Question: Please answer Questions 8 & 9 QUESTION 7 10 points Saved Suppose Dell Inc is currently has a debt to equity ratio of 1:2. The

Please answer Questions 8 & 9

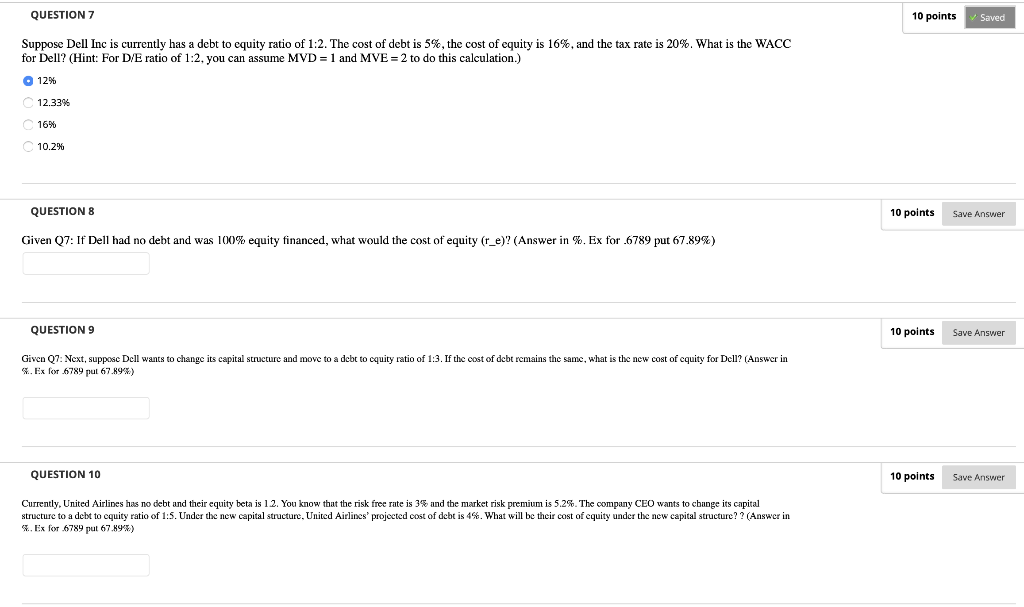

QUESTION 7 10 points Saved Suppose Dell Inc is currently has a debt to equity ratio of 1:2. The cost of debt is 5%, the cost of equity is 16%, and the tax rate is 20%. What is the WACC for Dell? (Hint: For D/E ratio of 1:2, you can assume MVD= 1 and MVE = 2 to do this calculation.) 12% 12.33% 16% 10.296 QUESTIONS 10 points Save Answer Given Q7: If Dell had no debt and was 100% equity financed, what would the cost of equity (r_e)? (Answer in %. Ex for .6789 put 67.89%) QUESTION 9 10 points Save Answer Given Q7: Next, suppose Dell wants to change its capital structure and move to a debt to cquity ratio of 1:3. If the cost of debt remains the same, what is the new cost of cquity for Dell? (Answer in 5. Ex for 6789 put 67.89%.) QUESTION 10 10 points Save Answer Currently. United Airlines has no debt and their equity beta is 12. You know that the risk free rate is 3% and the market risk premium is 5.2%. The company CEO wants to change its capital structure to a debt to equity ratio of 1:5. Under the new capital structure, United Airlines projected cost of debt is 4%. What will be their cost of equity under the new capital structure?? (Answer in %. Ex for 6789 put 67.89%)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts