Question: please answer question question i, ii, iii, and iv thank you very much (c) On May 15, you sold twenty futures contracts for 100,000 CAD

please answer question question i, ii, iii, and iv

thank you very much

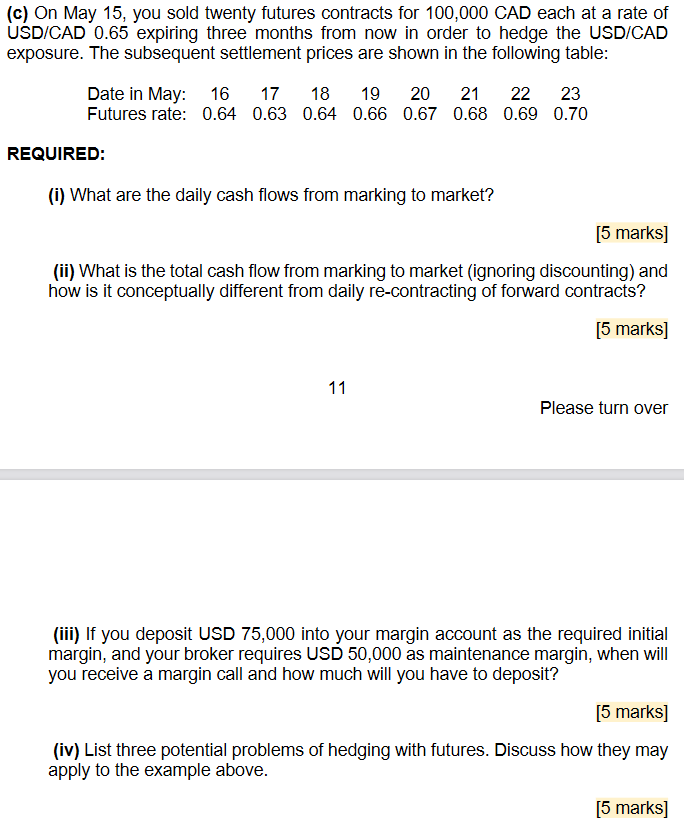

(c) On May 15, you sold twenty futures contracts for 100,000 CAD each at a rate of USD/CAD 0.65 expiring three months from now in order to hedge the USD/CAD exposure. The subsequent settlement prices are shown in the following table: Date in May: 16 17 18 20 23 Futures rate: 0.64 0.63 0.64 0.66 0.67 0.68 0.69 0.70 19 21 22 REQUIRED: (i) What are the daily cash flows from marking to market? [5 marks] (ii) What is the total cash flow from marking to market (ignoring discounting) and how is it conceptually different from daily re-contracting of forward contracts? [5 marks] 11 Please turn over (iii) If you deposit USD 75,000 into your margin account as the required initial margin, and your broker requires USD 50,000 as maintenance margin, when will you receive a margin call and how much will you have to deposit? [5 marks] (iv) List three potential problems of hedging with futures. Discuss how they may apply to the example above. [5 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts