Question: Please answer questions 2b& c and show work. Thank you! QUESTION 2 Assume that you manage a risky portfolio with an expected rate of return

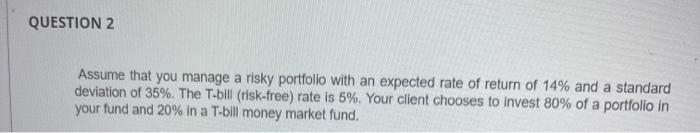

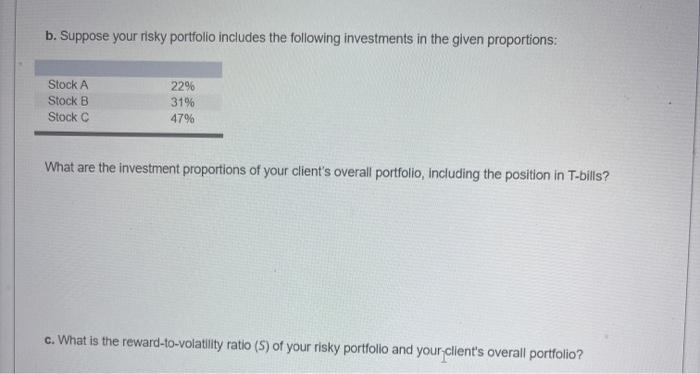

QUESTION 2 Assume that you manage a risky portfolio with an expected rate of return of 14% and a standard deviation of 35%. The T-bill (risk-free) rate is 5%. Your client chooses to invest 80% of a portfolio in your fund and 20% in a T-bill money market fund. b. Suppose your risky portfolio includes the following investments in the given proportions: Stock A Stock B Stock 22% 31% 47% What are the investment proportions of your client's overall portfolio, including the position in T-bills? c. What is the reward-to-volatility ratio (s) of your risky portfolio and your client's overall portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts