Question: PLEASE ANSWER QUICK Shareholders can remove money tax free from a C corporation: ONever O When the corporation declares a dividend O When there is

PLEASE ANSWER QUICK

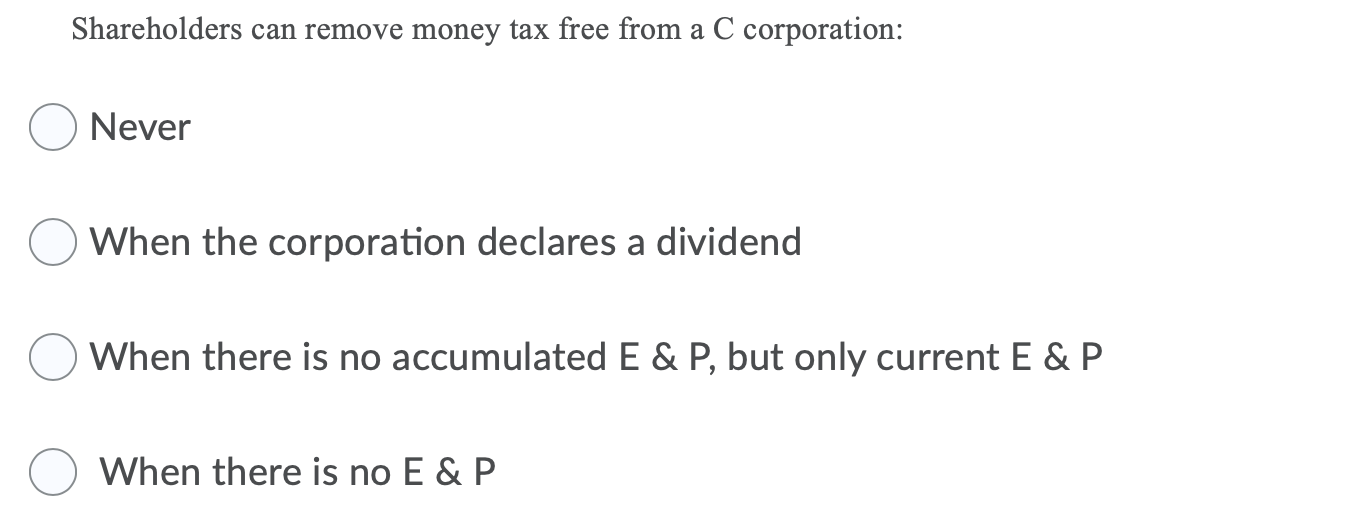

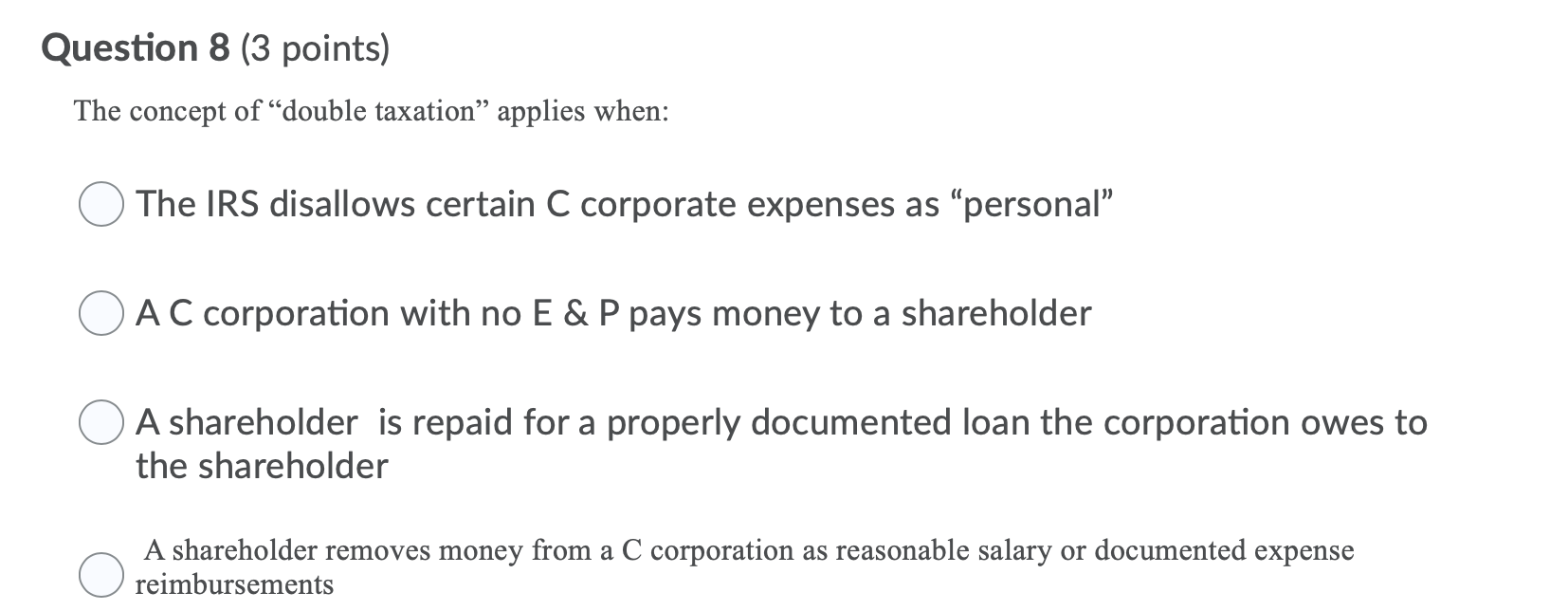

Shareholders can remove money tax free from a C corporation: ONever O When the corporation declares a dividend O When there is no accumulated E & P, but only current E&P o When there is no E&P Question 8 (3 points) The concept of double taxation applies when: O The IRS disallows certain C corporate expenses as personal O AC corporation with no E & P pays money to a shareholder O A shareholder is repaid for a properly documented loan the corporation owes to the shareholder A shareholder removes money from a C corporation as reasonable salary or documented expense reimbursements

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts