Question: Please answer risk management question . Company A is full-services airline business. Company A have to evaluate risk assessment or Key Risk and Opportunity Identification

Please answer risk management question.

Company A is full-services airline business. Company A have to evaluate risk assessment or Key Risk and Opportunity Identification (KRI) at the end of every year and Company A have 4 risk type including

- Strategic Risk (S) refers to the risks associated with the formulation of policies and strategic plans of the organization in the future. or assumptions for business planning Management decisions that affect the implementation of a given strategy and causing operations at the organizational level to not achieve the goals according to the strategic plans set by the organization and includes events that may occur and result in the failure of the organization's strategy such as

Strategic and Strategic Planning Risk

Strategic decision risk

Risks in implementing strategic plans

Organizational structure risk

Planning and resource management risks

Risks in governance, monitoring and management according to strategic plans

Risk of communication and responsiveness to the needs of customers and stakeholders

Risk of corporate image and reputation

- Financial Risk (F) means risk arising from financial management or budget that does not meet the plan. which affects the financial statements and thus failing to achieve the objectives according to the set goals

Risks related to investment plans / budget plans / budget allocations

financial status risk

Capital Structure Risk

Financial liquidity risk

Cost management risk

- income risk

Debt Risk

Tax planning risks

Risk of important financial information/financial reports

Internal control risk

currency exchange rate risk Interest rates, oil prices, market conditions

- Operational Risk (O) means the risk arising from the operational process at the operational level. that affect the operation and achievement of the plans and goals set due to lack of control and good governance This may involve internal operating processes. or external events that affect operations

Organizational structure risk

The risk of assignments

Risks related to work systems and operational processes

Security management risks operational safety

- time risk

Customer satisfaction risk

Image/reputation risk

Personnel risk

Resource Management Risk

Information Technology Risk

Communication system risk

Internal control risk

Asset preservation risk

The risk of using outside services

Environmental risks

Ethical/Corruption Risk

- Risk of natural disasters, public disasters

Risk in Co-Jointing, collaboration between departments, departments

4. Compliance Risk(C) means the risk arising from non-compliance with relevant laws, regulations and standards. or existing laws that impede operations such as

Risks related to government policies

Risks related to laws, regulations, regulations

Risks related to international or World Organization requirements that are relevant and affecting operations

Risk related to the failure of the counterparty to complete the work as specified in the contract or breach of contract

Ethical Risks Code of Business Conduct Corruption

Risks related to intellectual property rights

And all of this risk coming form internal and external risk factor

1.Internal Risk Factor means internal risk factors that can be controlled by the organization. but affects or hinders the implementation of the strategic plan to achieve the goals such as

Organizational structure corporate culture

Process and work methods

The adequacy and quality of personnel including the ethics of personnel

The sufficiency and quality of the resources used in the operation

The adequacy and accuracy of the information

- technology used in the operation

working environment

2.External Risk Factor means Threats from external factors that are difficult to control. or unable to control and unable to turn into an opportunity (Opportunities), which affect and hinder

Risk factors related to target customers such as changes in behavior, socio-economic status, attitudes and lifestyles (Life Style)

Market risk factors such as competition for the same product, substitute products, and new products

Technology risk factors such as changes in technology involved

Political and social risk factors, such as continuity in government policies, interference from outsiders cooperation between different stakeholder groups or groups relating to protests, riots, or unemployment, etc.

Environmental risk factors and natural disasters such as insurgency, internal and border wars, floods, typhoons, mudslides, earthquakes, droughts, epidemics, power shortages, etc.

Financial and economic risk factors such as labor shortages Consumer purchasing power, inflation, currency devaluation, rising oil and energy prices. interest rate volatility exchange rate volatility fluctuations in raw material prices, etc.

relevant legal, regulatory and regulatory risk factors, such as the ambiguity of relevant laws; changes in regulations lack of confidence in law enforcement The law does not cover the rules, regulations and regulations that are lagging behind changes. declaration of emergency, etc.

Company A have to evaluate risk assessment at the end of every year to evaluate risk of the company in order to develop or stopping that risk to happen in the future.

Risk assessment

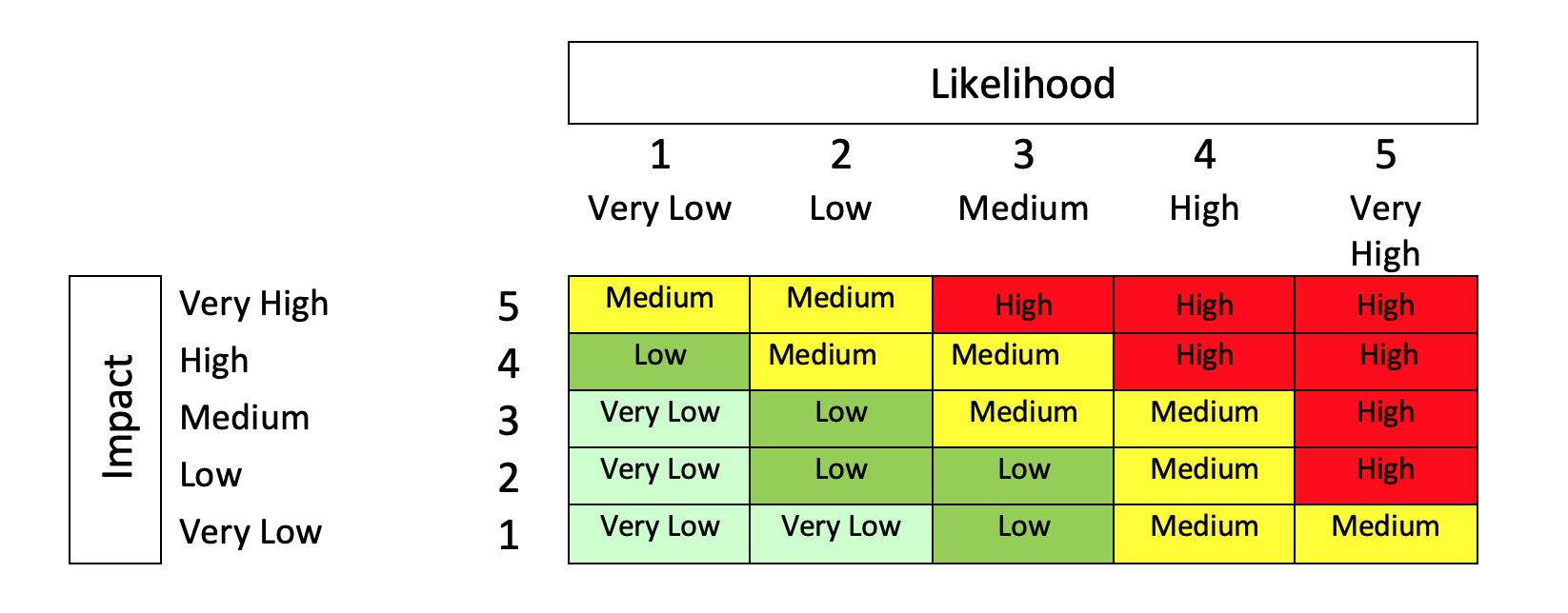

In risk assessment have 2 factor including likelihood and impact and we separate them into 5 level from very low (1), low (2), medium (3), high (4) and very high (5).

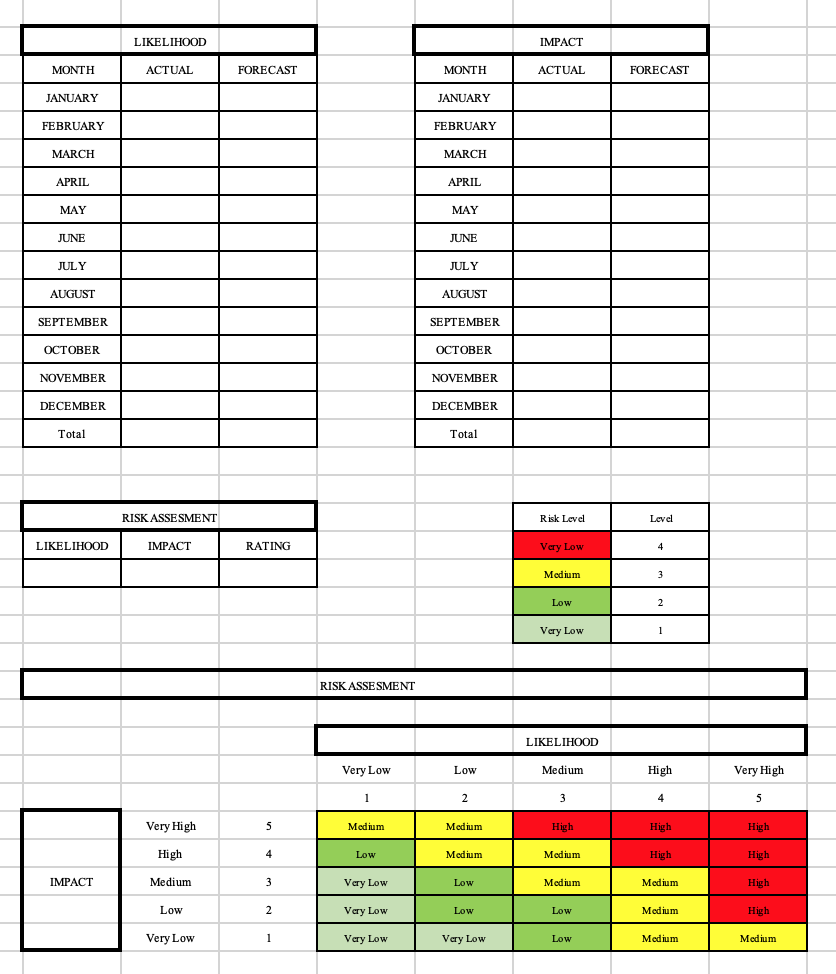

Normally in others company when they have to evaluate risk assessment they will use predict or forecast to evaluate impact and likelihood, but company A doesnt use forecast to evaluate risk assessment because if we use forecast to evaluate the result will be High, so company A use actual data of statistic that

used to happen in the past to evaluate. Advantage of using actual data when evaluate the result will show in Medium or Low. Disadvantage of using actual data which is some statistic that happen is never used to happen so when we evaluate the result will show in Very low.

So, company A plan to use actual data and forecast to evaluate risk assessment.

Company A want to use actual and forecast to evaluate risk assessment, what method that we can merging them together or what formular that we can balance them in easy way. In order to balance advantage and disadvantage of using actual statistic that used to happen and forecast.

Likelihood 2 1 Very Low 3 Medium 4 High Low 5 Very High High High 5 Medium Medium High Very High High Medium High High 4 Low Medium Medium Impact 3 Very Low Low Medium Medium High Low 2 Very Low Low Low Medium High Very Low 1 Very Low Very Low Low Medium Medium LIKELIHOOD IMPACT MONTH ACTUAL FORECAST MONTH ACTUAL FORECAST JANUARY JANUARY FEBRUARY FEBRUARY MARCH MARCH APRIL APRIL MAY MAY JUNE JUNE JULY JULY AUGUST AUGUST SEPTEMBER SEPTEMBER OCTOBER OCTOBER NOVEMBER NOVEMBER DECEMBER DECEMBER Total Total RISK ASSESMENT Risk Level Level LIKELIHOOD IMPACT RATING Very Low 4 Medium 3 Low 2 Very Low 1 1 RISK ASSESMENT LIKELIHOOD Very Low Low Medium High Very High 1 2 3 4 5 Very High 5 Medium Medium High High High High 4 Low Medium Medium High High IMPACT Medium 3 Very Low Low Medium Medium High Low 2 Very Low Low Low Medium High Very Low 1 Very Low Very Low Low Medium MediumStep by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts