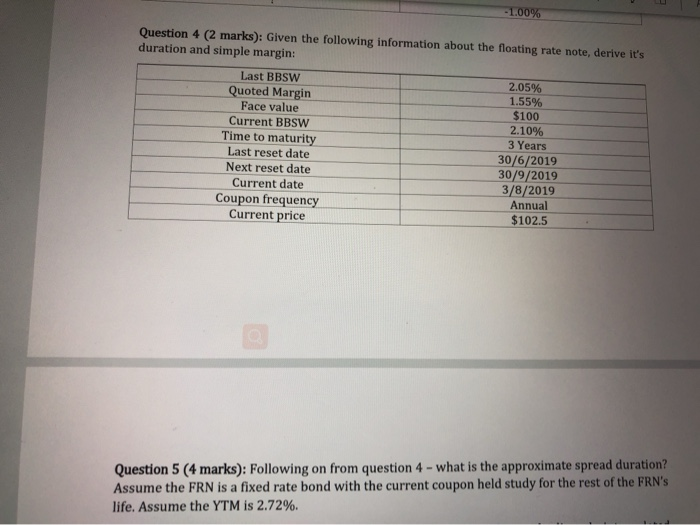

Question: Please answer Question 5 -1.00% Question 4 (2 marks): Given the following information about the floating rate note, derive it's duration and simple margin: Last

-1.00% Question 4 (2 marks): Given the following information about the floating rate note, derive it's duration and simple margin: Last BBSW Quoted Margin Face value 2.05% 1.55% $100 2.10% 3 Years Current BBSW Time to maturity Last reset date 30/6/2019 30/9/2019 3/8/2019 Annual $102.5 Next reset date Current date Coupon frequency Current price Question 5 (4 marks): Following on from question 4- what is the approximate spread duration? Assume the FRN is a fixed rate bond with the current coupon held study for the rest of the FRN's life. Assume the YTM is 2.72%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts