Question: Please answer questions 1-7 based on the following information: You have been asked by the president of your company to evaluate the proposed acquisition of

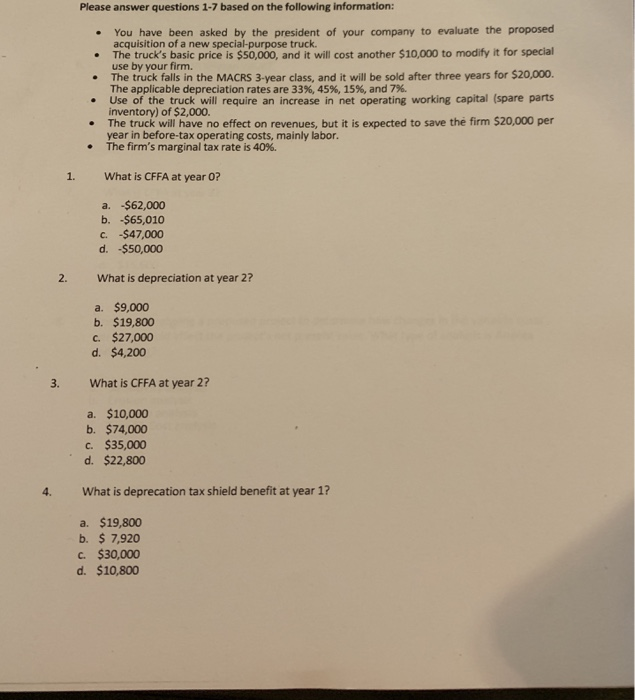

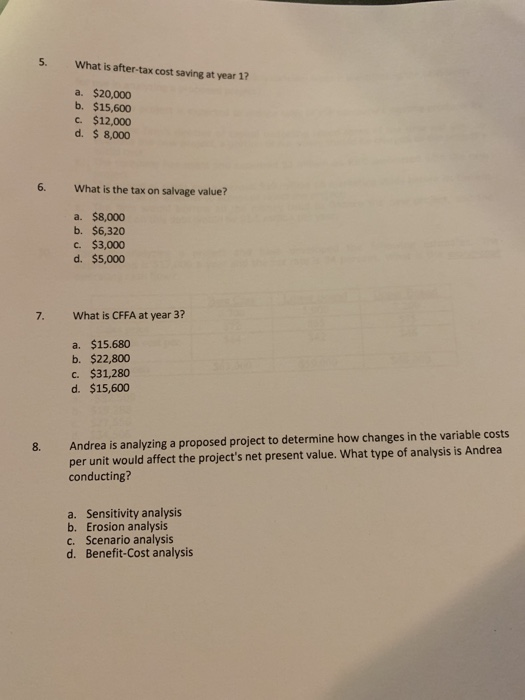

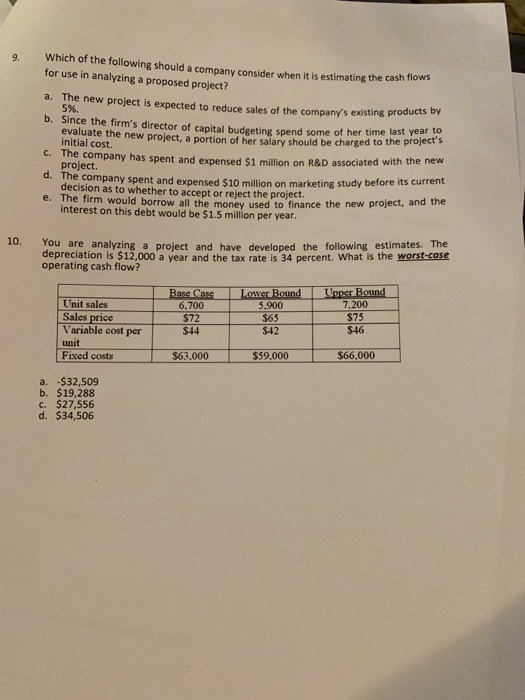

Please answer questions 1-7 based on the following information: You have been asked by the president of your company to evaluate the proposed acquisition of a new special-purpose truck The truck's basic price is $50,000, and it will cost another $10,000 to modify it for special use by your firm. The truck falls in the MACRS 3-year class, and it will be sold after three years for $20,000. The applicable depreciation rates are 33%, 45%, 15%, and 7%. Use of the truck will require an increase in net operating working capital (spare parts * inventory) of $2,000. The truck will have no effect on revenues, but it is expected to save the firm $20,000 per year in before-tax operating costs, mainly labor. The firm's marginal tax rate is 40%. 1. What is CFFA at year 0? a. -$62,000 b. -$65,010 C. $47,000 d. $50,000 2. What is depreciation at year 2? a. $9,000 b. $19,800 c. $27,000 d. $4,200 3. What is CFFA at year 2? a. $10,000 b. $74,000 c. $35,000 d. $22,800 4. What is deprecation tax shield benefit at year 1? a. $19,800 b. $ 7,920 c. $30,000 d. $10,800 5. What is after-tax cost saving at year 1? a. $20,000 b. $15,600 c. $12,000 d. $ 8,000 6. What is the tax on salvage value? a. $8,000 b. $6,320 c. $3,000 d. $5,000 7. What is CFFA at year 3? a. $15.680 b. $22,800 c. $31,280 d. $15,600 8. Andrea is analyzing a proposed project to determine how changes in the variable costs per unit would affect the project's net present value. What type of analysis is Andrea conducting? a. Sensitivity analysis b. Erosion analysis c. Scenario analysis d. Benefit-Cost analysis 9. Which of the following should a company consider when it is estimat for use in analyzing a proposed project? a. The new project is expected to reduce sales of the company's existing products by b. Since the firm's director of capital budgeting spend some of her time last yelect's 5% evaluate the new project, a portion of her salary should be charged to the P initial cost. roject's c. The company has spent and expensed $1 million on R&D associated with the new project. decision as to whether to accept or reject the project. interest on this debt would be $1.5 million per year. mpany spent and expensed $10 million on marketing study before its current money used to finance the new project, and the d. The co e. The firm would borrow all the 10. You are analyzing a project and have developed the following estimates. The depreciation is $12,000 a year and the tax rate is 34 percent. What is the worst-cose operating cash flow? Unit sales Sales price Variable cost per 6.700 $72 $44 5,900 $65 $42 7.200 S75 $46 $63.000 $59.000 $66,000 Fixed costs a. -$32,509 b. $19,288 c. $27,556 d. $34,506

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts