Question: Please answer question number 5 only. The intent of using more leverage was to increase the potential profitability of the firm. You are called in

Please answer question number 5 only.

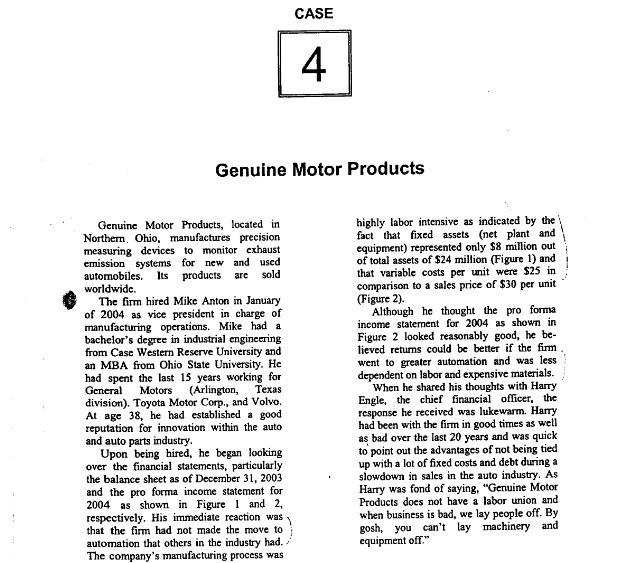

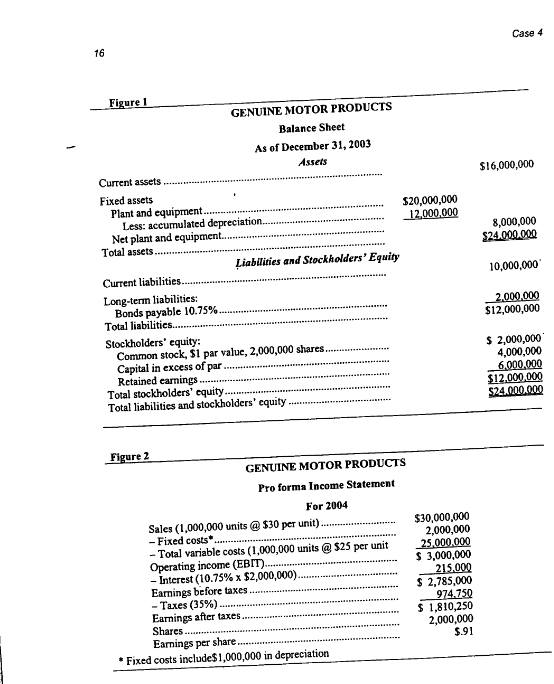

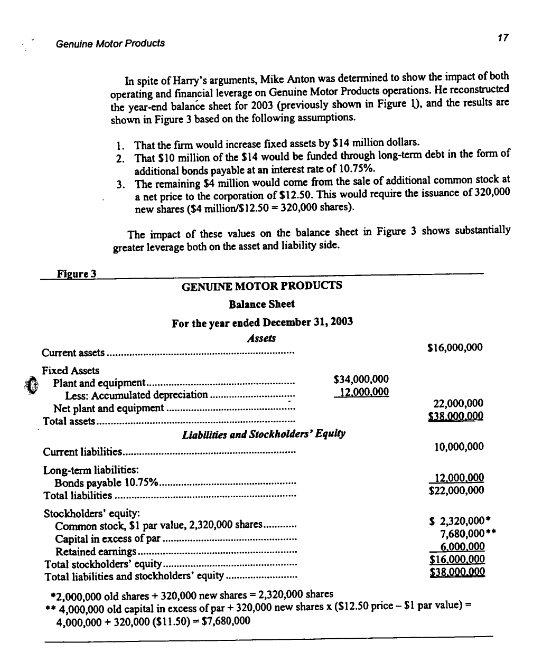

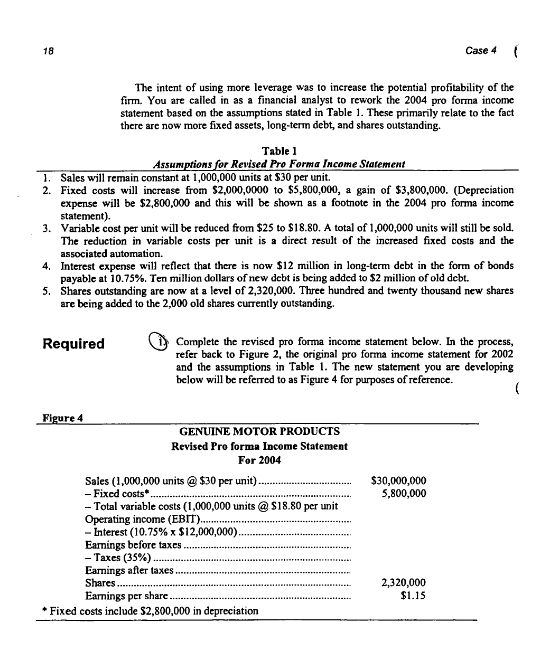

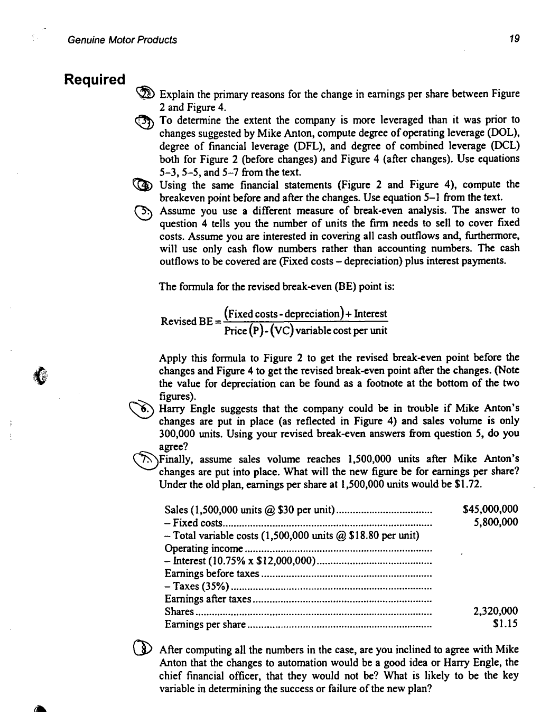

The intent of using more leverage was to increase the potential profitability of the firm. You are called in as a financial analyst to rework the 2004 pro forma income statement based on the assumptions stated in Table 1. These primarily relate to the fact there are now more fixed assets, long-term debt, and shares outstanding. Table 1 Assumptions for Revised Pro Forma Income Statement 1. Sales will remain constant at 1,000,000 units at $30 per unit. 2. Fixed costs will increase from $2,000,0000 to $5,800,000, a gain of $3,800,000. (Depreciation expense will be $2,800,000 and this will be shown as a footnote in the 2004 pro forma income statement). 3. Variable cost per unit will be reduced from $25 to $18.80. A total of 1,000,000 units will still be sold. The reduction in variable costs per unit is a direct result of the increased fixed costs and the associated automation. 4. Interest expense will reflect that there is now $12 million in long-term debt in the form of bonds payable at 10.75%. Ten million dollars of new debt is being added to $2 million of old debt. 5. Shares outstanding are now at a level of 2,320,000. Three hundred and twenty thousand new shares are being added to the 2,000 old shares currently outstanding. Required Complete the revised pro forma income statement below. In the process, refer back to Figure 2, the original pro forma income statement for 2002 The intent of using more leverage was to increase the potential profitability of the firm. You are called in as a financial analyst to rework the 2004 pro forma income statement based on the assumptions stated in Table 1. These primarily relate to the fact there are now more fixed assets, long-term debt, and shares outstanding. Table 1 Assumptions for Revised Pro Forma Income Statement 1. Sales will remain constant at 1,000,000 units at $30 per unit. 2. Fixed costs will increase from $2,000,0000 to $5,800,000, a gain of $3,800,000. (Depreciation expense will be $2,800,000 and this will be shown as a footnote in the 2004 pro forma income statement). 3. Variable cost per unit will be reduced from $25 to $18.80. A total of 1,000,000 units will still be sold. The reduction in variable costs per unit is a direct result of the increased fixed costs and the associated automation. 4. Interest expense will reflect that there is now $12 million in long-term debt in the form of bonds payable at 10.75%. Ten million dollars of new debt is being added to $2 million of old debt. 5. Shares outstanding are now at a level of 2,320,000. Three hundred and twenty thousand new shares are being added to the 2,000 old shares currently outstanding. Required Complete the revised pro forma income statement below. In the process, refer back to Figure 2, the original pro forma income statement for 2002

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts