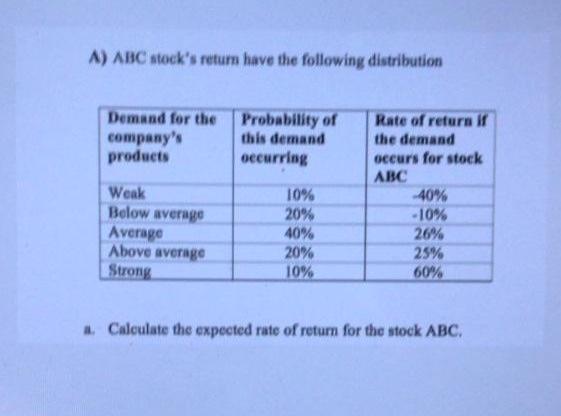

Question: please answer quick its urgent A) ABC stock's return have the following distribution Demand for the Probability of company's this demand products occurring Weak Below

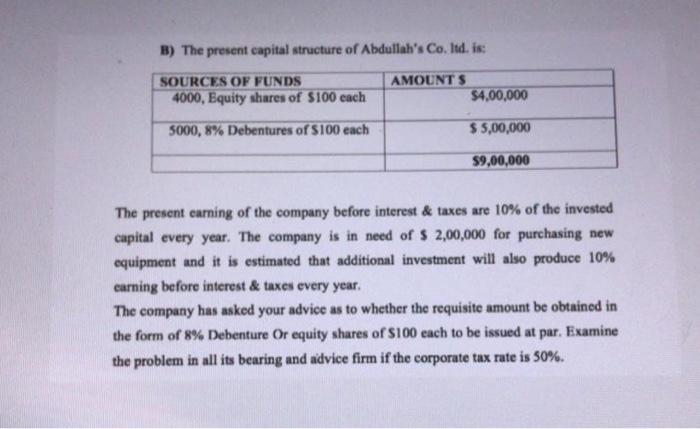

A) ABC stock's return have the following distribution Demand for the Probability of company's this demand products occurring Weak Below average Average Above average Strong 10% 20% 40% 20% 10% Rate of return of the demand occurs for stock ABC 40% -10% 26% 25% 60% Calculate the expected rate of return for the stock ABC. B) The present capital structure of Abdullah's Co. Itd. is: SOURCES OF FUNDS 4000, Equity shares of $100 each AMOUNTS $4,00,000 5000, 8% Debentures of $100 each $ 5,00,000 $9,00,000 The present earning of the company before interest & taxes are 10% of the invested capital every year. The company is in need of $ 2,00,000 for purchasing new equipment and it is estimated that additional investment will also produce 10% carning before interest & taxes every year. The company has asked your advice as to whether the requisite amount be obtained in the form of 8% Debenture or equity shares of $100 each to be issued at par. Examine the problem in all its bearing and advice firm if the corporate tax rate is 50%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts