Question: Please Answer Question 4 and 5 and show work. Thank you. 2. You need a new piece of equipment for your manufacturing process. You can

Please Answer Question 4 and 5 and show work. Thank you.

Please Answer Question 4 and 5 and show work. Thank you.

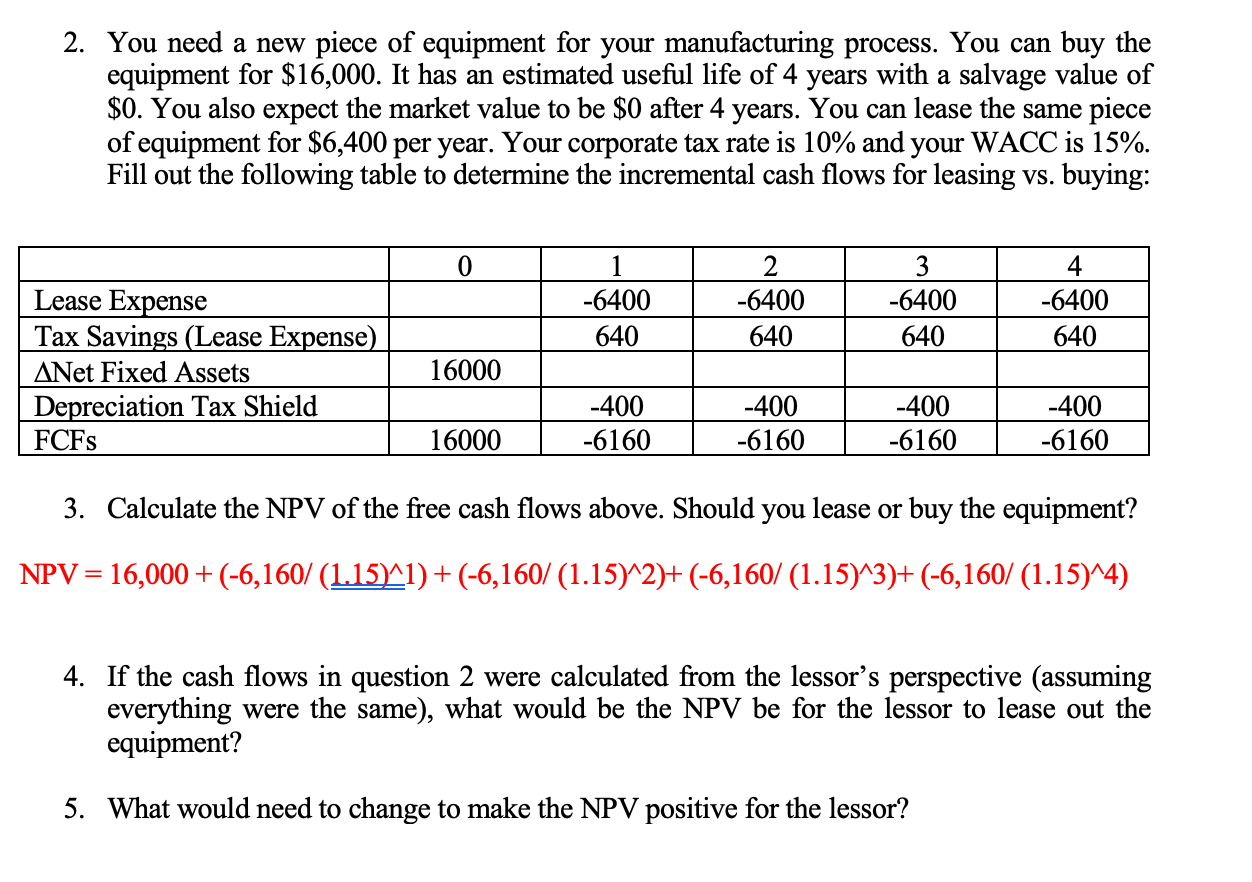

2. You need a new piece of equipment for your manufacturing process. You can buy the equipment for $16,000. It has an estimated useful life of 4 years with a salvage value of $0. You also expect the market value to be $0 after 4 years. You can lease the same piece of equipment for $6,400 per year. Your corporate tax rate is 10% and your WACC is 15%. Fill out the following table to determine the incremental cash flows for leasing vs. buying: 0 1 -6400 640 2 -6400 640 3 -6400 640 4 -6400 640 Lease Expense Tax Savings (Lease Expense) ANet Fixed Assets Depreciation Tax Shield FCFs 16000 -400 -6160 -400 -6160 -400 -6160 -400 -6160 16000 3. Calculate the NPV of the free cash flows above. Should you lease or buy the equipment? NPV = 16,000+(-6,160/ (1.15)^1) + (-6,160/ (1.15)^2)+(-6,160/ (1.15)^3)+ (-6,160/ (1.15)^4) = 4. If the cash flows in question 2 were calculated from the lessor's perspective (assuming everything were the same), what would be the NPV be for the lessor to lease out the equipment? 5. What would need to change to make the NPV positive for the lessor? 2. You need a new piece of equipment for your manufacturing process. You can buy the equipment for $16,000. It has an estimated useful life of 4 years with a salvage value of $0. You also expect the market value to be $0 after 4 years. You can lease the same piece of equipment for $6,400 per year. Your corporate tax rate is 10% and your WACC is 15%. Fill out the following table to determine the incremental cash flows for leasing vs. buying: 0 1 -6400 640 2 -6400 640 3 -6400 640 4 -6400 640 Lease Expense Tax Savings (Lease Expense) ANet Fixed Assets Depreciation Tax Shield FCFs 16000 -400 -6160 -400 -6160 -400 -6160 -400 -6160 16000 3. Calculate the NPV of the free cash flows above. Should you lease or buy the equipment? NPV = 16,000+(-6,160/ (1.15)^1) + (-6,160/ (1.15)^2)+(-6,160/ (1.15)^3)+ (-6,160/ (1.15)^4) = 4. If the cash flows in question 2 were calculated from the lessor's perspective (assuming everything were the same), what would be the NPV be for the lessor to lease out the equipment? 5. What would need to change to make the NPV positive for the lessor

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts