Question: please answer Requirement A, PLEASE show and do the work correctly. check each picture. Palermo Incorporated purchased 80 percent of the outstanding stock of Salina

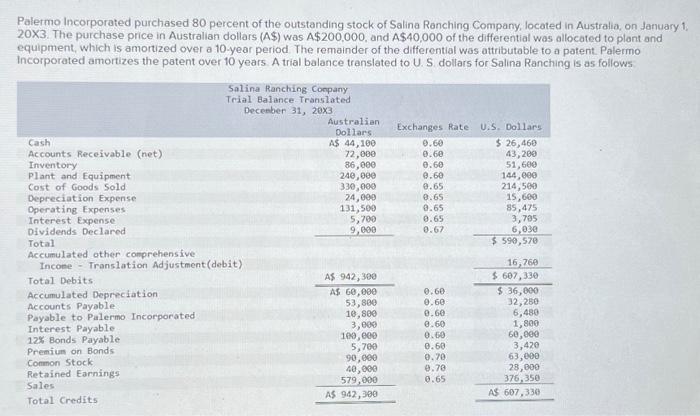

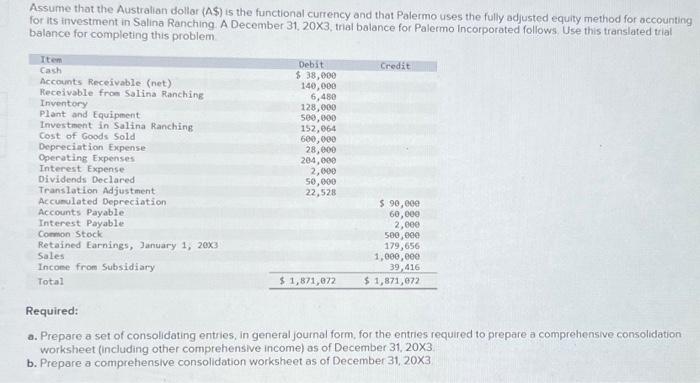

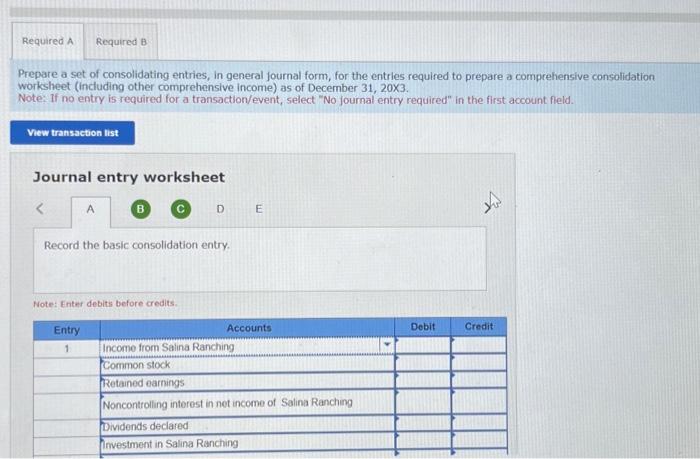

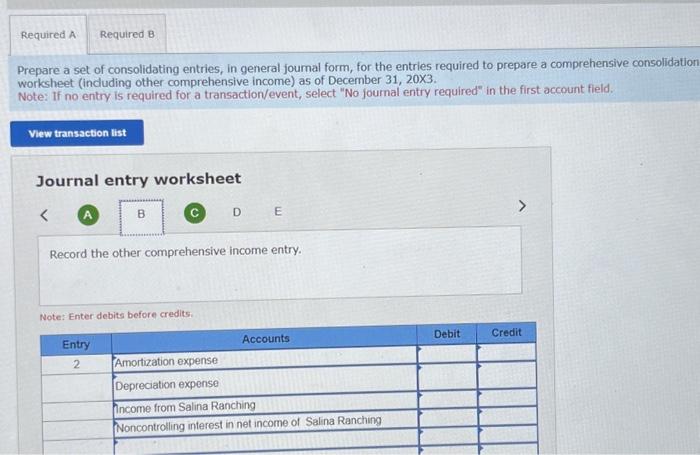

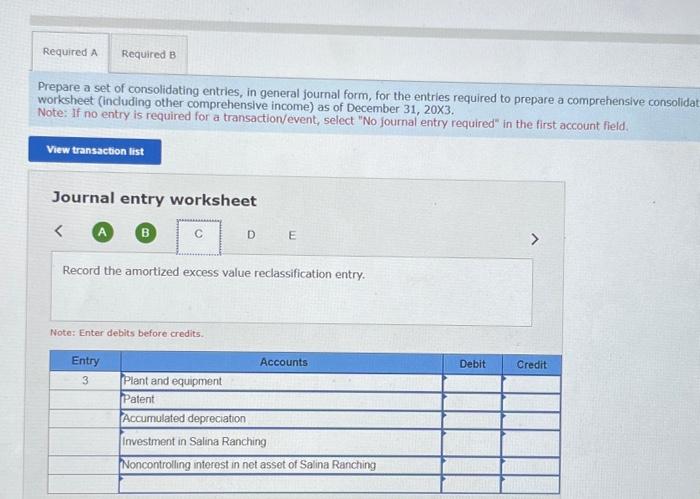

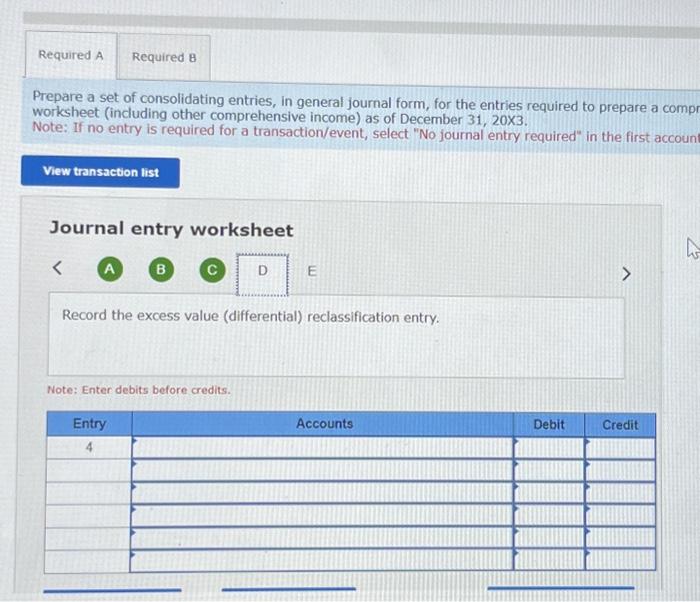

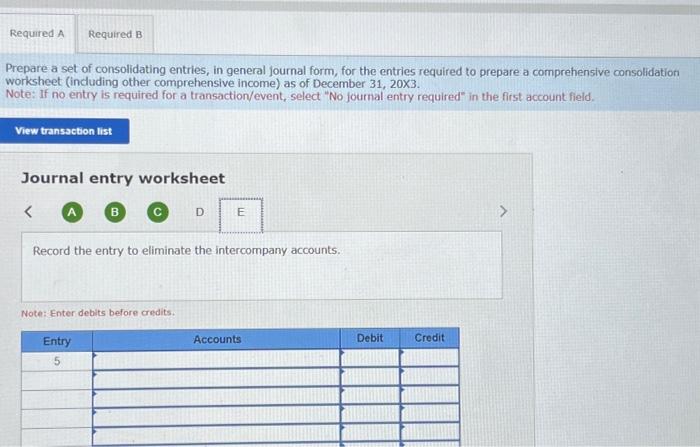

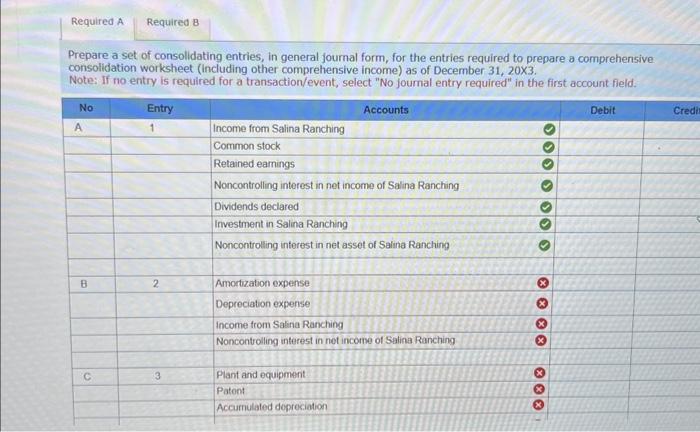

Palermo Incorporated purchased 80 percent of the outstanding stock of Salina Ranching Company, located in Australia, on January 1 . 20X3. The purchase price in Australian dollars (A\$) was A$200,000, and A$40,000 of the differential was allocated to plant and equipment, which is amortized over a 10 -year period. The remainder of the differential was attributable to a patent. Palermo Incorporated amortizes the patent over 10 years. A trial balance translated to U.S dollars for Salina Ranching is as follows Assume that the Australian dollar (AS) is the functional currency and that Palermo uses the fully adjusted equity method for accounting for its investment in Salina Ranching. A December 31, 20X3, trial balance for Palermo Incorporated follows, Use this translated trial balance for completing this problem Required: a. Prepare a set of consolidating entries, in general journal form, for the entries required to prepare a comprehensive consolidation worksheet (including other comprehensive income) as of December 31,203 b. Prepare a comprehensive consolidation worksheet as of December 31,203 Prepare a set of consolidating entries, in general fournal form, for the entries required to prepare a comprehensive consolidation worksheet (including other comprehensive income) as of December 31, 203. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Prepare a set of consolidating entries, in general joumal form, for the entries required to prepare a comprehensive consolidation worksheet (induding other comprehensive income) as of December 31,203. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet Record the other comprehensive income entry. Note: Enter debits before credits. Prepare a set of consolidating entries, in general journal form, for the entries required to prepare a comprehensive consolidat worksheet (induding other comprehensive income) as of December 31,203. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet (A) E Record the amortized excess value reclassification entry. Note: Enter debits before credits. Prepare a set of consolidating entries, in general journal form, for the entries required to prepare a comp worksheet (induding other comprehensive income) as of December 31,203. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first accoun Journal entry worksheet Record the excess value (differential) reclassification entry. Note: Enter debits before credits. Prepare a set of consolidating entries, in general journal form, for the entries required to prepare a comprehensive consolidation worksheet (induding other comprehensive income) as of December 31,20X3. Note: If no entry is nequired for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet A B D Record the entry to eliminate the intercompany accounts. Note: Enter debits before credits. Prepare a set of consolidating entries, in general journal form, for the entries required to prepare a comprehensive. consolidation worksheet (including other comprehensive income) as of December 31,203. Note: If no entry is required for a transaction/event, select "No joumal entry required" in the first account field. Palermo Incorporated purchased 80 percent of the outstanding stock of Salina Ranching Company, located in Australia, on January 1 . 20X3. The purchase price in Australian dollars (A\$) was A$200,000, and A$40,000 of the differential was allocated to plant and equipment, which is amortized over a 10 -year period. The remainder of the differential was attributable to a patent. Palermo Incorporated amortizes the patent over 10 years. A trial balance translated to U.S dollars for Salina Ranching is as follows Assume that the Australian dollar (AS) is the functional currency and that Palermo uses the fully adjusted equity method for accounting for its investment in Salina Ranching. A December 31, 20X3, trial balance for Palermo Incorporated follows, Use this translated trial balance for completing this problem Required: a. Prepare a set of consolidating entries, in general journal form, for the entries required to prepare a comprehensive consolidation worksheet (including other comprehensive income) as of December 31,203 b. Prepare a comprehensive consolidation worksheet as of December 31,203 Prepare a set of consolidating entries, in general fournal form, for the entries required to prepare a comprehensive consolidation worksheet (including other comprehensive income) as of December 31, 203. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Prepare a set of consolidating entries, in general joumal form, for the entries required to prepare a comprehensive consolidation worksheet (induding other comprehensive income) as of December 31,203. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet Record the other comprehensive income entry. Note: Enter debits before credits. Prepare a set of consolidating entries, in general journal form, for the entries required to prepare a comprehensive consolidat worksheet (induding other comprehensive income) as of December 31,203. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet (A) E Record the amortized excess value reclassification entry. Note: Enter debits before credits. Prepare a set of consolidating entries, in general journal form, for the entries required to prepare a comp worksheet (induding other comprehensive income) as of December 31,203. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first accoun Journal entry worksheet Record the excess value (differential) reclassification entry. Note: Enter debits before credits. Prepare a set of consolidating entries, in general journal form, for the entries required to prepare a comprehensive consolidation worksheet (induding other comprehensive income) as of December 31,20X3. Note: If no entry is nequired for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet A B D Record the entry to eliminate the intercompany accounts. Note: Enter debits before credits. Prepare a set of consolidating entries, in general journal form, for the entries required to prepare a comprehensive. consolidation worksheet (including other comprehensive income) as of December 31,203. Note: If no entry is required for a transaction/event, select "No joumal entry required" in the first account field

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts