Question: Please answer question a and b, and draw the binomial trees. Thank you so much!!! Consider options on a stock when the stock price is

Please answer question a and b, and draw the binomial trees. Thank you so much!!!

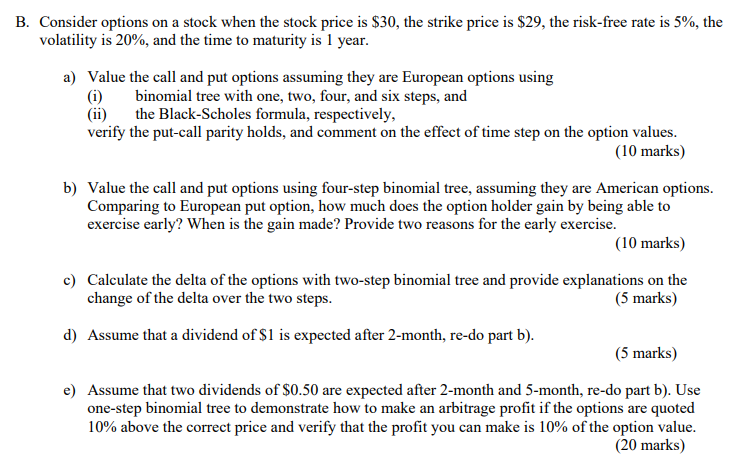

Consider options on a stock when the stock price is $30, the strike price is $29, the risk-free rate is 5%, the volatility is 20%, and the time to maturity is 1 year. a) Value the call and put options assuming they are European options using (i) binomial tree with one, two, four, and six steps, and (ii) the Black-Scholes formula, respectively, verify the put-call parity holds, and comment on the effect of time step on the option values. (10 marks) b) Value the call and put options using four-step binomial tree, assuming they are American options. Comparing to European put option, how much does the option holder gain by being able to exercise early? When is the gain made? Provide two reasons for the early exercise. (10 marks) c) Calculate the delta of the options with two-step binomial tree and provide explanations on the change of the delta over the two steps. (5 marks) d) Assume that a dividend of $1 is expected after 2-month, re-do part b). (5 marks) e) Assume that two dividends of $0.50 are expected after 2-month and 5-month, re-do part b). Use one-step binomial tree to demonstrate how to make an arbitrage profit if the options are quoted 10% above the correct price and verify that the profit you can make is 10% of the option value. (20 marks) Consider options on a stock when the stock price is $30, the strike price is $29, the risk-free rate is 5%, the volatility is 20%, and the time to maturity is 1 year. a) Value the call and put options assuming they are European options using (i) binomial tree with one, two, four, and six steps, and (ii) the Black-Scholes formula, respectively, verify the put-call parity holds, and comment on the effect of time step on the option values. (10 marks) b) Value the call and put options using four-step binomial tree, assuming they are American options. Comparing to European put option, how much does the option holder gain by being able to exercise early? When is the gain made? Provide two reasons for the early exercise. (10 marks) c) Calculate the delta of the options with two-step binomial tree and provide explanations on the change of the delta over the two steps. (5 marks) d) Assume that a dividend of $1 is expected after 2-month, re-do part b). (5 marks) e) Assume that two dividends of $0.50 are expected after 2-month and 5-month, re-do part b). Use one-step binomial tree to demonstrate how to make an arbitrage profit if the options are quoted 10% above the correct price and verify that the profit you can make is 10% of the option value. (20 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts