from_this activity would_not be subject to_any_passive_activity loss limitations_Capital gains_from price appreciation will be taxed at_20_percent_and_depreciation_recapture will be taxed at_25_percent. Because_the inyestor_works_over_750_hours per year in_real estate related activities,_she is_able_to avoid the NIIT 3.8_percent_surcharge. _a. What is the inyestor's expected after_-tax internal_rate of return_on_equity inyested_(ATIRR)? How_does this_compare_with the before-tax IRRR(BTIRR )_calculated earlier? _ b. - What is the_effective tax_rate_and before-tax equivalent yield? _c. How would_you eyaluate the taxbbenefits of this_investment? _d._ Recalculate_the ATIRR in_part_(a) under the_assumption that the investor cannot deduct any of the passive losses_(they all become_suspended) until the property_is sold after five years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts