Question: please answer questions A, B and C , thanks Cost recovery. Richardses' Tree Farm, Inc. purchased a new aerial tree trimmer for $93.000. It is

please answer questions A, B and C , thanks

please answer questions A, B and C , thanks

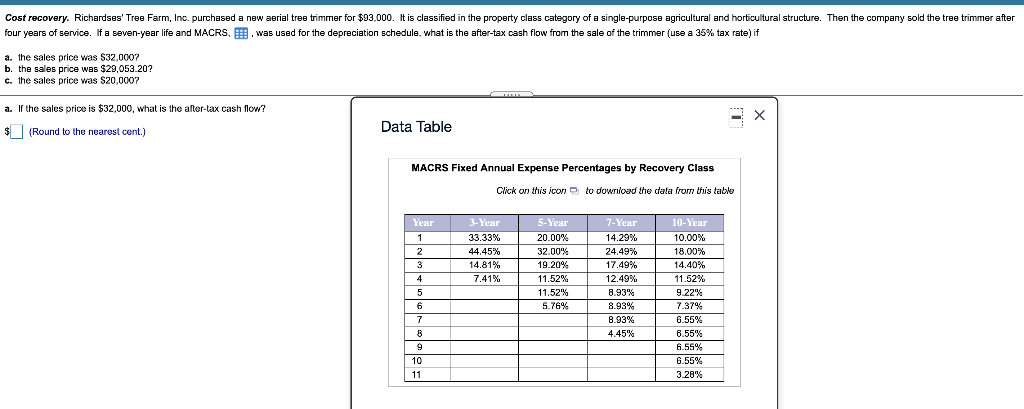

Cost recovery. Richardses' Tree Farm, Inc. purchased a new aerial tree trimmer for $93.000. It is classified in the property class category of a single-purpose agricultural and horticultural structure. Then the company sold the tree trimmer after four years of service. If a seven-year life and MACRS, B. was used for the depreciation schedule, what is the after-tax cash flow from the sale of the trimmer (use a 35% tax rate) if -(a a. the sales price was $32,000? b. the sales price was $29,053.20? C. the sales price was $20,000? a. If the sales price is $32,000, what is the after-tax cash flow? , $ (Round to the nearest cont.) X Data Table MACRS Fixed Annual Expense Percentages by Recovery Class Click on this icon to download the data from thuis table 3-Year 33.33% 44.45% 14.81% 7.41% Year 1 1 2 2 3 3 4 5 5 6 7 3 9 10 11 5-Year 20.00% 32.00% 19.20% 11.52% 11.52% 5.76% 7-Year 14.29% 24.49% 17.49% 12.49% 8.93% 8.93% 8.93% 4.45% 10-Year 10.00% 18.00% 14.40% 11.52% 9.22% 7.37% 6.55% 6.55% 6.55% 6.55% 3.28%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts