Question: Please answer question e&f only thank you Question 1 (20 Marks) Homantin, Inc. is considering a project for opening a new sporting goods store in

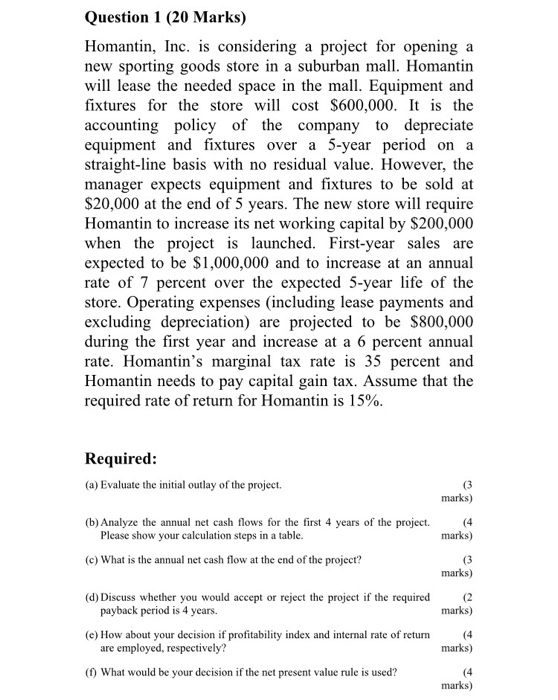

Question 1 (20 Marks) Homantin, Inc. is considering a project for opening a new sporting goods store in a suburban mall. Homantin will lease the needed space in the mall. Equipment and fixtures for the store will cost $600,000. It is the accounting policy of the company to depreciate equipment and fixtures over a 5-year period on a straight-line basis with no residual value. However, the manager expects equipment and fixtures to be sold at $20,000 at the end of 5 years. The new store will require Homantin to increase its net working capital by $200,000 when the project is launched. First-year sales are expected to be $1,000,000 and to increase at an annual rate of 7 percent over the expected 5-year life of the store. Operating expenses (including lease payments and excluding depreciation) are projected to be $800,000 during the first year and increase at a 6 percent annual rate. Homantin's marginal tax rate is 35 percent and Homantin needs to pay capital gain tax. Assume that the required rate of return for Homantin is 15%. Required: (a) Evaluate the initial outlay of the project. (3 marks) (b) Analyze the annual net cash flows for the first 4 years of the project. Please show your calculation steps in a table. (4 marks) (c) What is the annual net cash flow at the end of the project? marks) (d) Discuss whether you would accept or reject the project if the required payback period is 4 years. (2 marks) (c) How about your decision if profitability index and internal rate of return are employed, respectively? (4 marks) (1) What would be your decision if the net present value rule is used? marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts