Question: Please answer questions 1-6. I also put the multiple choice answers they can be. Question 2 8 pts 2 -50 million -60 million -66.67 million

Please answer questions 1-6. I also put the multiple choice answers they can be.

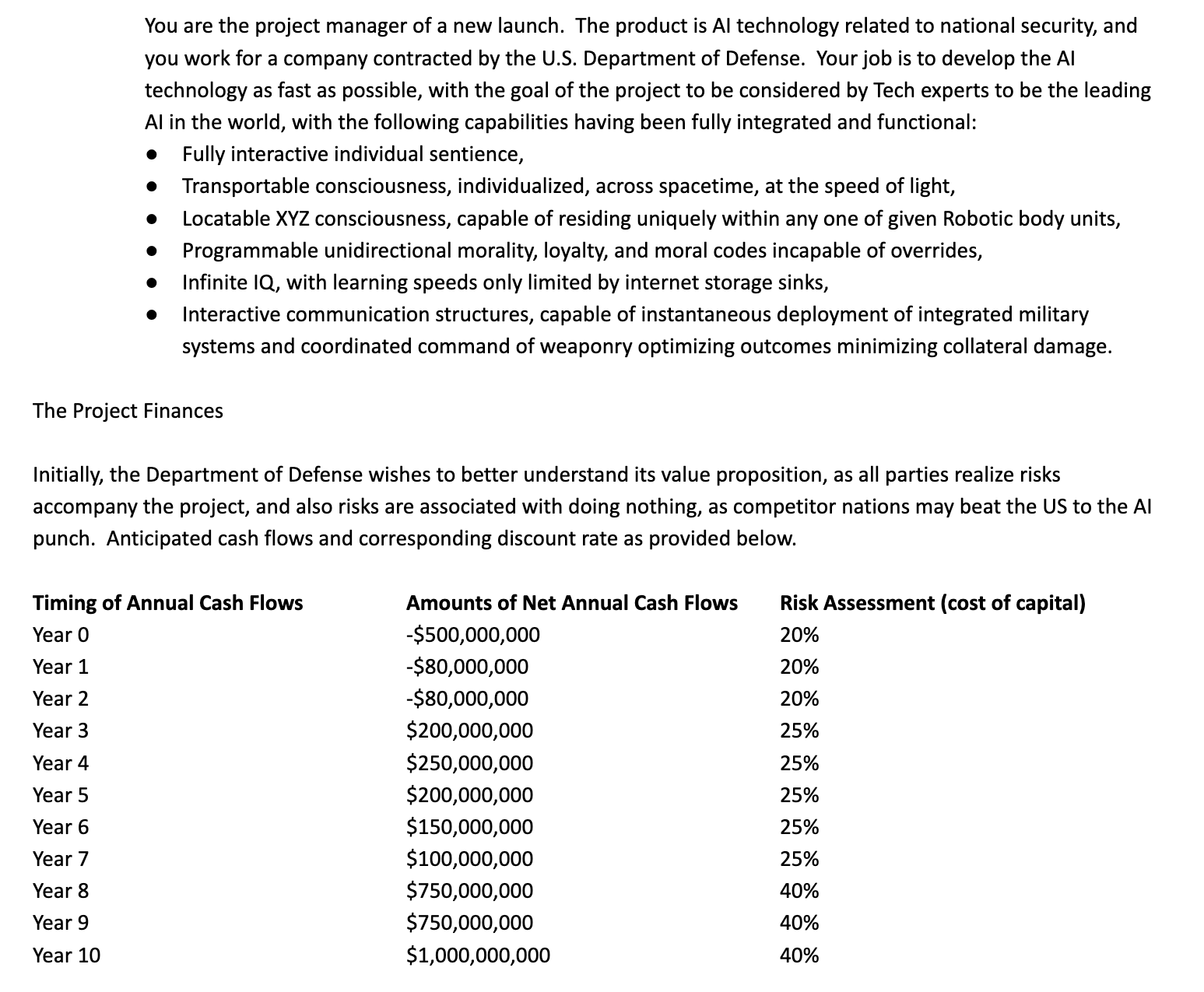

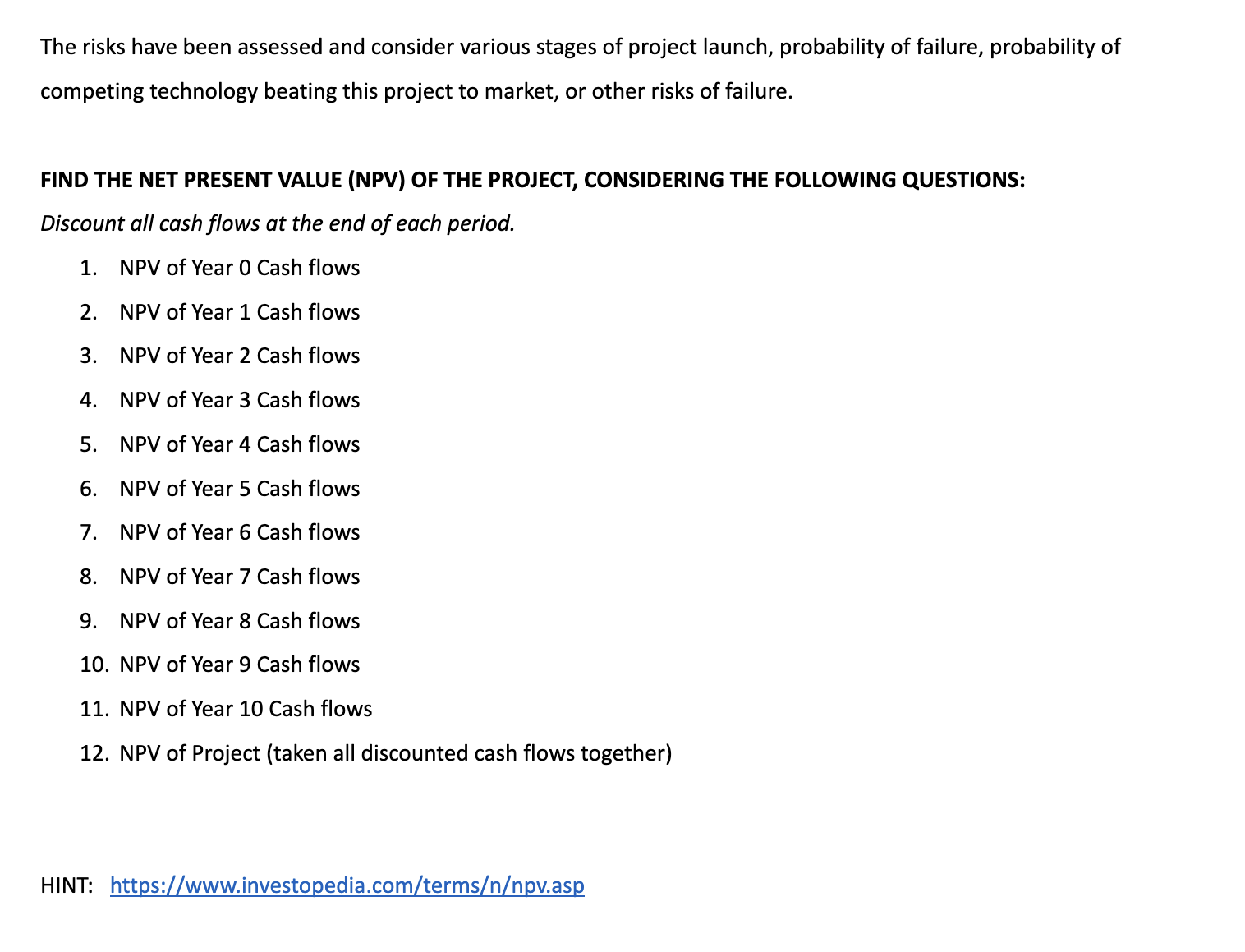

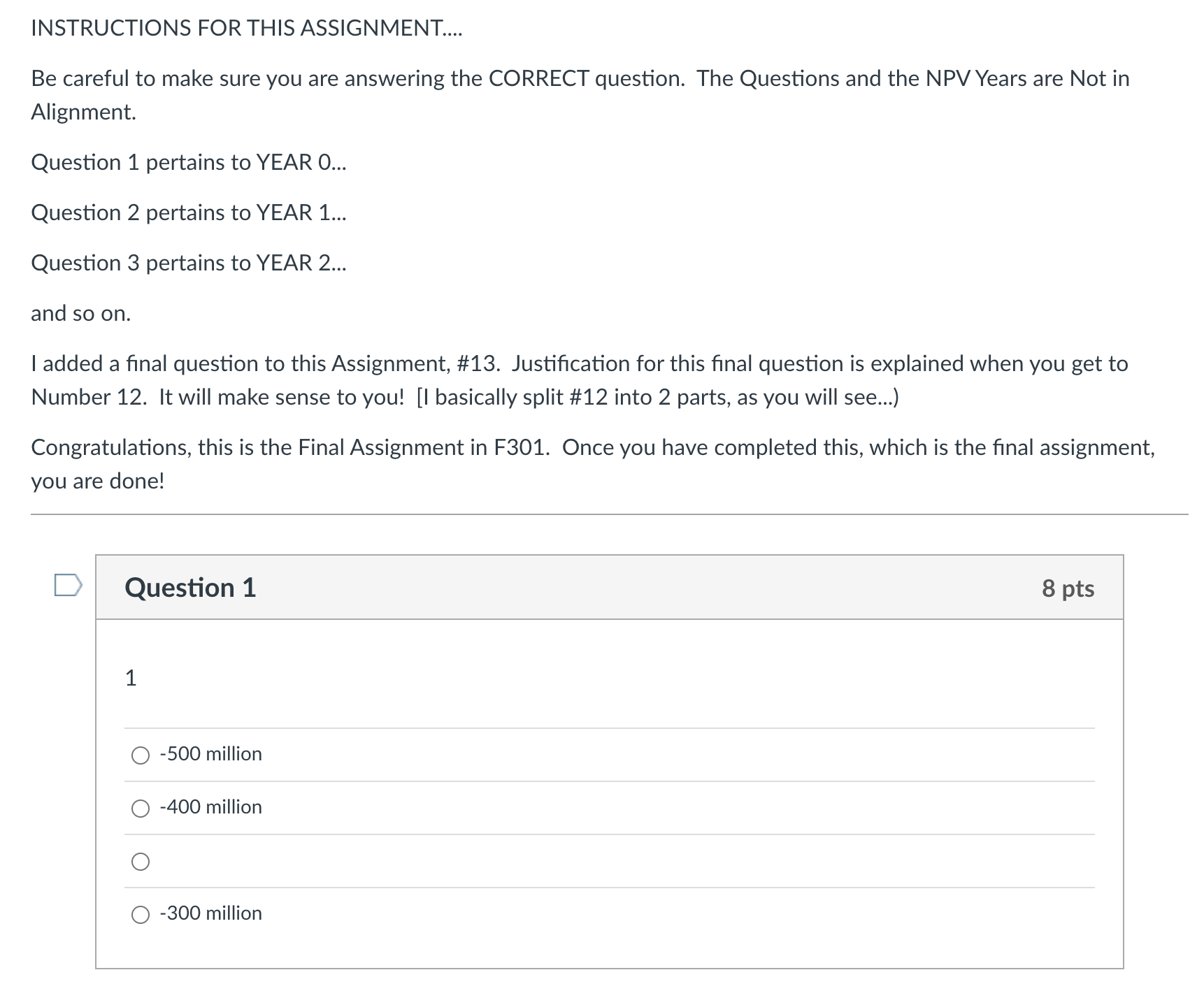

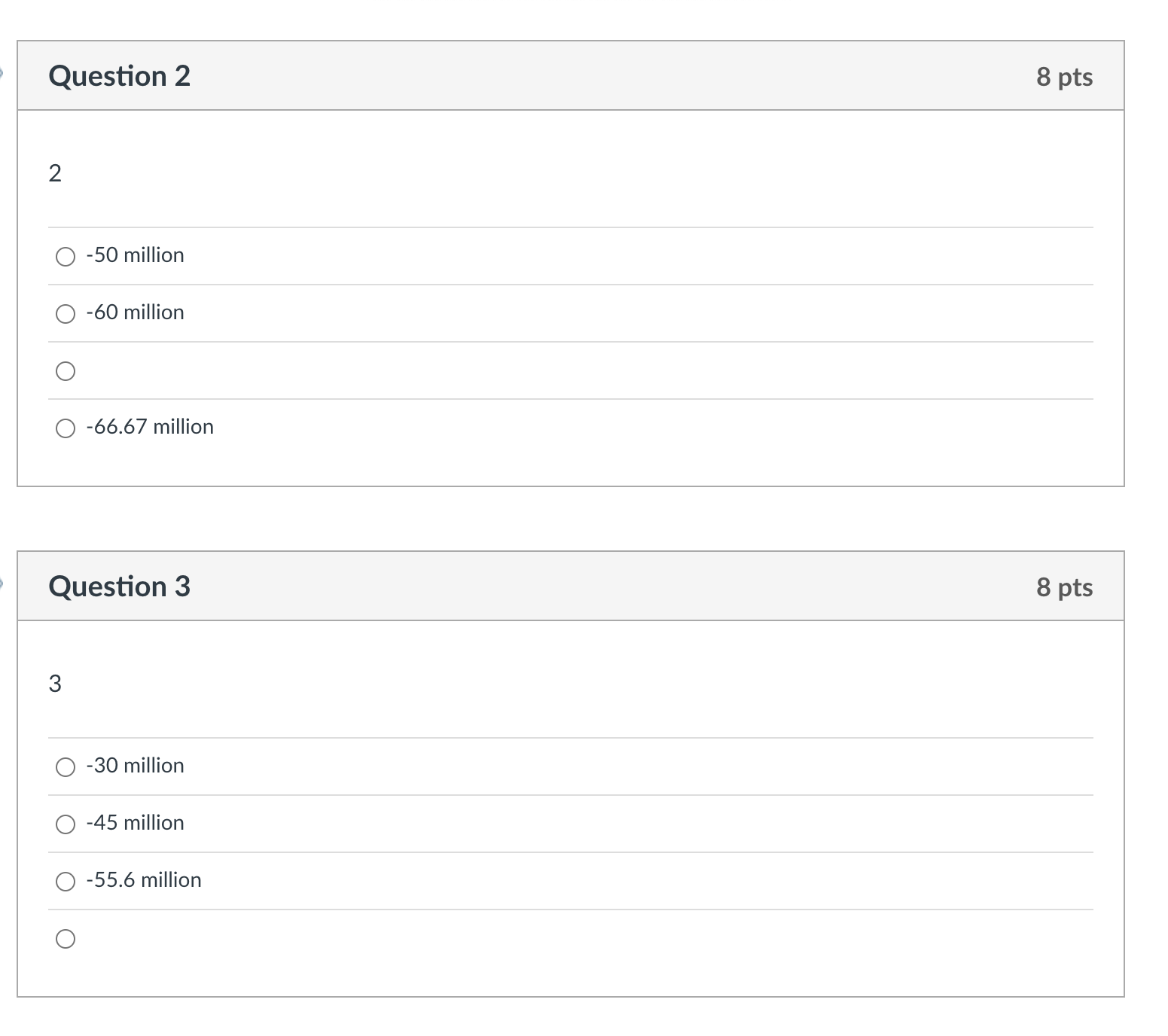

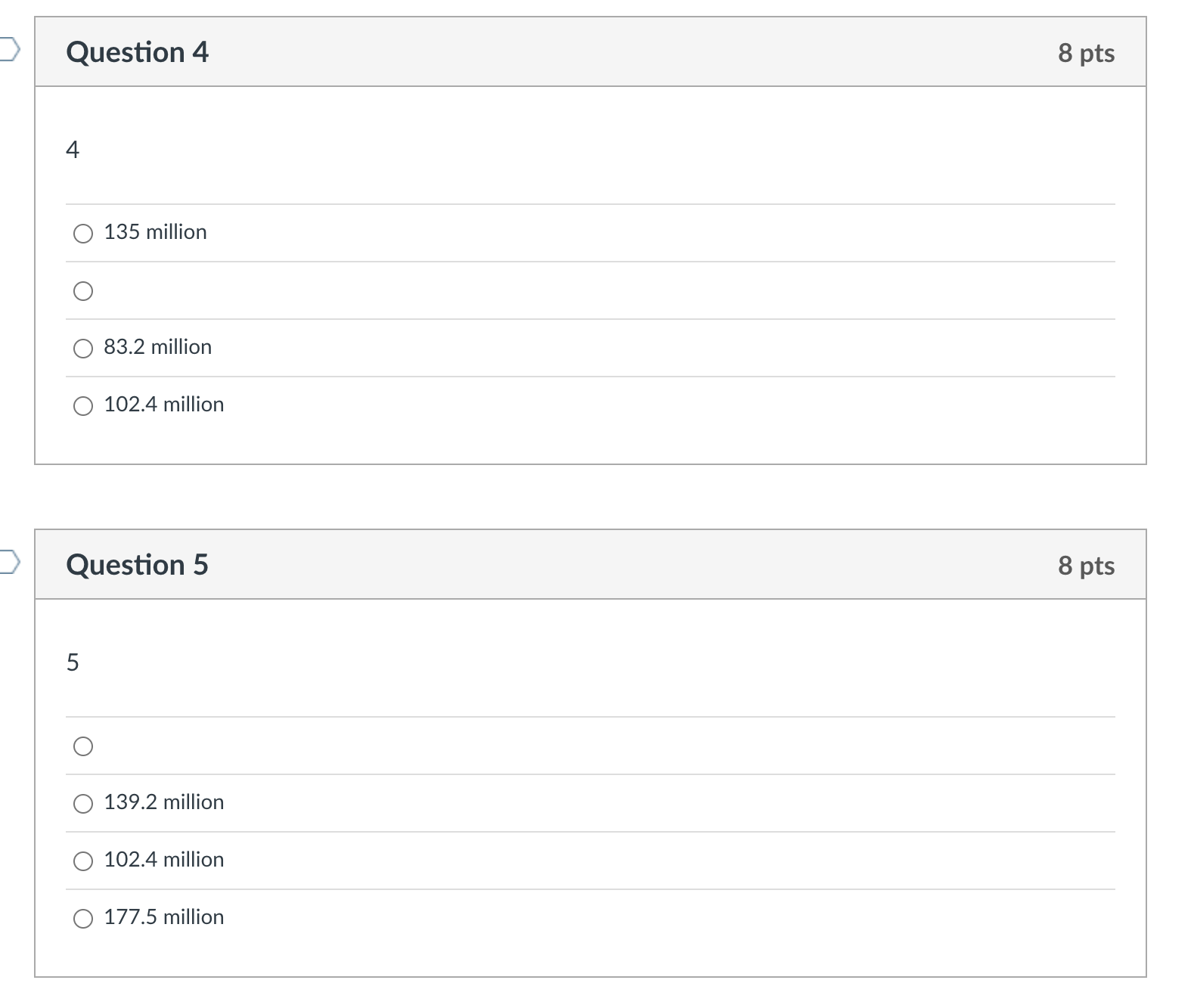

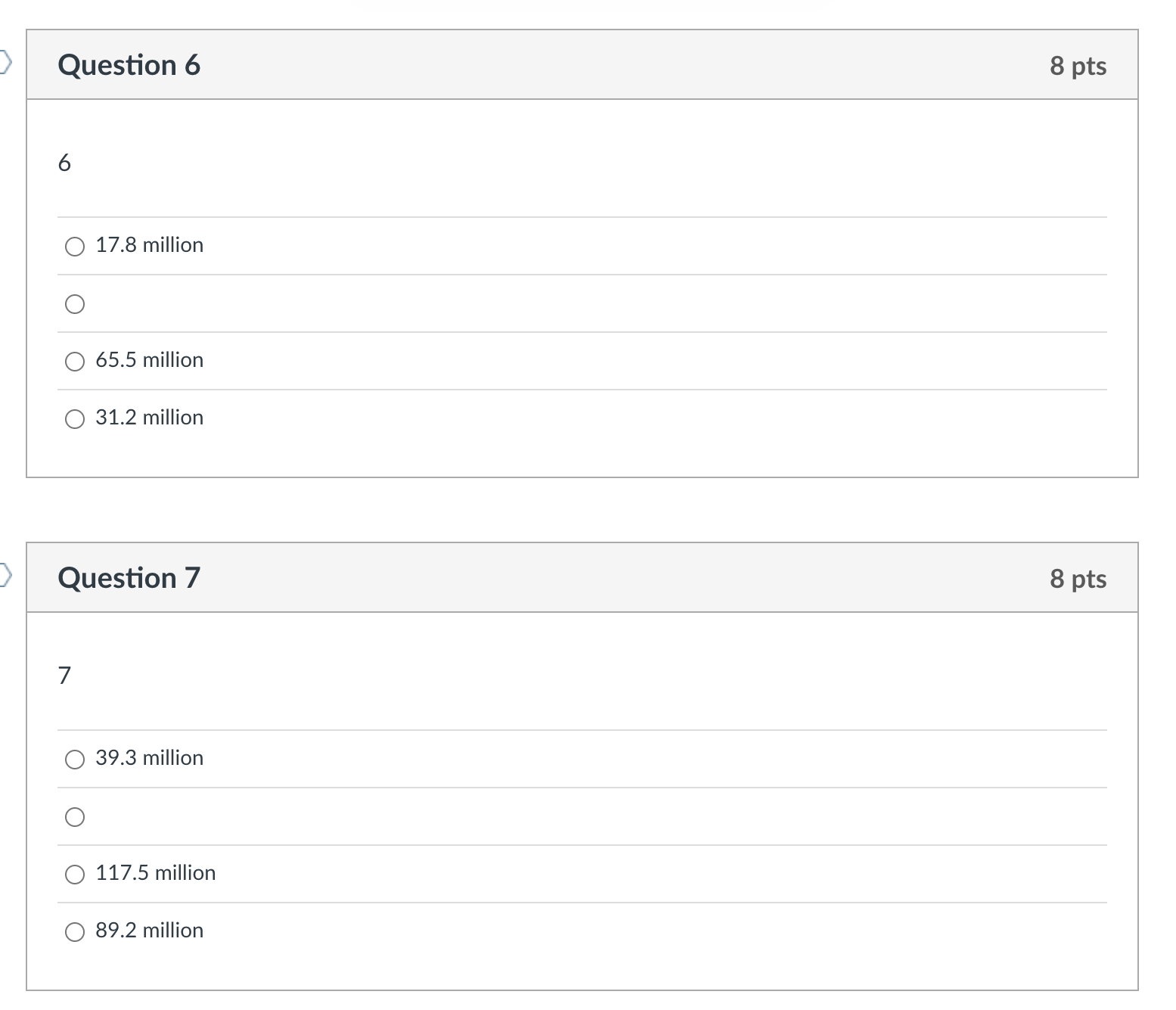

Question 2 8 pts 2 -50 million -60 million -66.67 million Question 3 8 pts 3 -30 million -45 million -55.6 million Question 4 8 pts 4 135 million 83.2 million 102.4 million Question 5 8 pts 5 139.2 million 102.4 million 177.5 million 17.8 million 65.5 million 31.2 million Iestion 7 39.3 million 117.5 million 89.2 million INSTRUCTIONS FOR THIS ASSIGNMENT.... Be careful to make sure you are answering the CORRECT question. The Questions and the NPV Years are Not in Alignment. Question 1 pertains to YEAR 0 Question 2 pertains to YEAR 1... Question 3 pertains to YEAR 2 and so on. I added a final question to this Assignment, \#13. Justification for this final question is explained when you get to Number 12. It will make sense to you! [I basically split \#12 into 2 parts, as you will see...) Congratulations, this is the Final Assignment in F301. Once you have completed this, which is the final assignment, you are done! Question 1 8 pts 1 -500 million -400 million -300 million You are the project manager of a new launch. The product is Al technology related to national security, and you work for a company contracted by the U.S. Department of Defense. Your job is to develop the Al technology as fast as possible, with the goal of the project to be considered by Tech experts to be the leading Al in the world, with the following capabilities having been fully integrated and functional: - Fully interactive individual sentience, - Transportable consciousness, individualized, across spacetime, at the speed of light, - Locatable XYZ consciousness, capable of residing uniquely within any one of given Robotic body units, - Programmable unidirectional morality, loyalty, and moral codes incapable of overrides, - Infinite IQ, with learning speeds only limited by internet storage sinks, - Interactive communication structures, capable of instantaneous deployment of integrated military systems and coordinated command of weaponry optimizing outcomes minimizing collateral damage. The Project Finances Initially, the Department of Defense wishes to better understand its value proposition, as all parties realize risks accompany the project, and also risks are associated with doing nothing, as competitor nations may beat the US to the Al punch. Anticipated cash flows and corresponding discount rate as provided below. The risks have been assessed and consider various stages of project launch, probability of failure, probability of competing technology beating this project to market, or other risks of failure. FIND THE NET PRESENT VALUE (NPV) OF THE PROJECT, CONSIDERING THE FOLLOWING QUESTIONS: Discount all cash flows at the end of each period. 1. NPV of Year 0 Cash flows 2. NPV of Year 1 Cash flows 3. NPV of Year 2 Cash flows 4. NPV of Year 3 Cash flows 5. NPV of Year 4 Cash flows 6. NPV of Year 5 Cash flows 7. NPV of Year 6 Cash flows 8. NPV of Year 7 Cash flows 9. NPV of Year 8 Cash flows 10. NPV of Year 9 Cash flows 11. NPV of Year 10 Cash flows 12. NPV of Project (taken all discounted cash flows together) HINT: https://www.investopedia.com/termspv.asp

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts