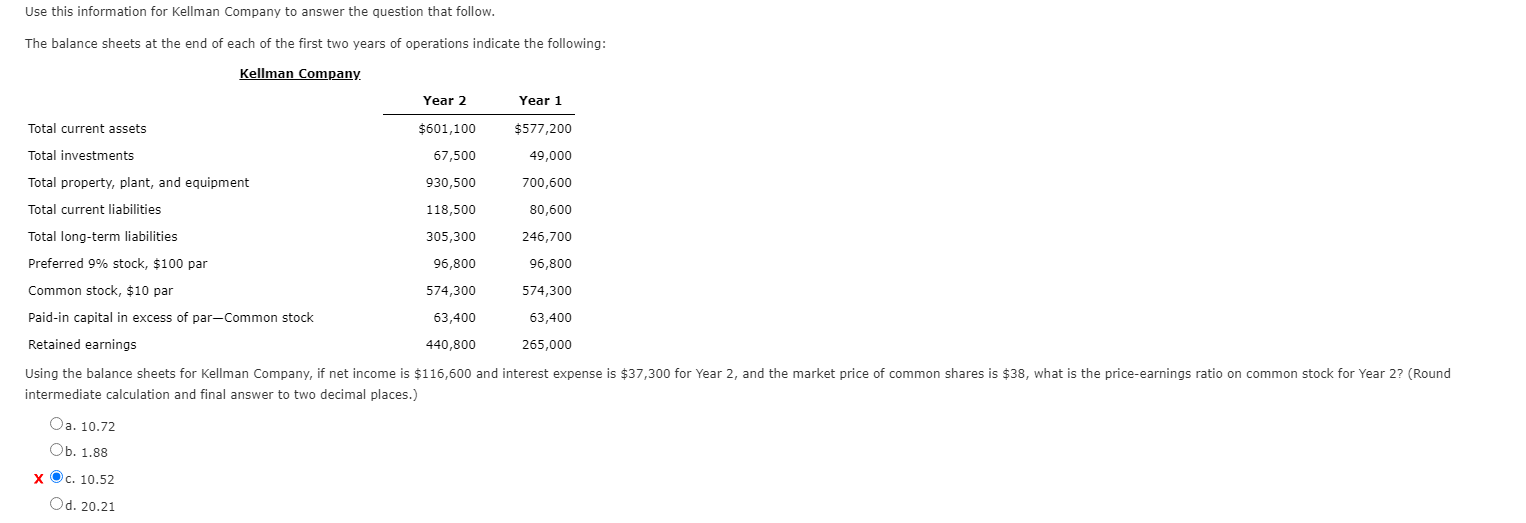

Question: Use this information for Kellman Company to answer the question that follow. The balance sheets at the end of each of the first two years

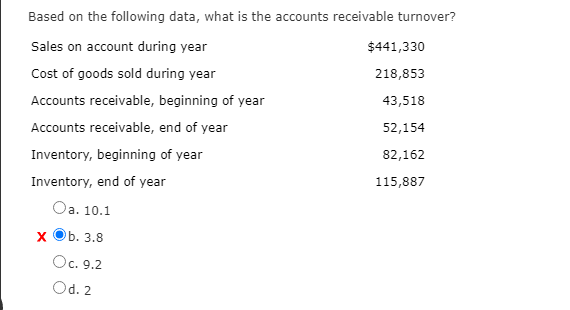

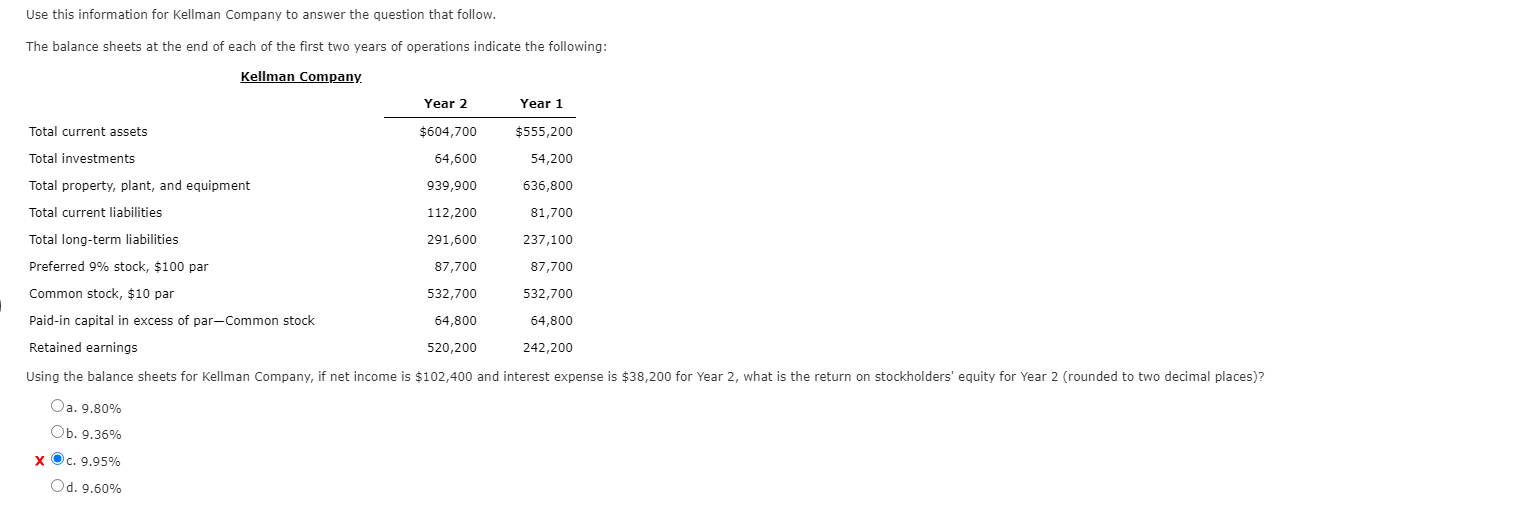

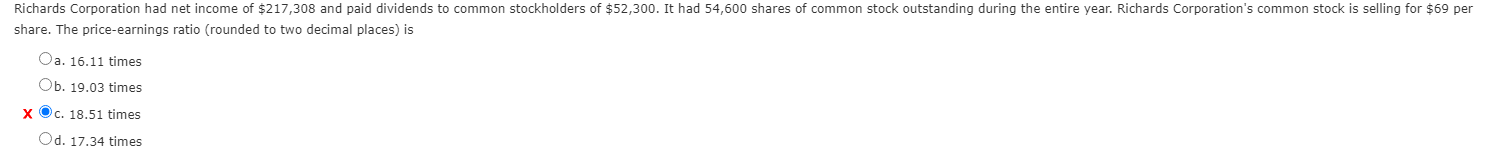

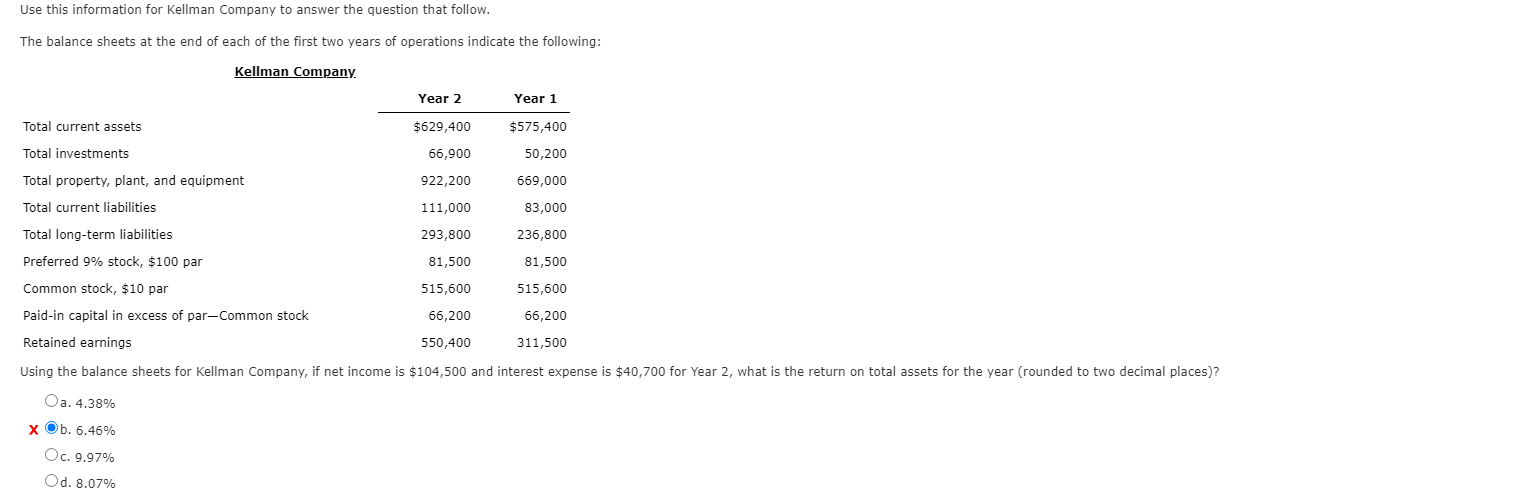

Use this information for Kellman Company to answer the question that follow. The balance sheets at the end of each of the first two years of operations indicate the following: Kellman Company Year 2 Year 1 Total current assets $601,100 $577,200 Total investments 67,500 49,000 Total property, plant, and equipment 930,500 700,600 Total current liabilities 118,500 80,600 Total long-term liabilities 305,300 246,700 Preferred 9% stock, $100 par 96,800 96,800 Common stock, $10 par 574,300 574,300 Paid-in capital in excess of par-Common stock 63,400 63,400 Retained earnings 440,800 265,000 Using the balance sheets for Kellman Company, if net income is $116,600 and interest expense is $37,300 for Year 2, and the market price of common shares is $38, what is the price-earnings ratio on common stock for Year 2? (Round intermediate calculation and final answer to two decimal places.) Oa. 10.72 Ob. 1.88 X c. 10.52 Od. 20.21 Based on the following data, what is the accounts receivable turnover? Sales on account during year $441,330 Cost of goods sold during year 218,853 Accounts receivable, beginning of year 43,518 Accounts receivable, end of year 52,154 Inventory, beginning of year 82,162 Inventory, end of year 115,887 Oa. 10.1 x Ob. 3.8 Oc. 9.2 O d. 2 Use this information for Kellman Company to answer the question that follow. The balance sheets at the end of each of the first two years of operations indicate the following: Kellman Company, Year 2 Year 1 Total current assets $604,700 $555,200 Total investments 64,600 54,200 Total property, plant, and equipment 939,900 636,800 Total current liabilities 112,200 81,700 Total long-term liabilities 291,600 237,100 Preferred 9% stock, $100 par 87,700 87,700 532,700 532,700 Common stock, $10 par Paid-in capital in excess of par-Common stock 64,800 64,800 Retained earnings 520,200 242,200 Using the balance sheets for Kellman Company, if net income is $102,400 and interest expense is $38,200 for Year 2, what is the return on stockholders' equity for Year 2 (rounded to two decimal places)? Oa. 9.80% Ob. 9.36% x Oc. 9.95% Od. 9.60% Richards Corporation had net income of $217,308 and paid dividends to common stockholders of $52,300. It had 54,600 shares of common stock outstanding during the entire year. Richards Corporation's common stock is selling for $69 per share. The price-earnings ratio (rounded to two decimal places) is Oa. 16.11 times Ob. 19.03 times X O c. 18.51 times Od. 17.34 times Use this information for Kellman Company to answer the question that follow. The balance sheets at the end of each of the first two years of operations indicate the following: Kellman Company Year 2 Year 1 Total current assets $629,400 $575,400 Total investments 66,900 50,200 922,200 669,000 Total property, plant, and equipment Total current liabilities 111,000 83,000 236,800 Total long-term liabilities 293,800 Preferred 9% stock, $100 par 81,500 81,500 515,600 515,600 Common stock, $10 par Paid-in capital in excess of par-Common stock 66,200 66,200 Retained earnings 550,400 311,500 Using the balance sheets for Kellman Company, if net income is $104,500 and interest expense is $40,700 for Year 2, what is the return on total assets for the year rounded to two decimal places)? Oa. 4.38% x Ob. 6.46% Oc. 9.97% Od. 8.07%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts