Question: please answer question 6 parts a and b ad-ons Help All changes saved in Drive Times New... 12 BI U AG I E E- Valuing

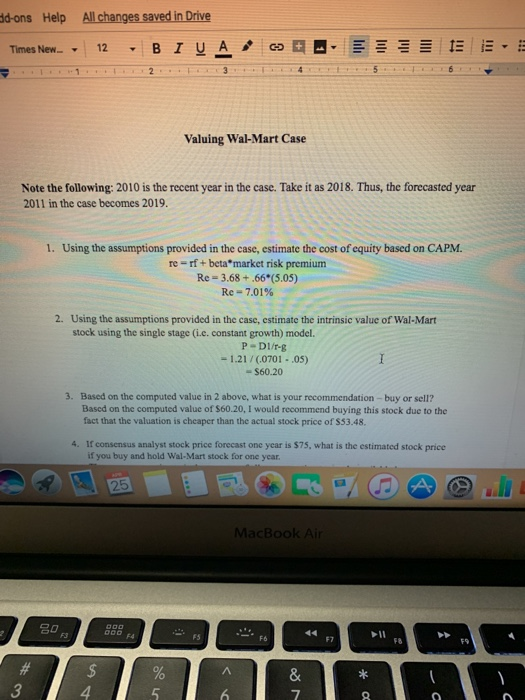

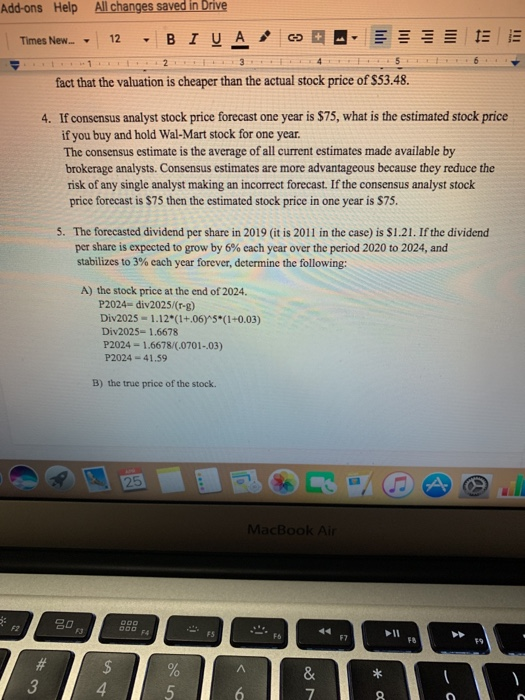

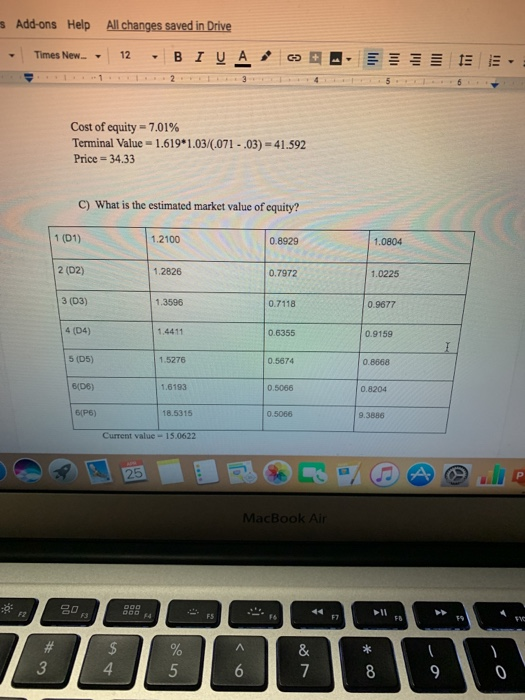

ad-ons Help All changes saved in Drive Times New... 12 BI U AG I E E- Valuing Wal-Mart Case Note the following: 2010 is the recent year in the case. Take it as 2018. Thus, the forecasted year 2011 in the case becomes 2019. 1. Using the assumptions provided in the case, estimate the cost of equity based on CAPM. re=rf+beta market risk premium Re = 3.68 +.66*(5.05) Re-7.01% 2. Using the assumptions provided in the case, estimate the intrinsic value of Wal-Mart stock using the single stage (i.e. constant growth) model. P-D1/- - 1.21/0.0701 - .05) - $60.20 3. Based on the computed value in 2 above, what is your recommendation - buy or sell? Based on the computed value of $60.20, I would recommend buying this stock due to the fact that the valuation is cheaper than the actual stock price of $53.48. 4. If consensus analyst stock price forecast one year is $75, what is the estimated stock price if you buy and hold Wal-Mart stock for one year. MacBook Air Add-ons Help All changes saved in Drive Times New... - 12 - BI VA . 15 15 fact that the valuation is cheaper than the actual stock price of $53.48. 4. If consensus analyst stock price forecast one year is $75, what is the estimated stock price if you buy and hold Wal-Mart stock for one year. The consensus estimate is the average of all current estimates made available by brokerage analysts. Consensus estimates are more advantageous because they reduce the risk of any single analyst making an incorrect forecast. If the consensus analyst stock price forecast is $75 then the estimated stock price in one year is $75. 5. The forecasted dividend per share in 2019 (it is 2011 in the case) is $1.21. If the dividend per share is expected to grow by 6% each year over the period 2020 to 2024, and stabilizes to 3% each year forever, determine the following: A) the stock price at the end of 2024. P2024 div 2025/(1-3) Div2025 - 1.12*(1+.06 5*(1+0.03) Div2025-1.6678 P2024 - 1.6678/6.0701-03) P2024 - 41.59 B) the true price of the stock. MacBook Air 4 5 6 7 8 Add-ons Help All changes saved in Drive - Times New.. 12 - B I V A co . E . Cost of equity = 7.01% Terminal Value = 1.619*1.03/(.071 - .03) = 41.592 Price = 34.33 C) What is the estimated market value of equity? 1 (01) 1.2100 0.8929 1.0804 2 (02) 1.2826 0.7972 1.0225 3 (03) 1.3596 0.7118 0.9677 4 (04) 0.6355 0.9159 5 (05) 1.5276 0.5674 0.8668 (6) 1.6193 0.5066 0.8204 P6) 18.5315 0.5066 9.3886 Current value-15.0622 MacBook Air 6. Assume that dividend per share increases by 8% in the next three years, then increases by 5% in the next two years, and 3% each year thereafter. A) Determine the terminal value and estimate the true price of the stock. B) Explain how to determine the total value of Wal-Mart. Estimate the total value. MacBook Air gos ad-ons Help All changes saved in Drive Times New... 12 BI U AG I E E- Valuing Wal-Mart Case Note the following: 2010 is the recent year in the case. Take it as 2018. Thus, the forecasted year 2011 in the case becomes 2019. 1. Using the assumptions provided in the case, estimate the cost of equity based on CAPM. re=rf+beta market risk premium Re = 3.68 +.66*(5.05) Re-7.01% 2. Using the assumptions provided in the case, estimate the intrinsic value of Wal-Mart stock using the single stage (i.e. constant growth) model. P-D1/- - 1.21/0.0701 - .05) - $60.20 3. Based on the computed value in 2 above, what is your recommendation - buy or sell? Based on the computed value of $60.20, I would recommend buying this stock due to the fact that the valuation is cheaper than the actual stock price of $53.48. 4. If consensus analyst stock price forecast one year is $75, what is the estimated stock price if you buy and hold Wal-Mart stock for one year. MacBook Air Add-ons Help All changes saved in Drive Times New... - 12 - BI VA . 15 15 fact that the valuation is cheaper than the actual stock price of $53.48. 4. If consensus analyst stock price forecast one year is $75, what is the estimated stock price if you buy and hold Wal-Mart stock for one year. The consensus estimate is the average of all current estimates made available by brokerage analysts. Consensus estimates are more advantageous because they reduce the risk of any single analyst making an incorrect forecast. If the consensus analyst stock price forecast is $75 then the estimated stock price in one year is $75. 5. The forecasted dividend per share in 2019 (it is 2011 in the case) is $1.21. If the dividend per share is expected to grow by 6% each year over the period 2020 to 2024, and stabilizes to 3% each year forever, determine the following: A) the stock price at the end of 2024. P2024 div 2025/(1-3) Div2025 - 1.12*(1+.06 5*(1+0.03) Div2025-1.6678 P2024 - 1.6678/6.0701-03) P2024 - 41.59 B) the true price of the stock. MacBook Air 4 5 6 7 8 Add-ons Help All changes saved in Drive - Times New.. 12 - B I V A co . E . Cost of equity = 7.01% Terminal Value = 1.619*1.03/(.071 - .03) = 41.592 Price = 34.33 C) What is the estimated market value of equity? 1 (01) 1.2100 0.8929 1.0804 2 (02) 1.2826 0.7972 1.0225 3 (03) 1.3596 0.7118 0.9677 4 (04) 0.6355 0.9159 5 (05) 1.5276 0.5674 0.8668 (6) 1.6193 0.5066 0.8204 P6) 18.5315 0.5066 9.3886 Current value-15.0622 MacBook Air 6. Assume that dividend per share increases by 8% in the next three years, then increases by 5% in the next two years, and 3% each year thereafter. A) Determine the terminal value and estimate the true price of the stock. B) Explain how to determine the total value of Wal-Mart. Estimate the total value. MacBook Air gos

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts