Question: please answer question 8,9 and 14 and show all work ! 14) S arah purchased a Personal Auto Policy with liability limits of 15/30/10, the

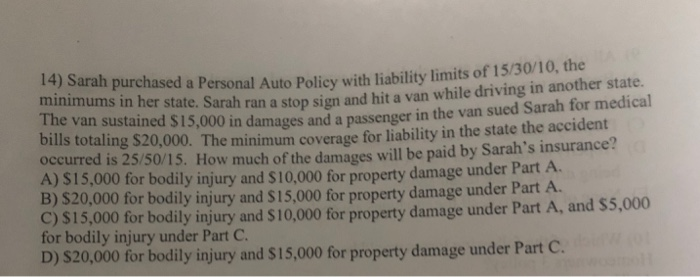

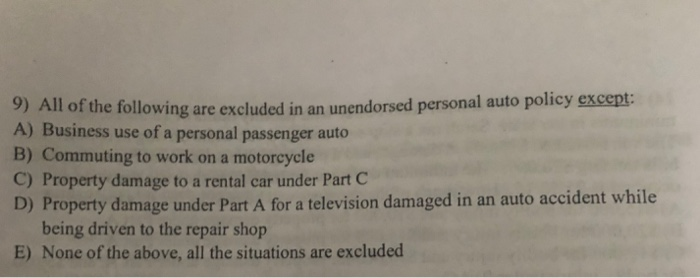

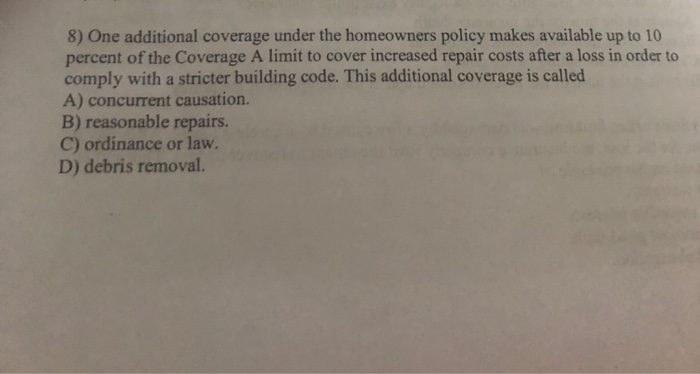

14) S arah purchased a Personal Auto Policy with liability limits of 15/30/10, the rmmmm in her state. Sarah ran a stop sign and hit a van while driving in another state. The van sustained $15,000 in damages and a passenger in ran a stop sign and hit a van while the van sued Sarah for medical s totaling $20,000. The minimum coverage for liability in the state the accident occurred is 25/50/15. How much of the damages will be paid by Sarah's insurance? A) $15,000 for bodily injury and S 10,000 for property damage under Part A. B) S20,000 for bodily injury and $15,000 for property damage under Part A C) S15,000 for bodily injury and $10,000 for property damage under Part A, and $5,000 for bodily injury under Part C D) S20,000 for bodily injury and $15,000 for property damage under Part C 9) All of the following are excluded in an unendorsed personal auto policy except A) Business use of a personal passenger auto B) Commuting to work on a motorcycle C) Property damage to a rental car under Part C D) Property damage under Part A for a television damaged in an auto accident while being driven to the repair shop E) None of the above, all the situations are excluded 8) One additional coverage under the homeowners policy makes available up to 10 percent of the Coverage A limit to cover increased repair costs after a loss in order to comply with a stricter building code. This additional coverage is called A) concurrent causation. B) reasonable repairs. C) ordinance or law. D) debris removal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts