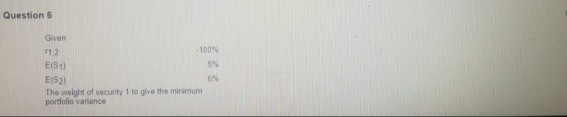

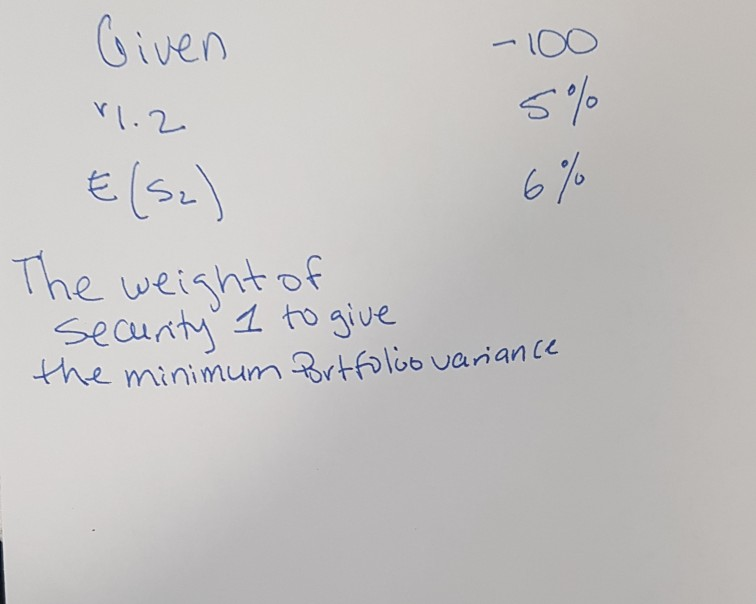

Question: please answer Question 6 Question 6 Given 192 ES1) E(S2) The weight of security 1 to give the minimum portfolio variance As an investor you

please answer Question 6

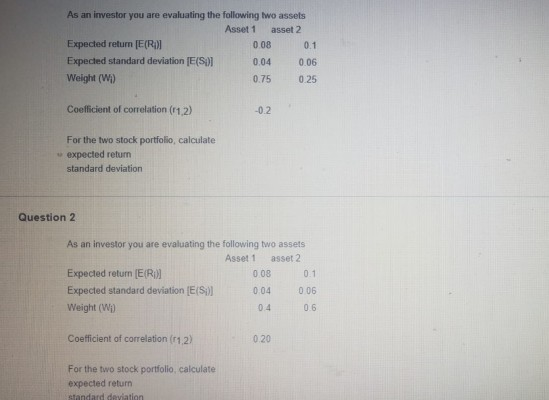

Question 6 Given 192 ES1) E(S2) The weight of security 1 to give the minimum portfolio variance As an investor you are evaluating the following two assets Asset 1 asset 2 Expected return [E(R) 0.08 0.1 Expected standard deviation (E(S1)] 0.04 0.06 Weight (Wi) 0.75 0.25 Coefficient of correlation (11.2) -02 For the two stock portfolio, calculate expected return standard deviation Question 2 As an investor you are evaluating the following two assets Asset 1 asset 2 Expected return (E(R) 008 0.1 Expected standard deviation (E(S)] 0.04 006 Weight (Wi) 06 Coefficient of correlation (11.2) 0.20 For the two stock portfolio calculate expected return Standard deviation Given a b v1.2. The weight of security 1 to give the minimum Portfolio variance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts