Question: Please answer quickly. I will give you like immediately. Swiss Ltd is considering investing in a project which requires an initial outlay of $650 000.

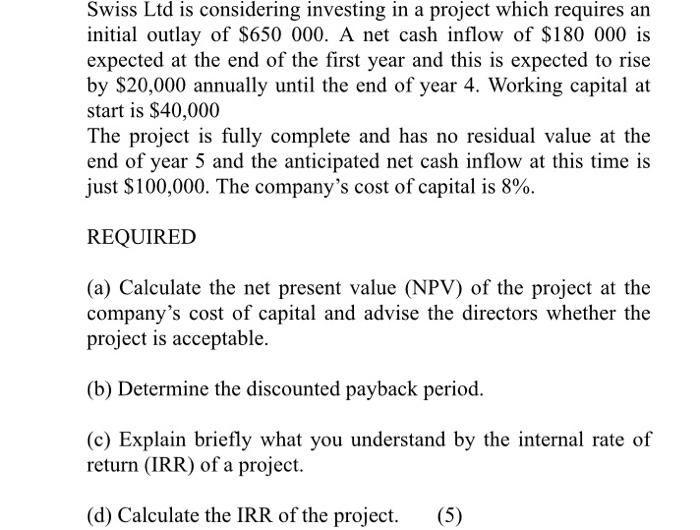

Swiss Ltd is considering investing in a project which requires an initial outlay of $650 000. A net cash inflow of $180 000 is expected at the end of the first year and this is expected to rise by $20,000 annually until the end of year 4. Working capital at start is $40,000 The project is fully complete and has no residual value at the end of year 5 and the anticipated net cash inflow at this time is just $100,000. The company's cost of capital is 8%. REQUIRED (a) Calculate the net present value (NPV) of the project at the company's cost of capital and advise the directors whether the project is acceptable. (b) Determine the discounted payback period. (c) Explain briefly what you understand by the internal rate of return (IRR) of a project. (d) Calculate the IRR of the project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts