Question: Please answer quickly, I rate good! :) 5) Required information Problem 3-9A (Algo) Complete the full accounting cycle (LO3-3, 3-4, 3-5, 3-6, 3-7) [The following

![following information applies to the questions displayed below.] The general ledger of](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/6716a5dac317b_4986716a5da4a82d.jpg)

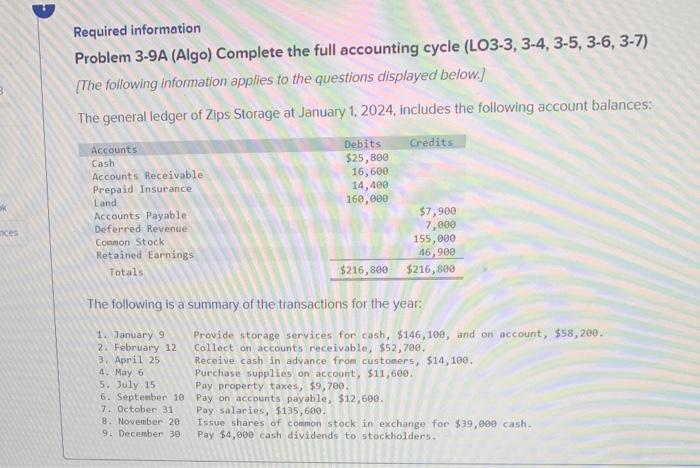

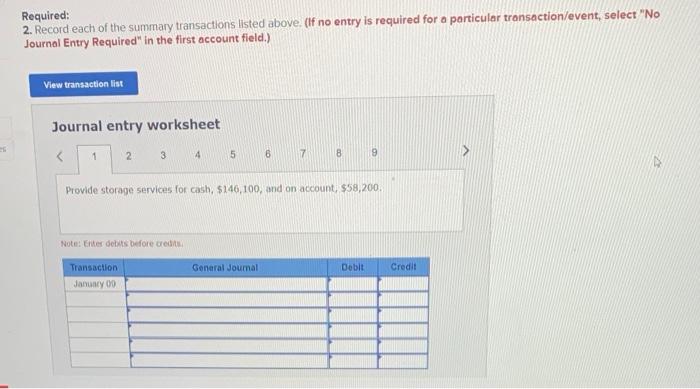

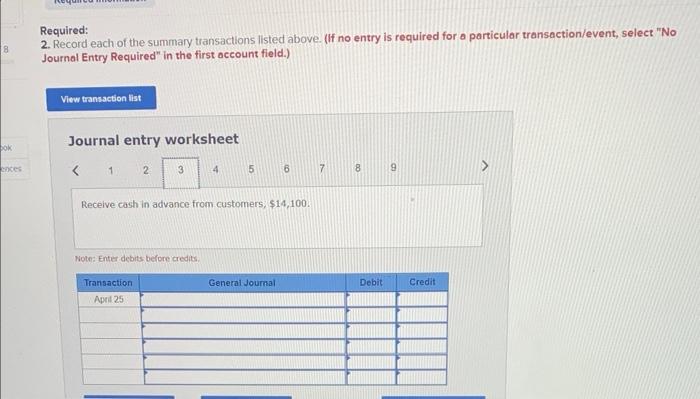

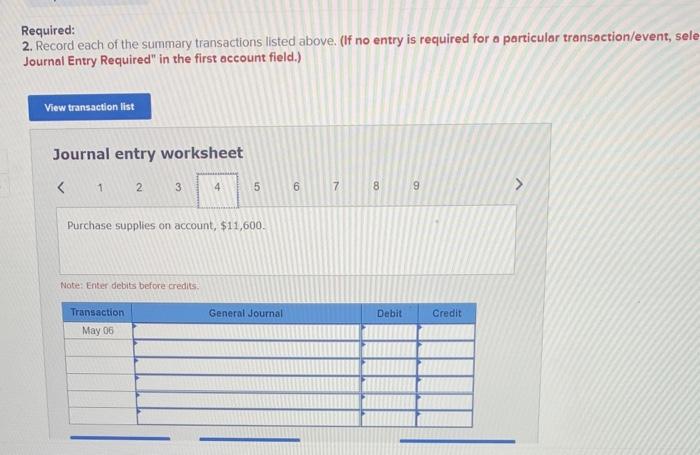

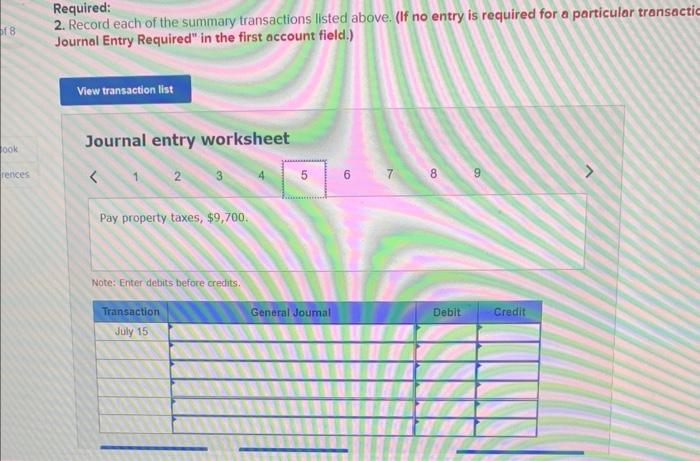

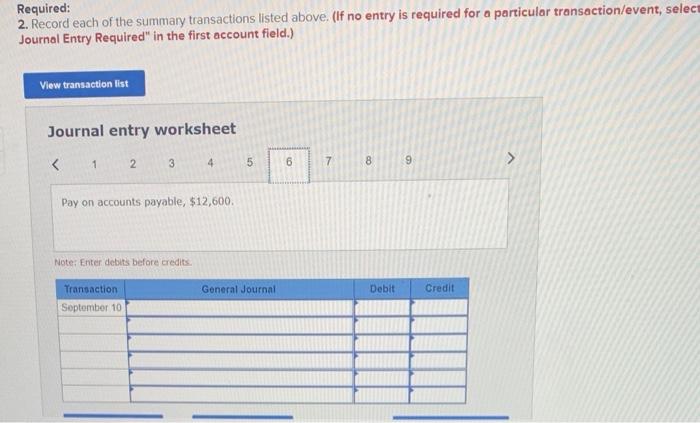

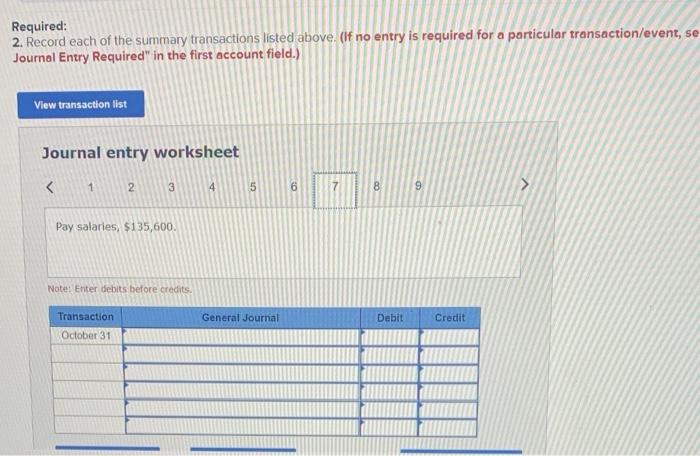

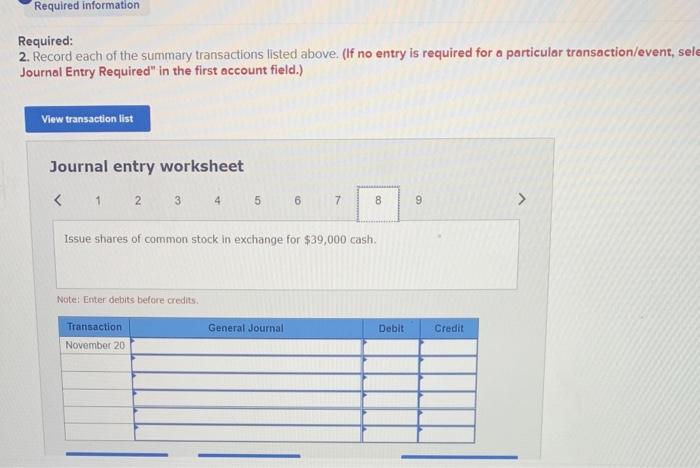

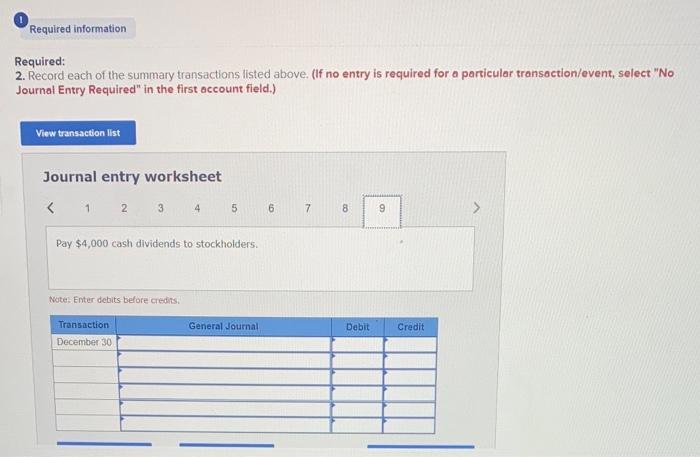

Required information Problem 3-9A (Algo) Complete the full accounting cycle (LO3-3, 3-4, 3-5, 3-6, 3-7) [The following information applies to the questions displayed below.] The general ledger of Zips Storage at January 1, 2024, includes the following account balances: The following is a summary of the transactions for the year: 1. January 9 Provide storage services for cash, $146,100, and on account, $58,200. 2. February 12 collect on accounts receivable, $52,700. 3. April 25 Receive cash in advance from customers, \$14, 190. 4. May 6 Purchase supplies on account, $11,600. 5. July 15 Pay property taxes, $9,700. 6. Septenber 10 Pay on accounts payable, $12,690. 7. October 31 Pay salaries, $135,600. 8. November 20 Issue shares of common stock in exchange for $39,000 cash. 9. December 30 Pay $4,800 cash dividends to stockholders. Required: 2. Record each of the summary transactions listed above. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Provide storage services for cash, $146,100, and on account, $58,200. Note: Eiter dehats before dedite: Required: 2. Record each of the summary transactions listed above. (If no entry is required for a particular Journal Entry Required" in the first account field.) Journal entry worksheet Note: Enter debits before credits. Required: 2. Record each of the summary transactions listed above. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Required: 2. Record each of the summary transactions listed above. (If no entry is required for a porticular transaction/event, sele Journal Entry Required" in the first account field.) Journal entry worksheet Purchase supplies on account, $11,600. Note: Enter debits before credits. Required: 2. Record each of the summary transactions listed above. (If no entry is required for a particular transactic Journal Entry Required" in the first account field.) Journal entry worksheet Required: 2. Record each of the summary transactions listed above. (If no entry is required for a particular transaction/event, selec Journal Entry Required" in the first account field.) Journal entry worksheet Required: 2. Record each of the summary transactions listed above. (If no entry is required for a particular transaction/event, s Journal Entry Required" in the first account field.) Journal entry worksheet Required: 2. Record each of the summary transadions listed above. (If no entry is required for a particular transaction/event, sel Journal Entry Required" in the first account field.) Journal entry worksheet Issue shares of common stock in exchange for $39,000 cash. Note: Enter debits before credits: Required: 2. Record each of the summary transactions listed above. (If no entry is required for a particular transoction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts