Question: please answer questions 1-4!!! and if your can answer the short answer that would be great! please answer the following questions....... 1. determine the cost

please answer questions 1-4!!! and if your can answer the short answer that would be great!

please answer the following questions.......

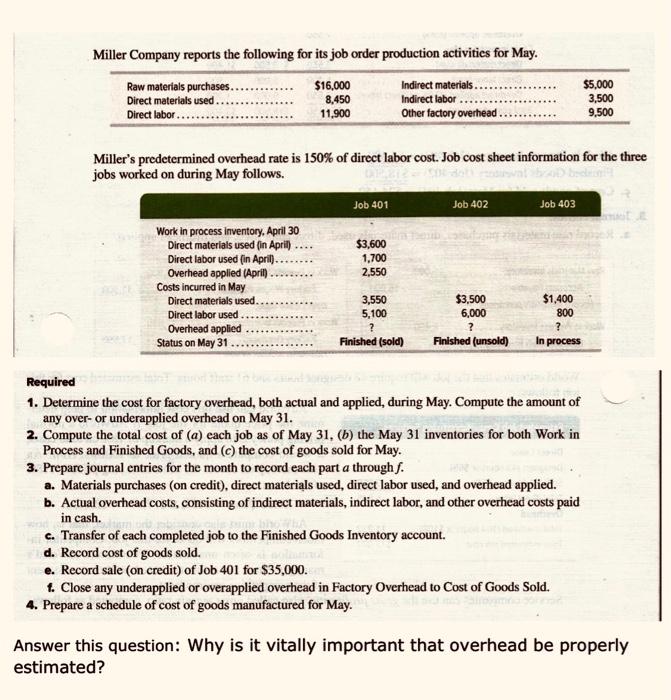

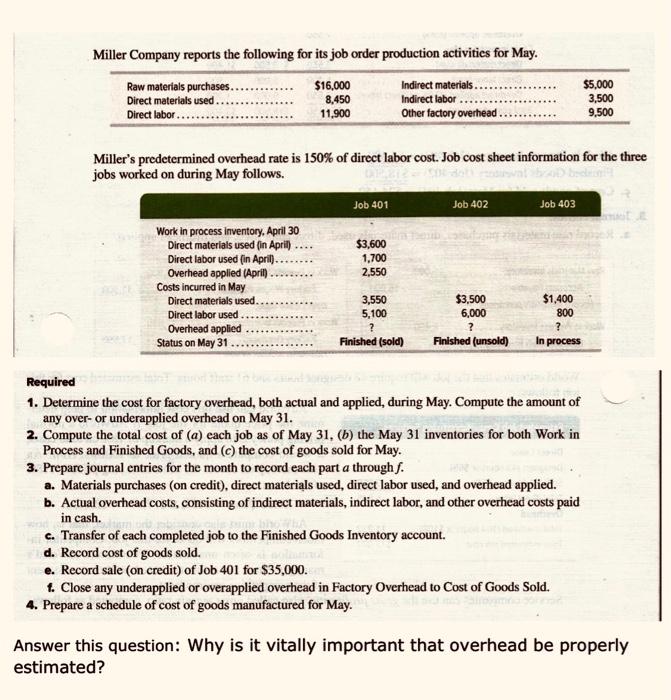

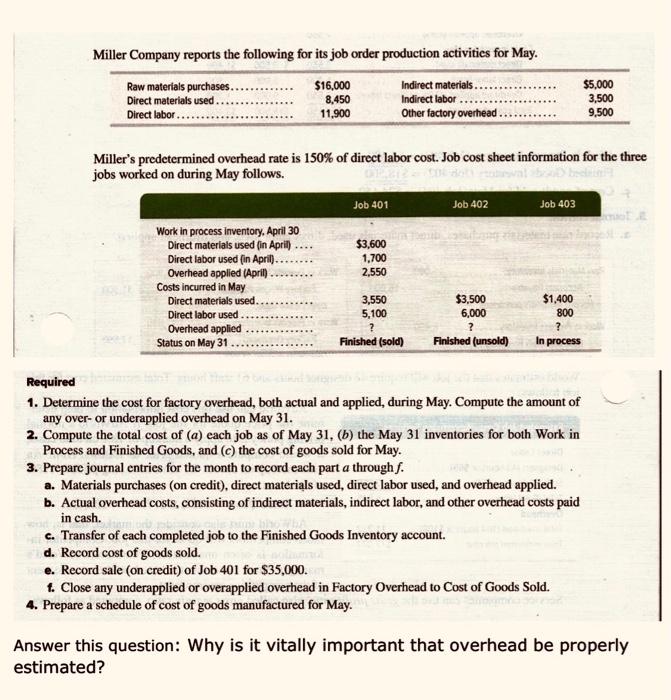

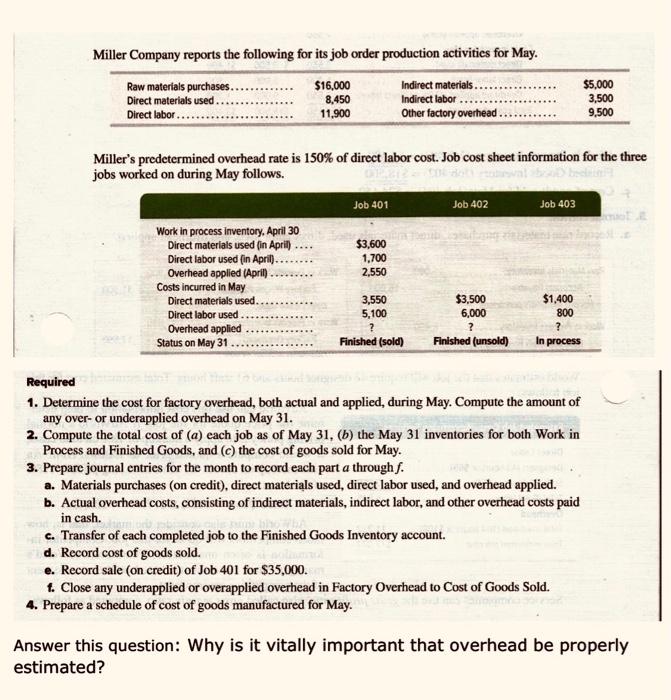

Miller Company reports the following for its job order production activities for May. Miller's predetermined overhead rate is 150% of direct labor cost. Job cost sheet information for the three jobs worked on during May follows. Required 1. Determine the cost for factory overhead, both actual and applied, during May. Compute the amount of any over-or underapplied overhead on May 31. 2. Compute the total cost of (a) each job as of May 31 , (b) the May 31 inventories for both Work in Process and Finished Goods, and (c) the cost of goods sold for May. 3. Prepare journal entries for the month to record each part a through f. a. Materials purchases (on credit), direct materials used, direct labor used, and overhead applied. b. Actual overhead costs, consisting of indirect materials, indirect labor, and other overhead costs paid in cash. c. Transfer of each completed job to the Finished Goods Inventory account. d. Record cost of goods sold. e. Record sale (on credit) of Job 401 for $35,000. f. Close any underapplied or overapplied overhead in Factory Overhead to Cost of Goods Sold. 4. Prepare a schedule of cost of goods manufactured for May. Answer this question: Why is it vitally important that overhead be properly estimated? Miller Company reports the following for its job order production activities for May. Miller's predetermined overhead rate is 150% of direct labor cost. Job cost sheet information for the three jobs worked on during May follows. Required 1. Determine the cost for factory overhead, both actual and applied, during May. Compute the amount of any over- or underapplied overhead on May 31 . 2. Compute the total cost of (a) each job as of May 31 , (b) the May 31 inventories for both Work in Process and Finished Goods, and (c) the cost of goods sold for May. 3. Prepare journal entries for the month to record each part a through f. a. Materials purchases (on credit), direct materials used, direct labor used, and overhead applied. b. Actual overhead costs, consisting of indirect materials, indirect labor, and other overhead costs paid in cash. c. Transfer of each completed job to the Finished Goods Inventory account. d. Record cost of goods sold. e. Record sale (on credit) of Job 401 for $35,000. f. Close any underapplied or overapplied overhead in Factory Overhead to Cost of Goods Sold. 4. Prepare a schedule of cost of goods manufactured for May. Answer this question: Why is it vitally important that overhead be properly estimated? Miller Company reports the following for its job order production activities for May. Miller's predetermined overhead rate is 150% of direct labor cost. Job cost sheet information for the three jobs worked on during May follows. Required 1. Determine the cost for factory overhead, both actual and applied, during May. Compute the amount of any over-or underapplied overhead on May 31. 2. Compute the total cost of (a) each job as of May 31 , (b) the May 31 inventories for both Work in Process and Finished Goods, and (c) the cost of goods sold for May. 3. Prepare journal entries for the month to record each part a through f. a. Materials purchases (on credit), direct materials used, direct labor used, and overhead applied. b. Actual overhead costs, consisting of indirect materials, indirect labor, and other overhead costs paid in cash. c. Transfer of each completed job to the Finished Goods Inventory account. d. Record cost of goods sold. e. Record sale (on credit) of Job 401 for $35,000. f. Close any underapplied or overapplied overhead in Factory Overhead to Cost of Goods Sold. 4. Prepare a schedule of cost of goods manufactured for May. Answer this question: Why is it vitally important that overhead be properly estimated? Miller Company reports the following for its job order production activities for May. Miller's predetermined overhead rate is 150% of direct labor cost. Job cost sheet information for the three jobs worked on during May follows. Required 1. Determine the cost for factory overhead, both actual and applied, during May. Compute the amount of any over- or underapplied overhead on May 31 . 2. Compute the total cost of (a) each job as of May 31 , (b) the May 31 inventories for both Work in Process and Finished Goods, and (c) the cost of goods sold for May. 3. Prepare journal entries for the month to record each part a through f. a. Materials purchases (on credit), direct materials used, direct labor used, and overhead applied. b. Actual overhead costs, consisting of indirect materials, indirect labor, and other overhead costs paid in cash. c. Transfer of each completed job to the Finished Goods Inventory account. d. Record cost of goods sold. e. Record sale (on credit) of Job 401 for $35,000. f. Close any underapplied or overapplied overhead in Factory Overhead to Cost of Goods Sold. 4. Prepare a schedule of cost of goods manufactured for May. Answer this question: Why is it vitally important that overhead be properly estimated

1. determine the cost for factory overhead, both actual and applied, during may. compute the amount of any over or under applied overhead on May 31

2. compute the total cost of (a) each job as of May 31, (b) The May 31 inventories for both work in process and finished goods, and (c) the cost of good sold for may.

3. prepare a journal entry for the month to record each part A through F

a: Materials purchased (on credit) Direct materials used, direct labor used, and overhead applied

b: actual overhead costs, consisting of indirect materials, indirect labor, and other overhead costs paid in cash.

c: transfer of each completed job to the finished goods inventory account.

d: Record cost of good sold

e: Record sale (on credit) of job 401 for 35,000.

f: Close any under applied or over applied overhead in factory overhead cost of good sold.

4. prepare a schedule of cost of goods manufacture for May

5. answer this question: why is it vitally important that overhead be properly estimated?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock