Question: Please answer question A, B, and C. (Objectives 9-6, 9-7) In Part I of the case, you performed preliminary analytical procedures for Pinnacle. The purpose

Please answer question A, B, and C.

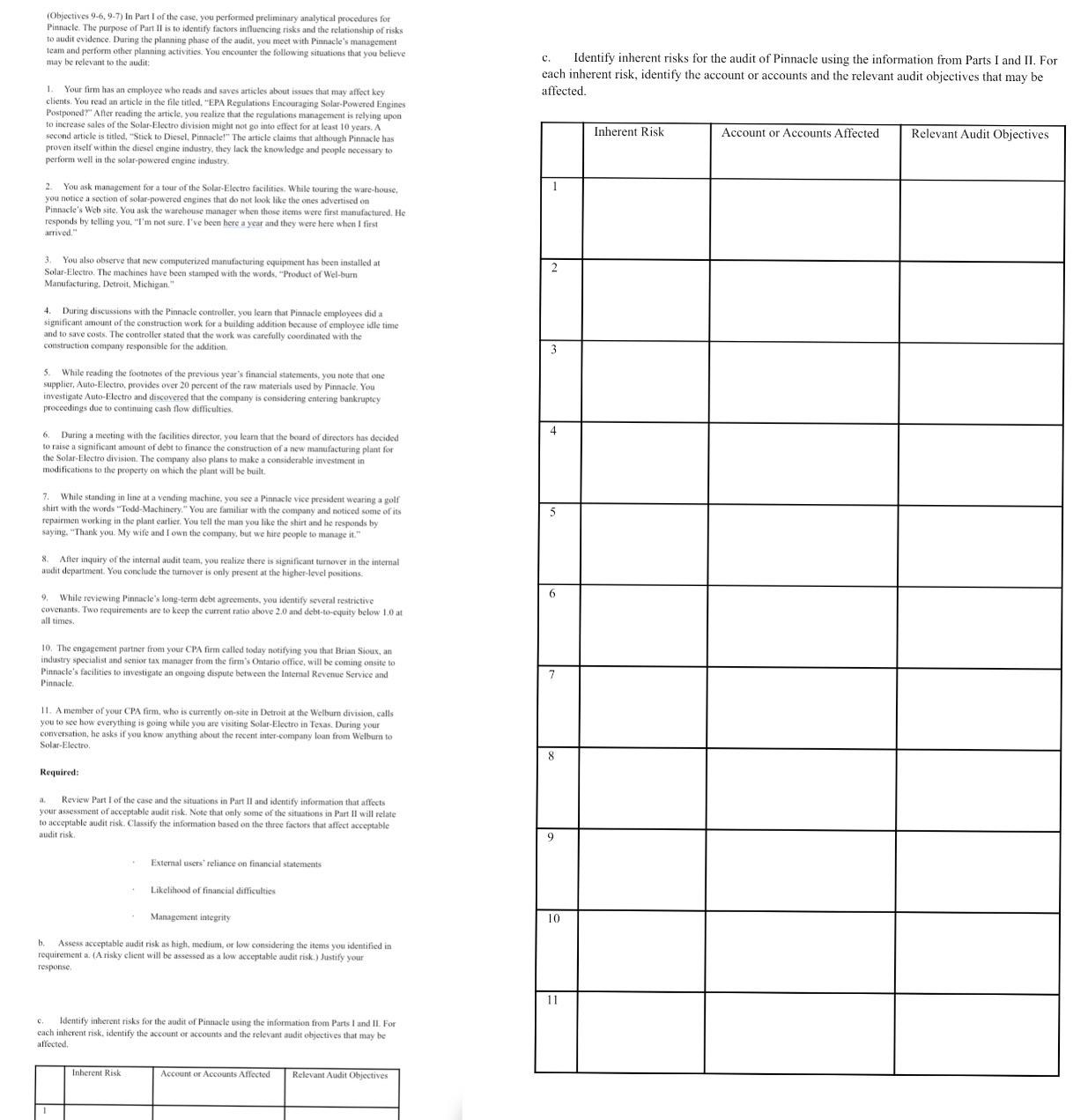

(Objectives 9-6, 9-7) In Part I of the case, you performed preliminary analytical procedures for Pinnacle. The purpose of Part II is to identify factors influencing risks and the relationship of rish to audit evidence. During the planning phase of the audit, you meet with Pinnacle's management team and perform other planning activities. You encounter the following situations that you believe may be relevant to the audit: C. Identify inherent risks for the audit of Pinnacle using the information from Parts I and II. For each inherent risk, identify the account or accounts and the relevant audit objectives that may be as an employee who reads and saves articles about issues that may affect key affected. clients. You read an article in the file titled, "EPA Regulations Encouraging Solar-Powered Engines Postponed?" After reading the article, you realize that the reg cement is relying to increase sales of the Solar-Electro division might not go into effect for at least 10 years. A second article is titled, "Stick to Diesel, Pinnacle!" The article claims that although Pinnacle has Inherent Risk Account or A Relevant Audit Objectives progen niself within the diesel engine industry, they lack the knowledge and people necessary to perform well in the solar-powered engine industry. You ask management for a tour of the Solar-Electro facilities. While touring the ware-house, you notice a section of solar-powered engines that do not look like the ones advertised on Pinnacle's Web site. You ask the warehouse manager when those items were first manufactured. He arrived." elling you. "I'm not sure. I've been here a year and they were here when I first .You also observe that new computerized manufacturing equipment has been installed at Solar-Electro. The machines have been stamped with the words, "Product of Wel-burn 2 Manufacturing. Detroit, Michigan." During discussions with the Pinnacle controller, you learn that Pinnacle employees did a significant amount of the construction work for a build and to save costs. The controller stated that the work was carefully coordinated with the construction company responsible for the addition. . While reading the footnotes of the previous year's financial statements, you note that one supplier, Auto-Electro, provides over 20 percent of the raw materials used by Pinnacle. You investigate Auto-Electro and discovered that the company is considering entering bankruptcy proceedings due to continuing cash flow difficulties, D. During a meeting with the facilities director, you learn that the board of directors has decided to raise a significant amount of debt to finance the construction of a new manufacturing plant for the Solar-Electro division. The company also plans to make a considerable investment in modifications to the property on which the plant will be built. . While standing in line at a vending machine, you see a Pinnacle vice president wearing a golf shirt with the words "Todd-Machinery." You are familiar with the company and noticed some of its epairmen working in the plant earlier. You tell the man you lik saying. "Thank you. My wife and I own the company, but we hire people to manage it." After inquiry of the internal audit team, you realize there is significant turnover in the internal s only present at the higher-level positions. While reviewing Pinnacle's long-term debt agreements, you identify several restrictive covenants. Two requirements are to keep the current ratio above 2.0 and debt-to-equity below 1.0 at all times. 10. The engagement partner from your CPA firm called today notifying you that Brian Sioux, an industry specialist and senior tax manager from the firm's Ontario office, will be coming onsite to Pinnacle Pinnacle's facilities to investigate an ongoing dispute between the Internal Revenue Service and 1 1. A member of your CPA firm, who is currently on-site in Detroit at the Welburn division, calls you to see how everything is going while you are visiting Solar-Electro in Texas, During your conversation, he asks if you know anything about the recent inter-company loan from Welburn to Solar-Electro. Required: . Review Part I of the case and the situations in Part II and identify information that affects your assessment of acceptable audit risk. Note that only some of the situations in Part II will relate audit risk. to acceptable audit risk. Classify the information based on the three factors that affect acceptable External users' reliance on financial statements Likelihood of financial difficulties Management integrity 10 Assess acceptable audit risk as high, medium, or low considering the items you identified in requirement a. (A risky client will be assessed as a low acceptable audit risk.) Justify your response. Identify inherent risks for the audit of Pinnacle using the information from Parts I and II. For each inherent risk, identify the account or accounts and the relevant audit objectives that may be affected. Inherent Risk Account or Accounts Affected Relevant Audit Objectives

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts