Question: Please answer question C A1. AX Plc. The capital structure of AX Plc. on 19 January 2020 consisted of 1,500,000 1 ordinary shares outstanding out

Please answer question C

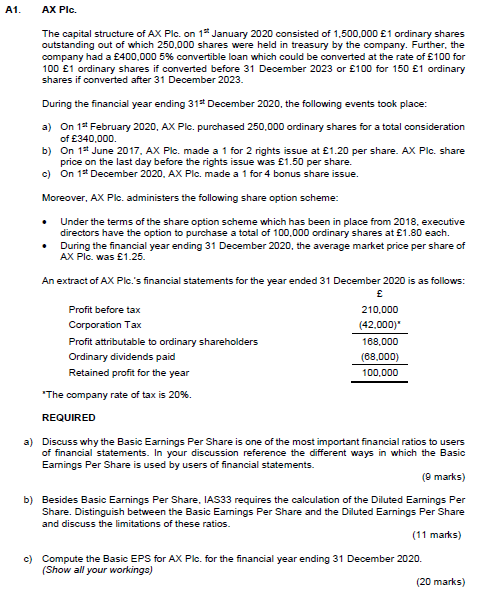

A1. AX Plc. The capital structure of AX Plc. on 19 January 2020 consisted of 1,500,000 1 ordinary shares outstanding out of which 250.000 shares were held in treasury by the company. Further, the company had a 400,000 5% convertible loan which could be converted at the rate of 100 for 100 1 ordinary shares if converted before 31 December 2023 or 100 for 150 1 ordinary shares if converted after 31 December 2023. During the financial year ending 319 December 2020, the following events took place: a) On 18 February 2020, AX Plc. purchased 250,000 ordinary shares for a total consideration of 340,000 b) On 18 June 2017. AX Plc. made a 1 for 2 nights issue at 1.20 per share. AX Plc. share price on the last day before the rights issue was 1.50 per share. c) On 15 December 2020, AX Plc. made a 1 for 4 bonus share issue. Moreover, AX Plc. administers the following share option scheme: Under the terms of the share option scheme which has been in place from 2018. executive directors have the option to purchase a total of 100,000 ordinary shares at 1.80 each. During the financial year ending 31 December 2020, the average market price per share of AX Plc. was 1.25. An extract of AX Plc.'s financial statements for the year ended 31 December 2020 is as follows: Profit before tax 210,000 Corporation Tax (42.000) Profit attributable to ordinary shareholders 168,000 Ordinary dividends paid (68.000) Retained profit for the year 100,000 "The company rate of tax is 20%. REQUIRED a) Discuss why the Basic Earnings Per Share is one of the most important financial ratios to users of financial statements. In your discussion reference the different ways in which the Basic Earnings Per Share is used by users of financial statements. (9 marks) b) Besides Basic Earnings Per Share. IAS33 requires the calculation of the Diluted Earnings Per Share. Distinguish between the Basic Earnings Per Share and the Diluted Earnings Per Share and discuss the limitations of these ratios. (11 marks) c) Compute the Basic EPS for AX Plc. for the financial year ending 31 December 2020. (Show all your workinge) (20 marks) A1. AX Plc. The capital structure of AX Plc. on 19 January 2020 consisted of 1,500,000 1 ordinary shares outstanding out of which 250.000 shares were held in treasury by the company. Further, the company had a 400,000 5% convertible loan which could be converted at the rate of 100 for 100 1 ordinary shares if converted before 31 December 2023 or 100 for 150 1 ordinary shares if converted after 31 December 2023. During the financial year ending 319 December 2020, the following events took place: a) On 18 February 2020, AX Plc. purchased 250,000 ordinary shares for a total consideration of 340,000 b) On 18 June 2017. AX Plc. made a 1 for 2 nights issue at 1.20 per share. AX Plc. share price on the last day before the rights issue was 1.50 per share. c) On 15 December 2020, AX Plc. made a 1 for 4 bonus share issue. Moreover, AX Plc. administers the following share option scheme: Under the terms of the share option scheme which has been in place from 2018. executive directors have the option to purchase a total of 100,000 ordinary shares at 1.80 each. During the financial year ending 31 December 2020, the average market price per share of AX Plc. was 1.25. An extract of AX Plc.'s financial statements for the year ended 31 December 2020 is as follows: Profit before tax 210,000 Corporation Tax (42.000) Profit attributable to ordinary shareholders 168,000 Ordinary dividends paid (68.000) Retained profit for the year 100,000 "The company rate of tax is 20%. REQUIRED a) Discuss why the Basic Earnings Per Share is one of the most important financial ratios to users of financial statements. In your discussion reference the different ways in which the Basic Earnings Per Share is used by users of financial statements. (9 marks) b) Besides Basic Earnings Per Share. IAS33 requires the calculation of the Diluted Earnings Per Share. Distinguish between the Basic Earnings Per Share and the Diluted Earnings Per Share and discuss the limitations of these ratios. (11 marks) c) Compute the Basic EPS for AX Plc. for the financial year ending 31 December 2020. (Show all your workinge) (20 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts