Question: PLEASE ANSWER QUESTIONS FULLY! PLEASE EXPLAIN EACH ANSWER DETAILED! I WILL LEAVE THUMBS UP! 1. The ( ) is the interest rate that would exist

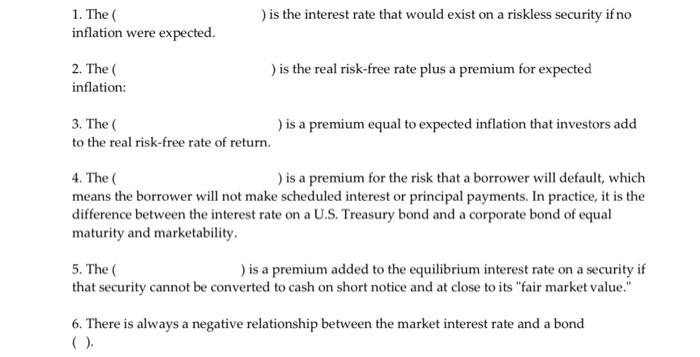

1. The ( ) is the interest rate that would exist on a riskless security if no inflation were expected. 2. The ( ) is the real risk-free rate plus a premium for expected inflation: 3. The ( ) is a premium equal to expected inflation that investors add to the real risk-free rate of return. 4. The ( ) is a premium for the risk that a borrower will default, which means the borrower will not make scheduled interest or principal payments. In practice, it is the difference between the interest rate on a U.S. Treasury bond and a corporate bond of equal maturity and marketability. 5. The ( l is a premium added to the equilibrium interest rate on a security if that security cannot be converted to cash on short notice and at close to its "fair market value." 6. There is always a negative relationship between the market interest rate and a bond ( )

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts