Question: PLEASE ANSWER QUESTION SHOWING ALL WORK AND CORRECT ANSWER COMPLETELY!!! QUESTIONS 13-17th!!! Question 13 Scott Co. acquired 70% of Gregg Co, for $525,000 on December

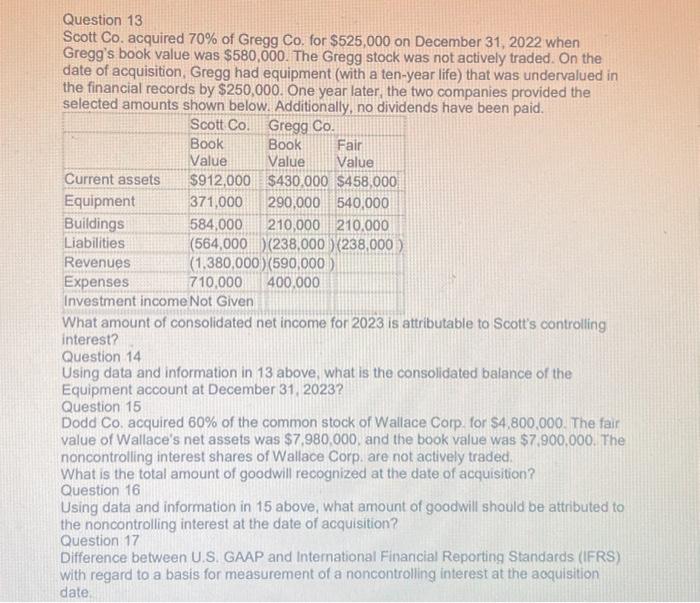

Question 13 Scott Co. acquired 70% of Gregg Co, for $525,000 on December 31, 2022 when Gregg's book value was $580,000. The Gregg stock was not actively traded. On the date of acquisition, Gregg had equipment (with a ten-year life) that was undervalued in the financial records by $250,000. One year later, the two companies provided the selected amounts shown below. Additionallu no divirands have been paid. What amount of consolidated net income for 2023 is attributable to Scott's controlling interest? Question 14 Using data and information in 13 above, what is the consolidated balance of the Equipment account at December 31, 2023? Question 15 Dodd Co. acquired 60% of the common stock of Wallace Corp. for $4,800,000. The fair value of Wallace's net assets was $7,980,000, and the book value was $7,900,000. The noncontrolling interest shares of Wallace Corp. are not actively traded. What is the total amount of goodwill recognized at the date of acquisition? Question 16 Using data and information in 15 above, what amount of goodwill should be attributed to the noncontrolling interest at the date of acquisition? Question 17 Difference between U.S. GAAP and International Financial Reporting Standards (IFRS) with regard to a basis for measurement of a noncontrolling interest at the aoquisition date

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts