Question: Total 45 marks Problem #1 (8 marks) Information on two assets, X & Y, is below. Portfolios A through Khave been constructed by varying the

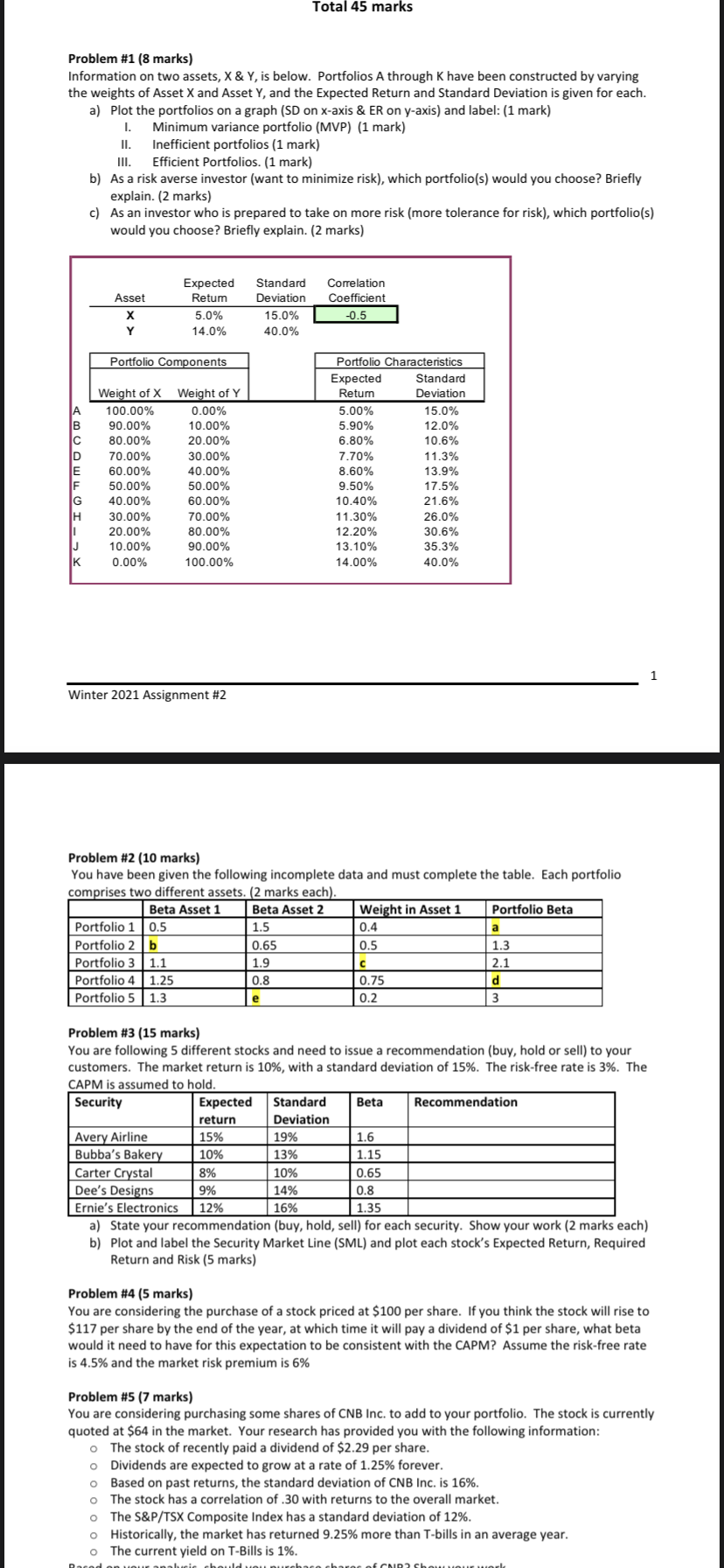

Total 45 marks Problem #1 (8 marks) Information on two assets, X & Y, is below. Portfolios A through Khave been constructed by varying the weights of Asset X and Asset Y, and the Expected Return and Standard Deviation is given for each. a) Plot the portfolios on a graph (SD on x-axis & ER on y-axis) and label: (1 mark) I. Minimum variance portfolio (MVP) (1 mark) II. Inefficient portfolios (1 mark) III. Efficient Portfolios. (1 mark) b) As a risk averse investor (want to minimize risk), which portfolio(s) would you choose? Briefly explain. (2 marks) c) As an investor who is prepared to take on more risk (more tolerance for risk), which portfolio(s) would you choose? Briefly explain. (2 marks) Asset Expected Retum 5.0% 14.0% Standard Deviation 15.0% 40.0% Correlation Coefficient -0.5 X Y Portfolio Components > Weight of Weight of Y 100.00% 0.00% 90.00% 10.00% 80.00% 20.00% 70.00% 30.00% 60.00% 40.00% 50.00% 50.00% 40.00% 60.00% 30.00% 70.00% 20.00% 80.00% 10.00% 90.00% 0.00% 100.00% Portfolio Characteristics Expected Standard Return Deviation 5.00% 15.0% 5.90% 12.0% 6.80% 10.6% 7.70% 11.3% 8.60% 13.9% 9.50% 17.5% 10.40% 21.6% 11.30% 26.0% 12.20% 30.6% 13.10% 35.3% 14.00% 40.0% IH IK Winter 2021 Assignment #2 Problem #2 (10 marks) You have been given the following incomplete data and must complete the table. Each portfolio comprises two different assets. (2 marks each). Beta Asset 1 Beta Asset 2 Weight in Asset 1 Portfolio Beta Portfolio 1 0.5 1.5 0.4 a Portfolio 2b 0.65 0.5 1.3 Portfolio 3 1.1 1.9 2.1 Portfolio 4 1.25 0.8 0.75 d Portfolio 5 1.3 e 0.2 3 15% Problem #3 (15 marks) You are following 5 different stocks and need to issue a recommendation (buy, hold or sell) to your customers. The market return is 10%, with a standard deviation of 15%. The risk-free rate is 3%. The CAPM is assumed to hold. Security Expected Standard Beta Recommendation return Deviation Avery Airline 19% 1.6 Bubba's Bakery 10% 13% 1.15 Carter Crystal 8% 10% Dee's Designs 9% 14% 0.8 Ernie's Electronics 12% 1.35 a) State your recommendation (buy, hold, sell) for each security. Show your work (2 marks each) b) Plot and label the Security Market Line (SML) and plot each stock's Expected Return, Required Return and Risk (5 marks) 0.65 16% Problem #4 (5 marks) You are considering the purchase of a stock priced at $100 per share. If you think the stock will rise to $117 per share by the end of the year, at which time it will pay a dividend of $1 per share, what beta would it need to have for this expectation to be consistent with the CAPM? Assume the risk-free rate is 4.5% and the market risk premium is 6% o Problem #5 (7 marks) You are considering purchasing some shares of CNB Inc. to add to your portfolio. The stock is currently quoted at $64 in the market. Your research has provided you with the following information: The stock of recently paid a dividend of $2.29 per share. o Dividends are expected to grow at a rate of 1.25% forever. Based on past returns, the standard deviation of CNB Inc. is 16%. The stock has a correlation of 30 with returns to the overall market. The S&P/TSX Composite Index has a standard deviation of 12%. o Historically, the market has returned 9.25% more than T-bills in an average year. The current yield on T-Bills is 1%. o o o o anahuric hould you purchaga charac of CMR2 S Total 45 marks Problem #1 (8 marks) Information on two assets, X & Y, is below. Portfolios A through Khave been constructed by varying the weights of Asset X and Asset Y, and the Expected Return and Standard Deviation is given for each. a) Plot the portfolios on a graph (SD on x-axis & ER on y-axis) and label: (1 mark) I. Minimum variance portfolio (MVP) (1 mark) II. Inefficient portfolios (1 mark) III. Efficient Portfolios. (1 mark) b) As a risk averse investor (want to minimize risk), which portfolio(s) would you choose? Briefly explain. (2 marks) c) As an investor who is prepared to take on more risk (more tolerance for risk), which portfolio(s) would you choose? Briefly explain. (2 marks) Asset Expected Retum 5.0% 14.0% Standard Deviation 15.0% 40.0% Correlation Coefficient -0.5 X Y Portfolio Components > Weight of Weight of Y 100.00% 0.00% 90.00% 10.00% 80.00% 20.00% 70.00% 30.00% 60.00% 40.00% 50.00% 50.00% 40.00% 60.00% 30.00% 70.00% 20.00% 80.00% 10.00% 90.00% 0.00% 100.00% Portfolio Characteristics Expected Standard Return Deviation 5.00% 15.0% 5.90% 12.0% 6.80% 10.6% 7.70% 11.3% 8.60% 13.9% 9.50% 17.5% 10.40% 21.6% 11.30% 26.0% 12.20% 30.6% 13.10% 35.3% 14.00% 40.0% IH IK Winter 2021 Assignment #2 Problem #2 (10 marks) You have been given the following incomplete data and must complete the table. Each portfolio comprises two different assets. (2 marks each). Beta Asset 1 Beta Asset 2 Weight in Asset 1 Portfolio Beta Portfolio 1 0.5 1.5 0.4 a Portfolio 2b 0.65 0.5 1.3 Portfolio 3 1.1 1.9 2.1 Portfolio 4 1.25 0.8 0.75 d Portfolio 5 1.3 e 0.2 3 15% Problem #3 (15 marks) You are following 5 different stocks and need to issue a recommendation (buy, hold or sell) to your customers. The market return is 10%, with a standard deviation of 15%. The risk-free rate is 3%. The CAPM is assumed to hold. Security Expected Standard Beta Recommendation return Deviation Avery Airline 19% 1.6 Bubba's Bakery 10% 13% 1.15 Carter Crystal 8% 10% Dee's Designs 9% 14% 0.8 Ernie's Electronics 12% 1.35 a) State your recommendation (buy, hold, sell) for each security. Show your work (2 marks each) b) Plot and label the Security Market Line (SML) and plot each stock's Expected Return, Required Return and Risk (5 marks) 0.65 16% Problem #4 (5 marks) You are considering the purchase of a stock priced at $100 per share. If you think the stock will rise to $117 per share by the end of the year, at which time it will pay a dividend of $1 per share, what beta would it need to have for this expectation to be consistent with the CAPM? Assume the risk-free rate is 4.5% and the market risk premium is 6% o Problem #5 (7 marks) You are considering purchasing some shares of CNB Inc. to add to your portfolio. The stock is currently quoted at $64 in the market. Your research has provided you with the following information: The stock of recently paid a dividend of $2.29 per share. o Dividends are expected to grow at a rate of 1.25% forever. Based on past returns, the standard deviation of CNB Inc. is 16%. The stock has a correlation of 30 with returns to the overall market. The S&P/TSX Composite Index has a standard deviation of 12%. o Historically, the market has returned 9.25% more than T-bills in an average year. The current yield on T-Bills is 1%. o o o o anahuric hould you purchaga charac of CMR2 S

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts