Question: PLEASE ANSWER QUESTION 4 (refer to Thinking Critically 6.1 for more information on Ponzi schemes). The reduced liquidity of the CDs gave Stanford time to

PLEASE ANSWER QUESTION 4

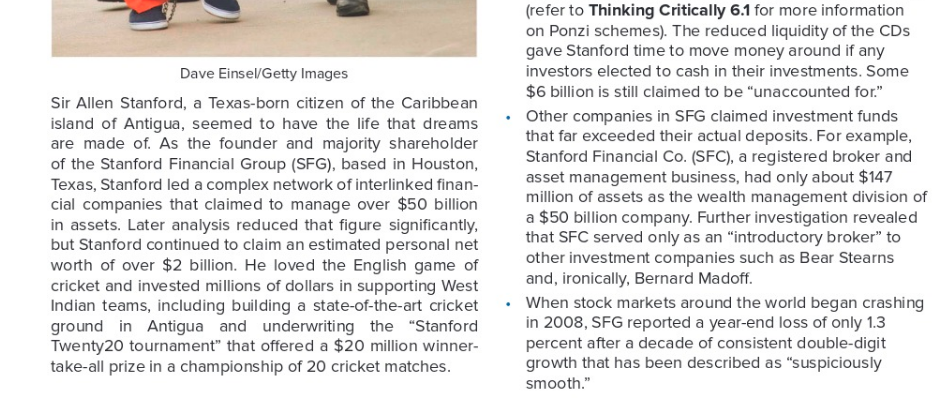

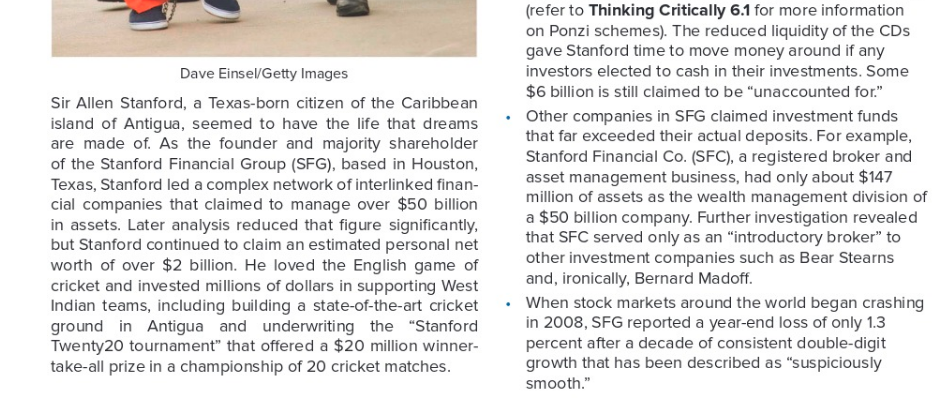

(refer to Thinking Critically 6.1 for more information on Ponzi schemes). The reduced liquidity of the CDs gave Stanford time to move money around if any Dave Einsel/Getty Images investors elected to cash in their investments. Some $6 billion is still claimed to be "unaccounted for." Sir Allen Stanford, a Texas-born citizen of the Caribbean island of Antigua, seemed to have the life that dreams Other companies in SFG claimed investment funds are made of. As the founder and majority shareholder that far exceeded their actual deposits. For example, of the Stanford Financial Group (SFG), based in Houston, Stanford Financial Co. (SFC), a registered broker and Texas, Stanford led a complex network of interlinked finan- asset management business, had only about $147 cial companies that claimed to manage over $50 billion million of assets as the wealth management division of in assets. Later analysis reduced that figure significantly, a $50 billion company. Further investigation revealed but Stanford continued to claim an estimated personal net that SFC served only as an introductory broker to worth of over $2 billion. He loved the English game of other investment companies such as Bear Stearns cricket and invested millions of dollars in supporting West and, ironically, Bernard Madoff. Indian teams, including building a state-of-the-art cricket. When stock markets around the world began crashing ground in Antigua and underwriting the Stanford in 2008, SFG reported a year-end loss of only 1.3 Twenty20 tournament" that offered a $20 million winner- percent after a decade of consistent double-digit take-all prize in a championship of 20 cricket matches. growth that has been described as "suspiciously smooth." Stanford continued to profess his innocence by claiming that he was wrong to trust the integrity of his CFO, James QUESTIONS Davis. "The investment and risk committee reported to Jim Davis, not to me," he said. As for the collapse of his finan- 1. How did SIB's status as an "offshore bank facilitate cial empire and his inability to repay investors, Stanford Stanford's alleged fraud? blamed the SEC for using him as a scapegoat" after failing 2. Why would investors be willing to sacrifice immediate to catch Bernard Madoff, and for the ripple effect of its access to the funds they deposited with SIB? indictment that prompted regulatory agencies around the 3. What elements were missing from the governance world to freeze the assets of his multiple investment com- structure of Stanford Financial Group? panies. I don't think there is any money missing, Stanford said. There never was a Ponzi scheme, and there never 4. What was the basis of Stanford's defense? was an attempt to defraud anybody." Sources: Sam Jones, "Fraud Probe at Labyrinth of SFG Stanford's time in prison was particularly eventful. He was companies," Financial Times, February 18, 2009; "Howzat! severely beaten by fellow prisoners; he was hospitalized Shocking Allegations against Stanford Group." The Economist , for heart problems, and he developed an alleged addic- Lemer, "The Stanford Scandal: Why Were Red Flags Ignored?" February 19, 2009; Joanna Chung, Tracey Alloway, and Jeremy tion to antianxiety medication and was declared incompe- The Financial Times, February 19, 2009; Clifford Krauss, "Chief tent to stand trial. After receiving treatment for the addic- Investment Officer at Stanford Group Indicted," The New York tion, he continued to plead not guilty in the face of mount- Times, May 13, 2009; Clifford Krauss, "Stanford Points Fingers in ing evidence against him. In March 2012, he was found Fraud Case," The New York Times, April 21, 2009; "Ex-Tycoon R. guilty on 13 of 14 counts of fraud, money laundering, and Allen Stanford Sentenced to 110 Years," Associated Press, June obstruction of justice. In June 2012, he was sentenced to 14, 2012; Michael E. Lindenberger and Murray Wass, "Allen 110 years in prison. Prosecutors had asked for the max- Stanford Files 299-Page Appeal of His 110-Year Sentence." The imum term of 230 years. Stanford's defense team had Stanford Loses Appeal of Ponzi Scheme Conviction," Reuters, Dallas Morning News, October 4, 2014; Jonathan Stempel, "Allen asked for 44 months, including time served in prison, October 29, 2015; Dan Roan and Patrick Nathanson, "Defiant US which would have left him with only 8 months to serve. Fraudster Allen Stanford Vows to Clear His Name," BBC News, In November 2014, Stanford's legal team filed a 299-page $7B Ponzi Scheme Will Wait Years to Be Repaid," DMagazine, January 11, 2016; Thomas Korosec, "Victims of Allen Stanford's appeal motion in the Fifth U.S. Circuit Court of Appeals November 2017, and Scott Cohn, "Victims of That Other Ponzi in New Orleans, making 10 distinct arguments as to why Scheme-Allen Stanford's-Say They Have Been Short-changed," he should be set free. After having retained over a dozen CNBC, February 20, 2019. lawyers over the course of his criminal case, Stanford elected to represent himself in the appeal, only to see the