Question: PLEASE ANSWER QUESTION COREECTLY AND SHOW ALL WORK!!! THANKS James Company, a 90% owned subsidiary of Drew Corporation, transfers inventory to Drew at a 30%

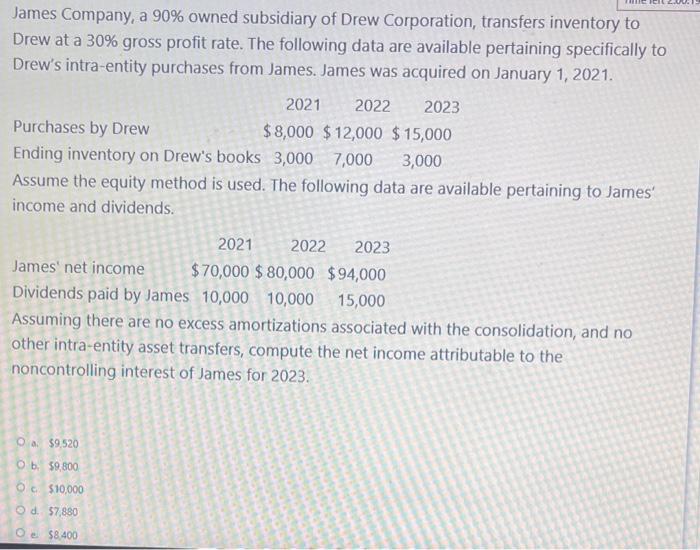

James Company, a 90% owned subsidiary of Drew Corporation, transfers inventory to Drew at a 30% gross profit rate. The following data are available pertaining specifically to Drew's intra-entity purchases from James. James was acquired on January 1,2021. Assume the equity method is used. The following data are available pertaining to James' income and dividends. Assuming there are no excess amortizations associated with the consolidation, and no other intra-entity asset transfers, compute the net income attributable to the noncontrolling interest of James for 2023. a. $9.520 b. $9,800 c. $10,000 d. $7.880 e. $8,400

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts