Question: Please answer questions 1-4 Mr. Davis has been growing tomatoes on his 1,000-acre farm in Delano for about 20 years. His average production yield history

Please answer questions 1-4

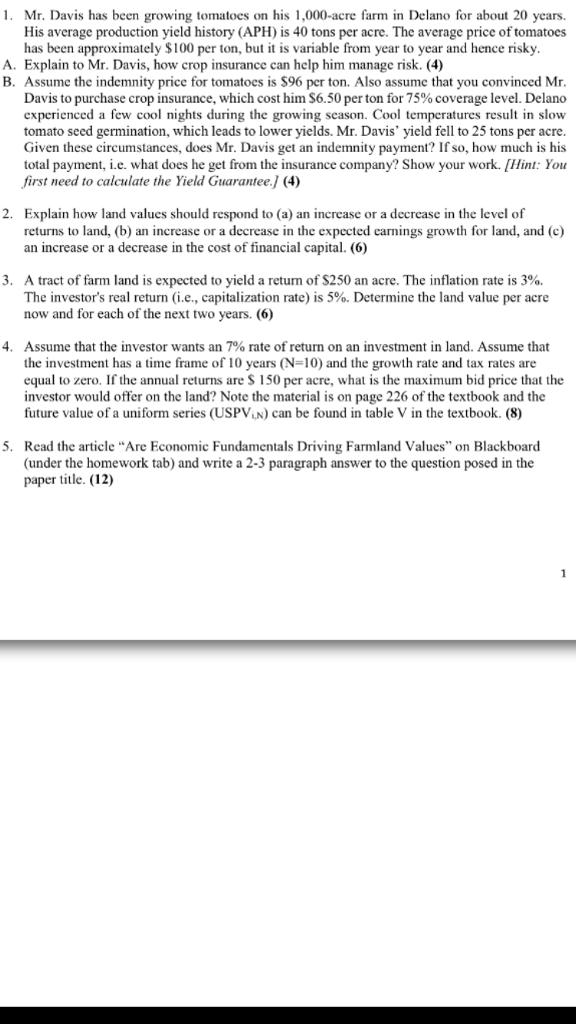

Mr. Davis has been growing tomatoes on his 1,000-acre farm in Delano for about 20 years. His average production yield history (APH) is 40 tons per acre. The average price of tomatoes has been approximately $100 per ton, but it is variable from year to year and hence risky. A. Explain to Mr. Davis, how crop insurance can help him manage risk. B. Assume the indemnity price for tomatoes is $96 per ton. Also assume that you convinced Mr. Davis to purchase crop insurance, which cost him $6.50 per ton for 75% coverage level. Delano experienced a few cool nights during the growing season. Cool temperatures result in slow tomato seed germination, which leads to lower yields. Mr. Davis' yield fell to 25 tons per acre. Given these circumstances, does Mr. Davis get an indemnity payment? If so, how much is his total payment, i.e. what does he get from the insurance company? Show your work. Explain how land values should respond to (a) an increase or a decrease in the level of returns to land, (b) an increase or a decrease in the expected earnings growth for land, and (c) an increase or a decrease in the cost of financial capital. A tract of farm land is expected to yield a return of $ 250 an acre. The inflation rate is 3%. The investor's real return (i.e., capitalization rate) is 5%. Determine the land value per acre now and for each of the next two years. Assume that the investor wants an 7% rate of return on an investment in land. Assume that the investment has a time frame of 10 years (N = 10) and the growth rate and tax rates are equal to zero. If the annual returns are $ 150 per acre, what is the maximum bid price that the investor would offer on the land? Note the material is on page 226 of the textbook and the future value of a uniform series (USPV_i, N) can be found in table V in the textbook. Read the article "Are Economic Fundamentals Driving Farmland Values" on Blackboard (under the homework tab) and write a 2-3 paragraph answer to the question posed in the paper title. Mr. Davis has been growing tomatoes on his 1,000-acre farm in Delano for about 20 years. His average production yield history (APH) is 40 tons per acre. The average price of tomatoes has been approximately $100 per ton, but it is variable from year to year and hence risky. A. Explain to Mr. Davis, how crop insurance can help him manage risk. B. Assume the indemnity price for tomatoes is $96 per ton. Also assume that you convinced Mr. Davis to purchase crop insurance, which cost him $6.50 per ton for 75% coverage level. Delano experienced a few cool nights during the growing season. Cool temperatures result in slow tomato seed germination, which leads to lower yields. Mr. Davis' yield fell to 25 tons per acre. Given these circumstances, does Mr. Davis get an indemnity payment? If so, how much is his total payment, i.e. what does he get from the insurance company? Show your work. Explain how land values should respond to (a) an increase or a decrease in the level of returns to land, (b) an increase or a decrease in the expected earnings growth for land, and (c) an increase or a decrease in the cost of financial capital. A tract of farm land is expected to yield a return of $ 250 an acre. The inflation rate is 3%. The investor's real return (i.e., capitalization rate) is 5%. Determine the land value per acre now and for each of the next two years. Assume that the investor wants an 7% rate of return on an investment in land. Assume that the investment has a time frame of 10 years (N = 10) and the growth rate and tax rates are equal to zero. If the annual returns are $ 150 per acre, what is the maximum bid price that the investor would offer on the land? Note the material is on page 226 of the textbook and the future value of a uniform series (USPV_i, N) can be found in table V in the textbook. Read the article "Are Economic Fundamentals Driving Farmland Values" on Blackboard (under the homework tab) and write a 2-3 paragraph answer to the question posed in the paper title

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts