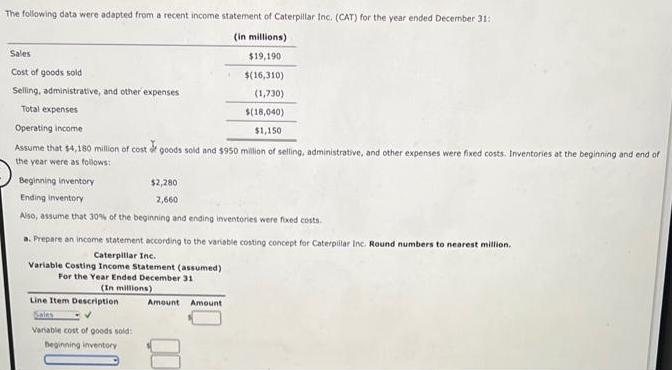

Question: The following data were adapted from a recent income statement of Caterpillar Inc. (CAT) for the year ended December 31: (in millions) $19,190 $(16,310)

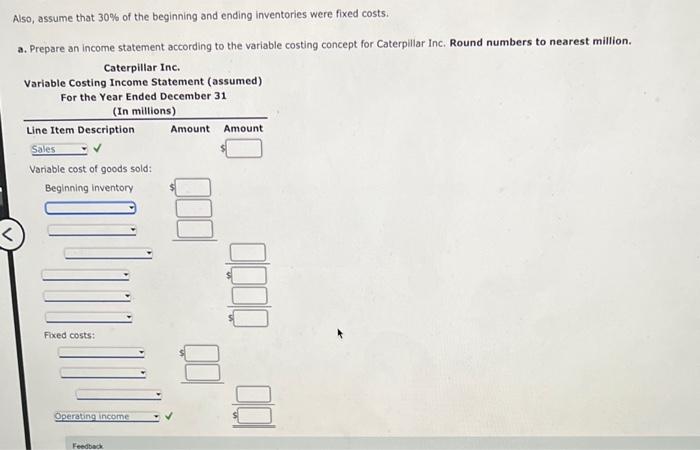

The following data were adapted from a recent income statement of Caterpillar Inc. (CAT) for the year ended December 31: (in millions) $19,190 $(16,310) (1,730) $(18,040) Operating income $1,150 Assume that $4,180 million of cost & goods sold and $950 million of selling, administrative, and other expenses were fixed costs. Inventories at the beginning and end of the year were as follows: Sales Cost of goods sold Selling, administrative, and other expenses Total expenses Beginning inventory Ending inventory Also, assume that 30% of the beginning and ending inventories were fixed costs. a. Prepare an income statement according to the variable costing concept for Caterpillar Inc. Round numbers to nearest million. Caterpillar Inc. Variable Costing Income Statement (assumed) For the Year Ended December 31 (In millions) Line Item Description Sales Variable cost of goods sold: beginning inventory $2,280 2,660 Amount Amount Also, assume that 30% of the beginning and ending inventories were fixed costs. a. Prepare an income statement according to the variable costing concept for Caterpillar Inc. Round numbers to nearest million. Caterpillar Inc. Variable Costing Income Statement (assumed) For the Year Ended December 31 (In millions) Line Item Description Sales Variable cost of goods sold: Beginning inventory Fixed costs: Operating income Feedback Amount Amount 000 00

Step by Step Solution

3.49 Rating (149 Votes )

There are 3 Steps involved in it

Sales revenue 19190 million Variable costs Cost of goods sold 12464 million calculated as 70 of begi... View full answer

Get step-by-step solutions from verified subject matter experts