Question: please answer question below. 1. Herbal Inc. is a company based in Mauritius that specializes in the manufacturing of herbal medicines. Since its existence, the

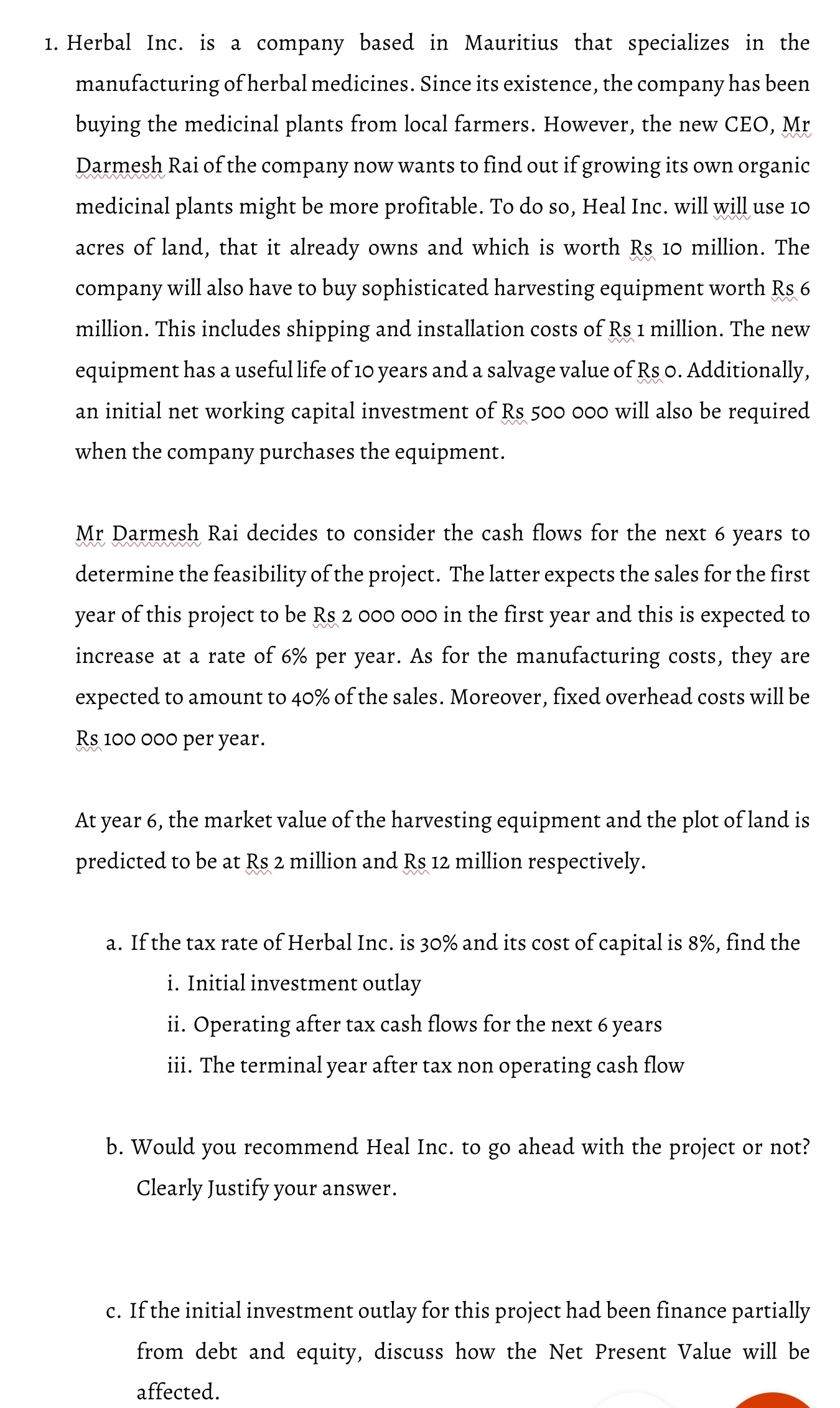

please answer question below. 1. Herbal Inc. is a company based in Mauritius that specializes in the manufacturing of herbal medicines. Since its existence, the company has been buying the medicinal plants from local farmers. However, the new CEO, Mr Darmesh Rai of the company now wants to find out if growing its own organic medicinal plants might be more profitable. To do so, Heal Inc. will will use 10 acres of land, that it already owns and which is worth Rs 10 million. The company will also have to buy sophisticated harvesting equipment worth Rs 6 million. This includes shipping and installation costs of Rs 1 million. The new equipment has a useful life of 10 years and a salvage value of Rs 0. Additionally, an initial net working capital investment of Rs 500 000 will also be required when the company purchases the equipment.Mr Darmesh Rai decides to consider the cash flows for the next 6 years to determine the feasibility of the project. The latter expects the sales for the first year of this project to be Rs 2 000 000 in the first year and this is expected to increase at a rate of 6% per year. As for the manufacturing costs, they are expected to amount to 40% of the sales. Moreover, fixed overhead costs will be Rs 100 000 per year.At year 6, the market value of the harvesting equipment and the plot of land is predicted to be at Rs 2 million and Rs 12 million respectively.a. If the tax rate of Herbal Inc. is 30% and its cost of capital is 8%, find thei. Initial investment outlayii. Operating after tax cash flows for the next 6 yearsiii. The terminal year after tax non operating cash flowb. Would you recommend Heal Inc. to go ahead with the project or not? Clearly Justify your answer. c. If the initial investment outlay for this project had been finance partially from debt and equity, discuss how the Net Present Value will be affected. .

1. Herbal Inc. is a company based in Mauritius that specializes in the manufacturing of herbal medicines. Since its existence, the company has been buying the medicinal plants from local farmers. However, the new CEO, Mr Darmesh Rai of the company now wants to find out if growing its own organic medicinal plants might be more profitable. To do so, Heal Inc. will will use 10 acres of land, that it already owns and which is worth Rs 10 million. The company will also have to buy sophisticated harvesting equipment worth Rs 6 million. This includes shipping and installation costs of Rs 1 million. The new equipment has a useful life of 10 years and a salvage value of Rs o. Additionally, an initial net working capital investment of Rs 500 ooo will also be required when the company purchases the equipment. Mr Darmesh Rai decides to consider the cash flows for the next 6 years to determine the feasibility of the project. The latter expects the sales for the first year of this project to be Rs 2 ooo ooo in the first year and this is expected to increase at a rate of 6% per year. As for the manufacturing costs, they are expected to amount to 40% of the sales. Moreover, fixed overhead costs will be Rs 100 000 per year. At year 6, the market value of the harvesting equipment and the plot of land is predicted to be at Rs 2 million and Rs 12 million respectively. a. If the tax rate of Herbal Inc. is 30% and its cost of capital is 8%, find the i. Initial investment outlay ii. Operating after tax cash flows for the next 6 years iii. The terminal year after tax non operating cash flow b. Would you recommend Heal Inc. to go ahead with the project or not? Clearly Justify your answer. c. If the initial investment outlay for this project had been finance partially from debt and equity, discuss how the Net Present Value will be affected

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts