Question: Please answer question a and b. Please include all the python used to achieve the answer. An equities analyst is studying the pharmaceutical industry and

Please answer question a and b. Please include all the python used to achieve the answer.

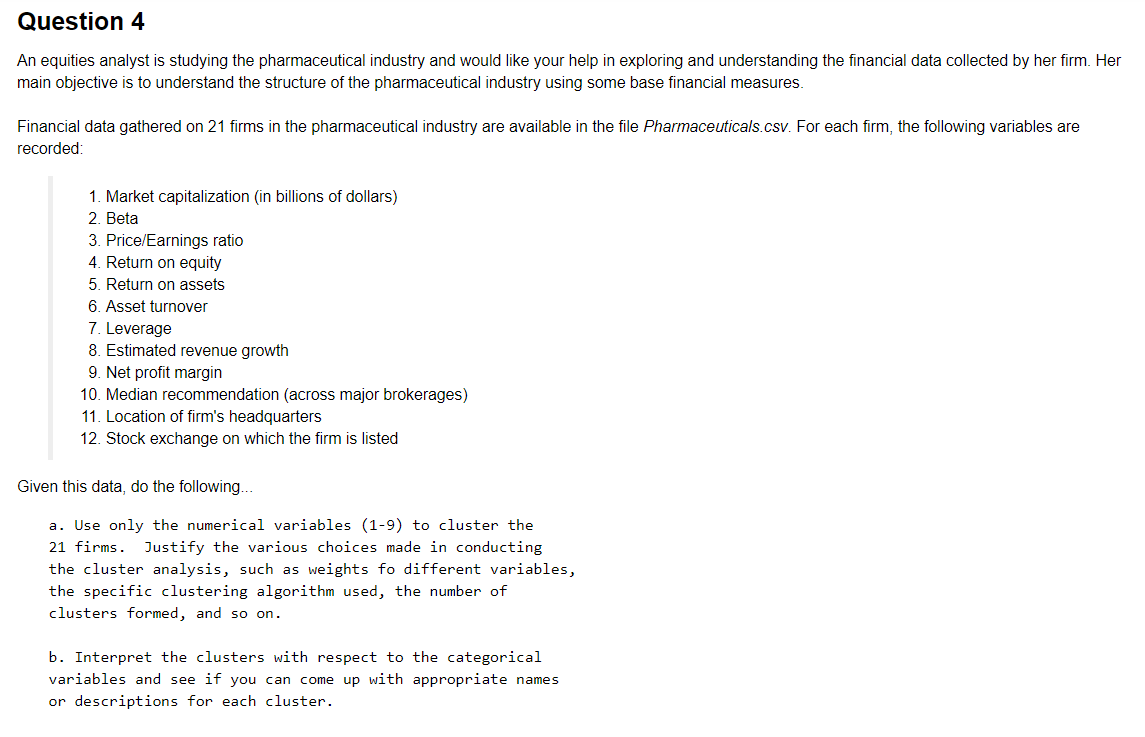

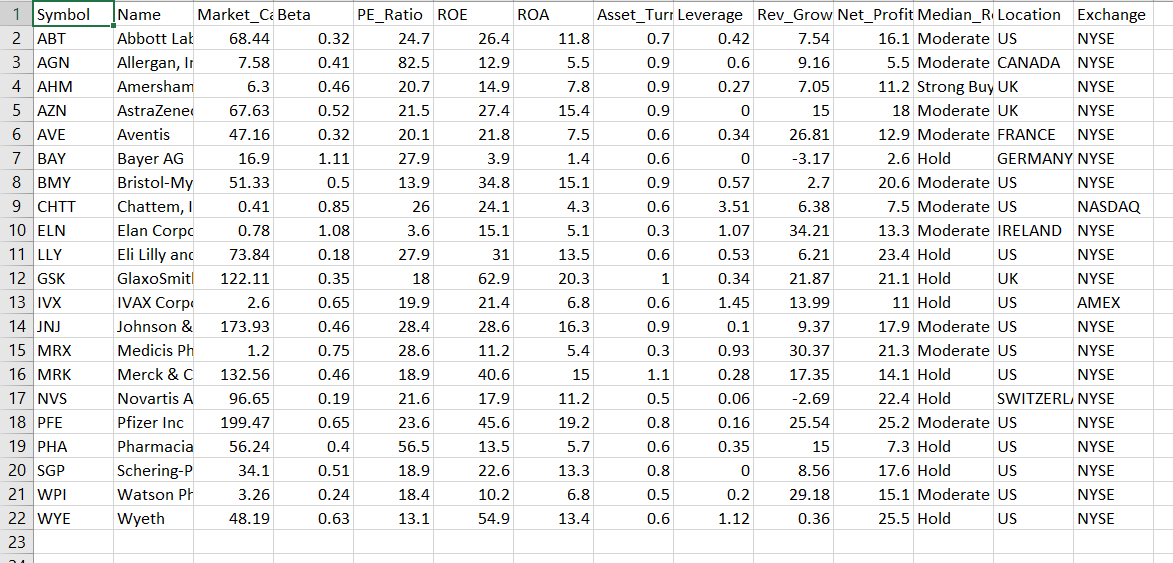

An equities analyst is studying the pharmaceutical industry and would like your help in exploring and understanding the financial data collected by her firm. Her main objective is to understand the structure of the pharmaceutical industry using some base financial measures. Financial data gathered on 21 firms in the pharmaceutical industry are available in the file *Pharmaceuticals.csv*. For each firm, the following variables are recorded:

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts