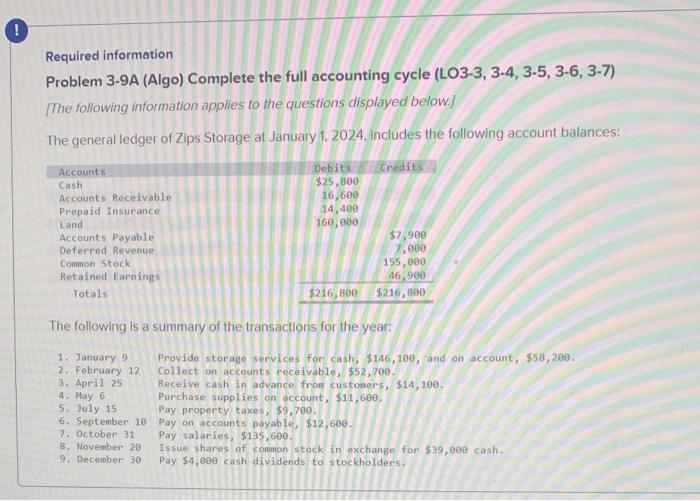

Question: Please answer quickly, I rate good! :) 7) Required information Problem 3-9A (Algo) Complete the full accounting cycle (LO3-3, 3-4, 3-5, 3-6, 3-7) [The following

![following information applies to the questions displayed below.] The general ledger of](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/6716a5bd96b0f_4696716a5bd24e97.jpg)

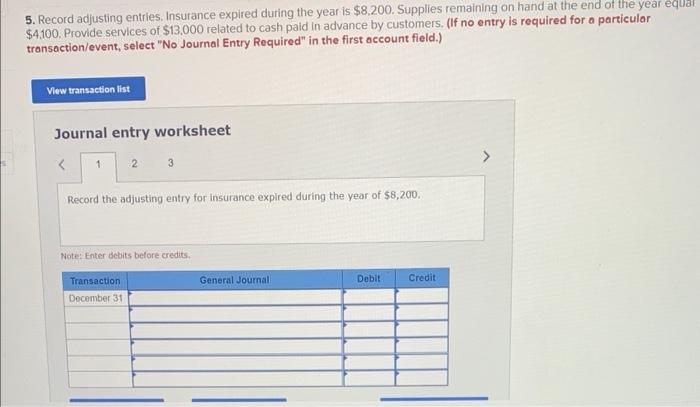

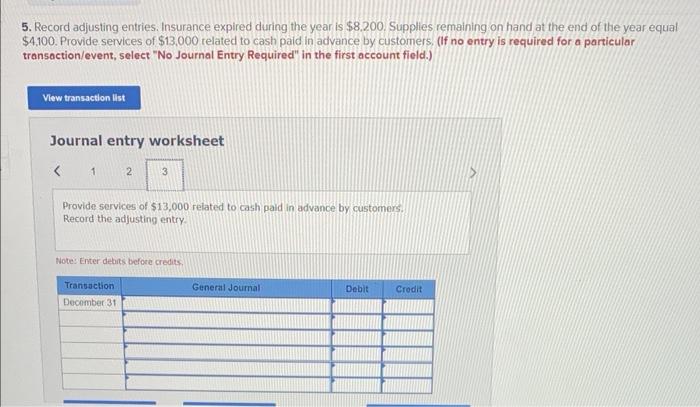

Required information Problem 3-9A (Algo) Complete the full accounting cycle (LO3-3, 3-4, 3-5, 3-6, 3-7) [The following information applies to the questions displayed below.] The general ledger of Zips Storage at January 1, 2024. Includes the following account balances: The following is a summary of the transactions for the year: 1. January 9 Provide storage services for cash, $146,109, and on account, $58,209. 2. February 12 Collect on accounts receivable, $52,700. 3. April 25 Receive cash in advance from custoners, $14,109. 4. May 6 Purchase supplies on account, $11,600. 5. July 15 Pay property taxes, \$9,709. 6. September 10 Pay on accounts payable, $12,609. 7. Octoben 31 Pay salaries, $135,600. 8. November 20 Issue shares of common stock in exchange for $39,609 cash. 9. December 30 Pay $4,000 cash dividends to stockhoiders. 5. Record adjusting entries. Insurance expired during the year is $8,200. Supplies remaining on hand at the end of the yea $4,100. Provide services of $13,000 related to cash paid In advance by customers. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Record the adjusting entry for insurance expired during the year of $8,200. Note: Enter debits before credits. 5. Record adjusting entries. Insurance explred during the year is $8,200. Supplies remaining on hand at the end of the year equal $4.100. Provide services of $13.000 related to cash paid in advance by customers. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet 3 Supplies remaining on hand at the end of the year equal \$4,100. Record the adjusting entry. Note: Enter debits before credits. 5. Record adjusting entries. Insurance expired during the year is $8.200. Supplies remaining on hand at the end of the year equal $4,100. Provide services of $13,000 related to cash paid in advance by customers, (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Provide services of $13,000 related to cash paid in advance by customers. Record the adjusting entry. Wote: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts