Question: please answer question one and question two and show all work Question 1 (20 points) Suppose you wish to sell short 150 shares of Boeing

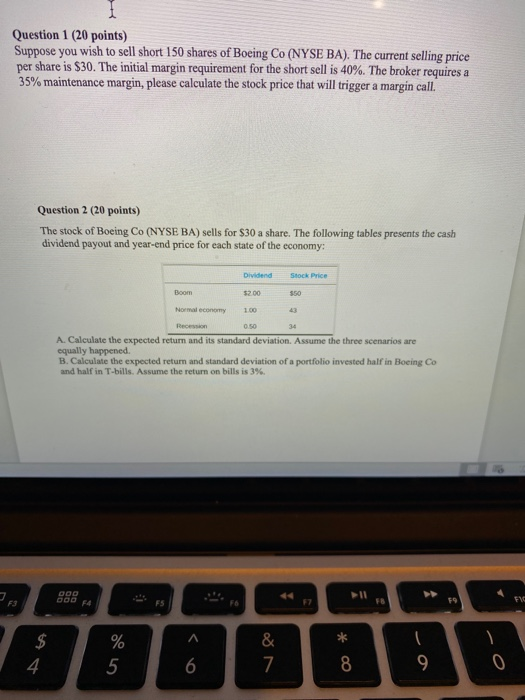

Question 1 (20 points) Suppose you wish to sell short 150 shares of Boeing Co (NYSE BA). The current selling price per share is $30. The initial margin requirement for the short sell is 40%. The broker requires a 35% maintenance margin, please calculate the stock price that will trigger a margin call. Question 2 (20 points) The stock of Boeing Co (NYSE BA) sells for $30 a share. The following tables presents the cash dividend payout and year-end price for each state of the economy: Dividend Stock Price $2.00 Normal economy 100 0.50 A. Calculate the expected return and its standard deviation. Assume the three scenarios are equally happened. B. Calculate the expected return and standard deviation of a portfolio invested half in Boeing Co and half in T-bills. Assume the return on bills is 3%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts