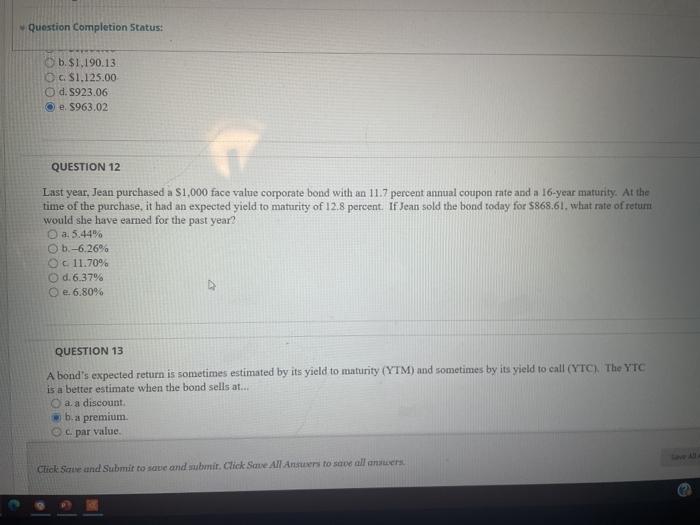

Question: please answer questions 12 and 4 Question Completion Status: b. $1.190.13 $1.125.00 O d. 1923.06 e. $963.02 QUESTION 12 Last year, Jean purchased a $1,000

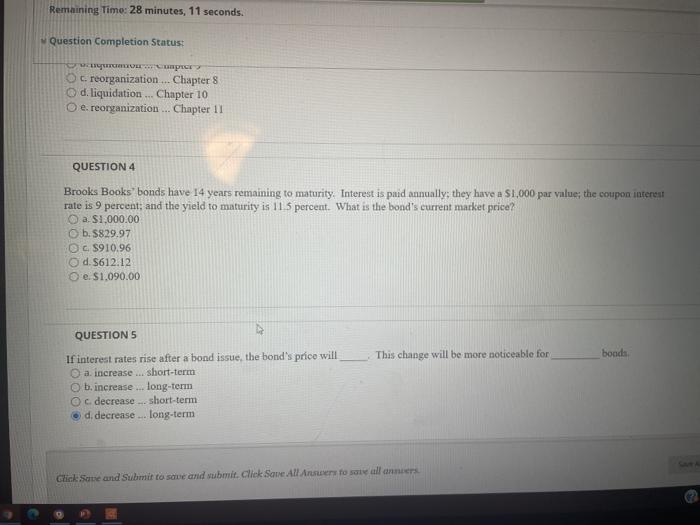

Question Completion Status: b. $1.190.13 $1.125.00 O d. 1923.06 e. $963.02 QUESTION 12 Last year, Jean purchased a $1,000 face value corporate bond with an 11.7 percent annual coupon rate and a 16-year maturity. At the time of the purchase, it had an expected yield to maturity of 12.8 percent. If Jean sold the bond today for $868.61. what rate of retum would she have earned for the past year? a 5,44% b.-6.26% OC 11.70% d. 6.37% e. 6.80% QUESTION 13 A bond's expected return is sometimes estimated by its yield to maturity (YTM) and sometimes by its yield to call (YTC). The YTC is a better estimate when the bond sells at... a, a discount b.a premium c. par value Click Sare and Submit to save and submit. Click Save All Ansur to save all answer Remaining Time: 28 minutes, 11 seconds. Question Completion Status: c. reorganization ... Chapter 8 O d. liquidation ... Chapter 10 Oe.reorganization... Chapter 11 QUESTION 4 Brooks Books' bonds have 14 years remaining to maturity. Interest is paid annually, they have a $1,000 par value; the coupon interest rate is 9 percent, and the yield to maturity is 11.5 percent. What is the bond's current market price? O a $1,000.00 b. $829.97 OC S910.96 d. 8612.12 e. S1.090.00 QUESTION 5 This change will be more noticeable for bonda If interest rates rise after a bond issue, the bond's price will a increase ... short-term b.increase ... long-term Oc decrease ... short-term d. decrease ... long-term Click Save and submit to save and submit. Click Save All Answers to sate all anners

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts