Question: please answer quickly as on timed exam A firm is considering replacing an existing machine with a new machine. Both machines are expected to have

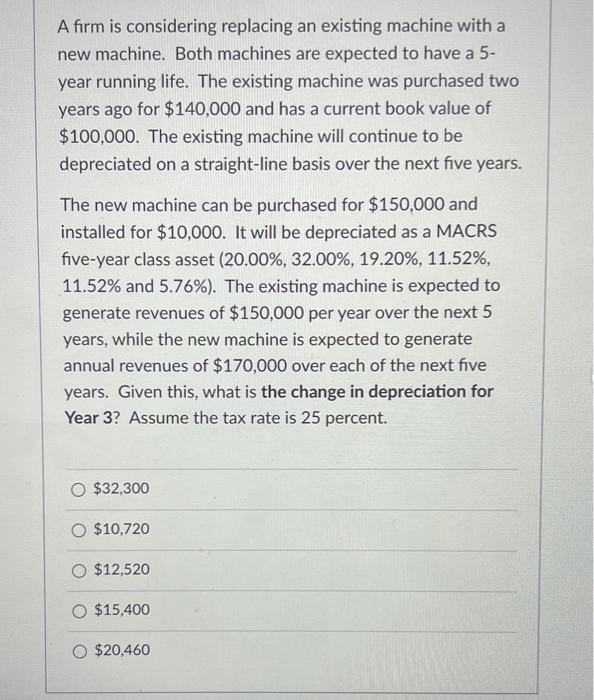

A firm is considering replacing an existing machine with a new machine. Both machines are expected to have a 5- year running life. The existing machine was purchased two years ago for $140,000 and has a current book value of $100,000. The existing machine will continue to be depreciated on a straight-line basis over the next five years. The new machine can be purchased for $150,000 and installed for $10,000. It will be depreciated as a MACRS five-year class asset (20.00%, 32.00%, 19.20%, 11.52%, 11.52% and 5.76%). The existing machine is expected to generate revenues of $150,000 per year over the next 5 years, while the new machine is expected to generate annual revenues of $170,000 over each of the next five years. Given this, what is the change in depreciation for Year 3? Assume the tax rate is 25 percent. $32,300 O $10,720 $12,520 O $15,400 $20,460

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts