Question: Please answer questions 9&10 and show work. Thank you! The following information relates to questions 9-10: Suppose you have invested $120,000 in an Exchange Traded

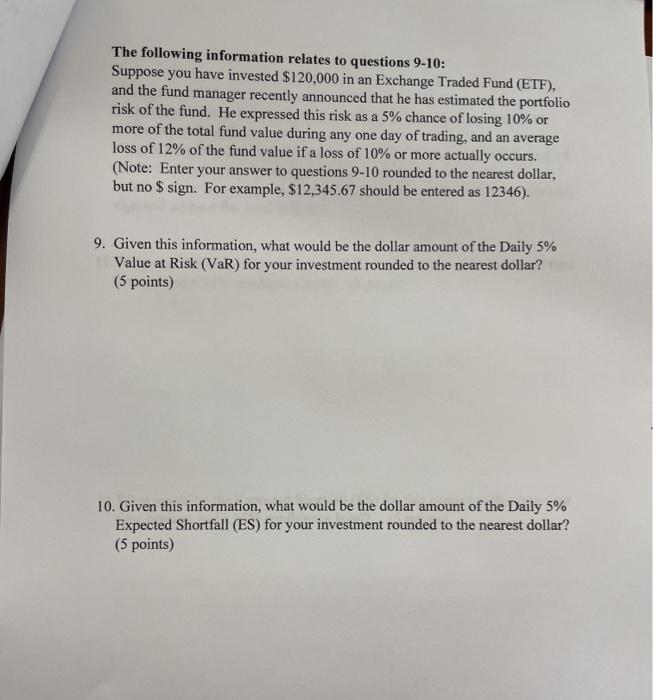

The following information relates to questions 9-10: Suppose you have invested $120,000 in an Exchange Traded Fund (ETF). and the fund manager recently announced that he has estimated the portfolio risk of the fund. He expressed this risk as a 5% chance of losing 10% or more of the total fund value during any one day of trading, and an average loss of 12% of the fund value if a loss of 10% or more actually occurs. (Note: Enter your answer to questions 9-10 rounded to the nearest dollar, but no $ sign. For example, $12,345.67 should be entered as 12346). 9. Given this information, what would be the dollar amount of the Daily 5% Value at Risk (VaR) for your investment rounded to the nearest dollar? (5 points) 10. Given this information, what would be the dollar amount of the Daily 5% Expected Shortfall (ES) for your investment rounded to the nearest dollar? (5 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts