Question: please answer questions 1-3. The methods that can be used are attached. Name Grade Valuing Options Structures We determined in class the value of a

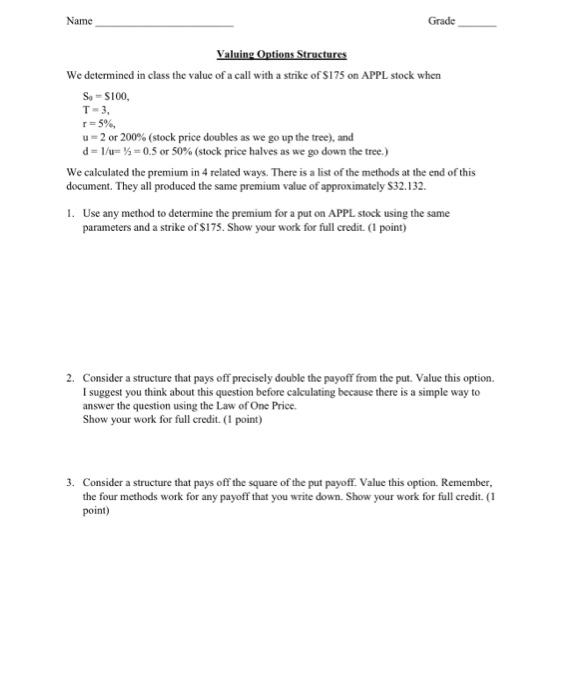

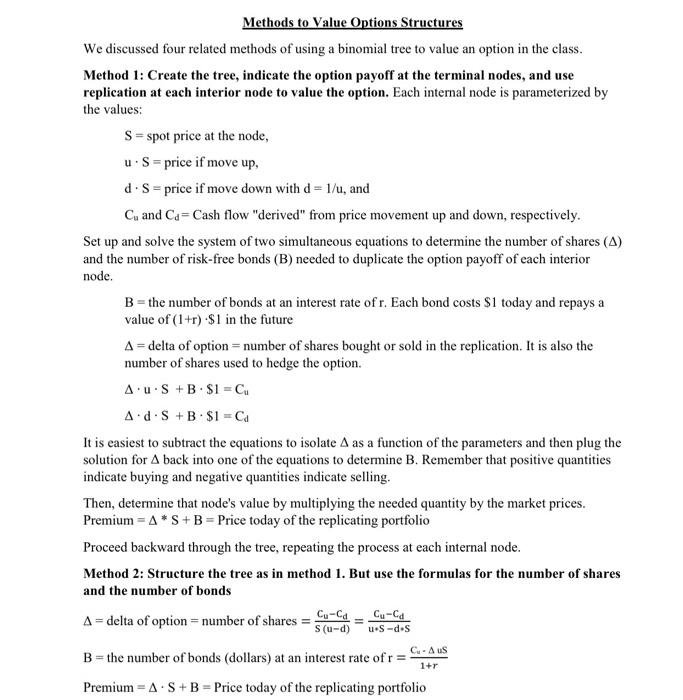

Name Grade Valuing Options Structures We determined in class the value of a call with a strike of $175 on APPL stock when So-$100, T=3, r=5%, u=2 or 200% (stock price doubles as we go up the tree), and d=1/u==0.5 or 50% (stock price halves as we go down the tree.) We calculated the premium in 4 related ways. There is a list of the methods at the end of this document. They all produced the same premium value of approximately $32.132. 1. Use any method to determine the premium for a put on APPL stock using the same parameters and a strike of $175. Show your work for full credit. (1 point) 2. Consider a structure that pays off precisely double the payoff from the put. Value this option. I suggest you think about this question before calculating because there is a simple way to answer the question using the Law of One Price. Show your work for full credit. (1 point) 3. Consider a structure that pays off the square of the put payoff. Value this option. Remember, the four methods work for any payoff that you write down. Show your work for full credit. (1 point) Methods to Value Options Structures We discussed four related methods of using a binomial tree to value an option in the class. Method 1: Create the tree, indicate the option payoff at the terminal nodes, and use replication at each interior node to value the option. Each internal node is parameterized by the values: S = spot price at the node, u S = price if move up, d. S = price if move down with d=1/u, and Cu and C=Cash flow "derived" from price movement up and down, respectively. Set up and solve the system of two simultaneous equations to determine the number of shares (A) and the number of risk-free bonds (B) needed to duplicate the option payoff of each interior node. B = the number of bonds at an interest rate of r. Each bond costs $1 today and repays a value of (1+r) $1 in the future A = delta of option = number of shares bought or sold in the replication. It is also the number of shares used to hedge the option. A u S+B $1 = Cu A d S+B $1 = Ca It is easiest to subtract the equations to isolate A as a function of the parameters and then plug the solution for A back into one of the equations to determine B. Remember that positive quantities indicate buying and negative quantities indicate selling. Then, determine that node's value by multiplying the needed quantity by the market prices. Premium = A * S + B = Price today of the replicating portfolio Proceed backward through the tree, repeating the process at each internal node. Method 2: Structure the tree as in method 1. But use the formulas for the number of shares and the number of bonds Cu-Cd A = delta of option = number of shares Cu-Cd S (u-d) u s-d.S Cu - A US 1+r B = the number of bonds (dollars) at an interest rate of r = Premium = A S + B = Price today of the replicating portfolio = Name Grade Valuing Options Structures We determined in class the value of a call with a strike of $175 on APPL stock when So-$100, T=3, r=5%, u=2 or 200% (stock price doubles as we go up the tree), and d=1/u==0.5 or 50% (stock price halves as we go down the tree.) We calculated the premium in 4 related ways. There is a list of the methods at the end of this document. They all produced the same premium value of approximately $32.132. 1. Use any method to determine the premium for a put on APPL stock using the same parameters and a strike of $175. Show your work for full credit. (1 point) 2. Consider a structure that pays off precisely double the payoff from the put. Value this option. I suggest you think about this question before calculating because there is a simple way to answer the question using the Law of One Price. Show your work for full credit. (1 point) 3. Consider a structure that pays off the square of the put payoff. Value this option. Remember, the four methods work for any payoff that you write down. Show your work for full credit. (1 point) Methods to Value Options Structures We discussed four related methods of using a binomial tree to value an option in the class. Method 1: Create the tree, indicate the option payoff at the terminal nodes, and use replication at each interior node to value the option. Each internal node is parameterized by the values: S = spot price at the node, u S = price if move up, d. S = price if move down with d=1/u, and Cu and C=Cash flow "derived" from price movement up and down, respectively. Set up and solve the system of two simultaneous equations to determine the number of shares (A) and the number of risk-free bonds (B) needed to duplicate the option payoff of each interior node. B = the number of bonds at an interest rate of r. Each bond costs $1 today and repays a value of (1+r) $1 in the future A = delta of option = number of shares bought or sold in the replication. It is also the number of shares used to hedge the option. A u S+B $1 = Cu A d S+B $1 = Ca It is easiest to subtract the equations to isolate A as a function of the parameters and then plug the solution for A back into one of the equations to determine B. Remember that positive quantities indicate buying and negative quantities indicate selling. Then, determine that node's value by multiplying the needed quantity by the market prices. Premium = A * S + B = Price today of the replicating portfolio Proceed backward through the tree, repeating the process at each internal node. Method 2: Structure the tree as in method 1. But use the formulas for the number of shares and the number of bonds Cu-Cd A = delta of option = number of shares Cu-Cd S (u-d) u s-d.S Cu - A US 1+r B = the number of bonds (dollars) at an interest rate of r = Premium = A S + B = Price today of the replicating portfolio =

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts