Question: Please answer second portion in excel in accordance to solution sample please 5 4 The decision problem is to select the size of the new

Please answer second portion in excel in accordance to solution sample please

Please answer second portion in excel in accordance to solution sample please

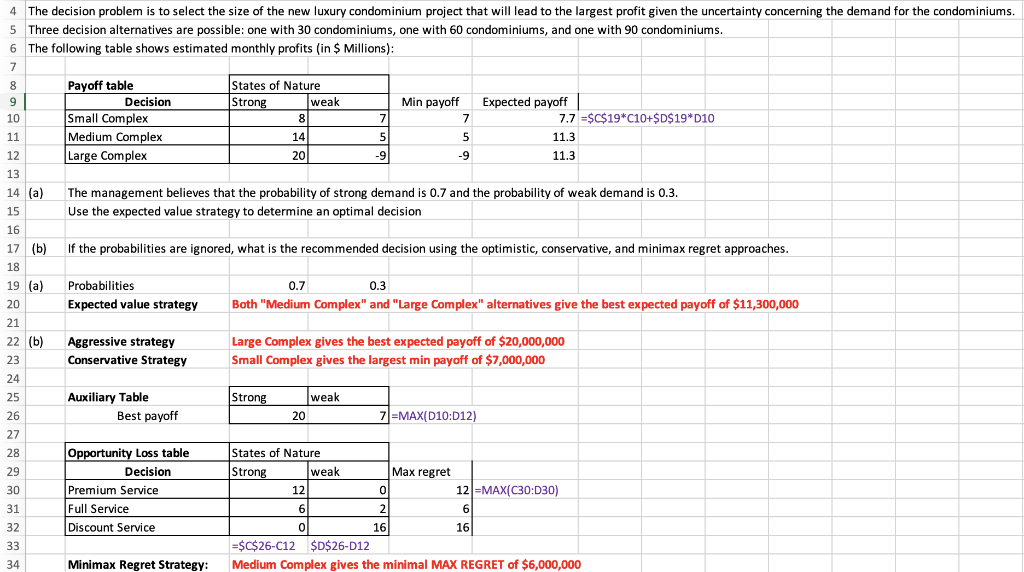

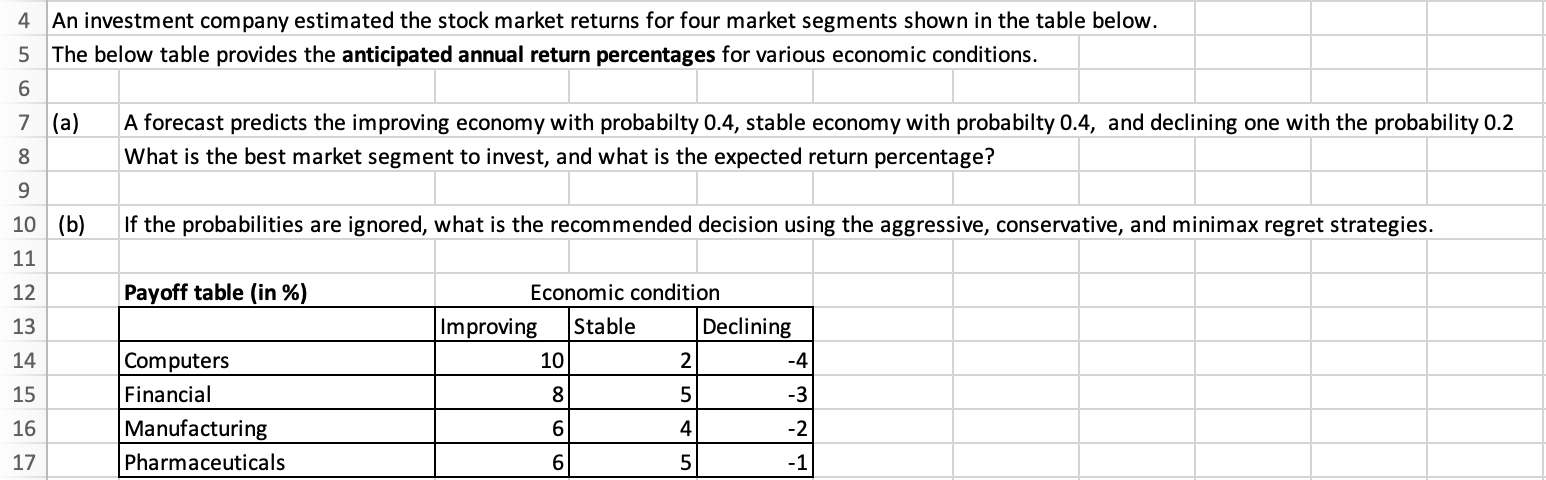

5 4 The decision problem is to select the size of the new luxury condominium project that will lead to the largest profit given the uncertainty concerning the demand for the condominiums. Three decision alternatives are possible: one with 30 condominiums, one with 60 condominiums, and one with 90 condominiums. 6 The following table shows estimated monthly profits (in $ Millions): 7 8 Payoff table States of Nature 9 Decision Strong weak Min payoff Expected payoff 10 Small Complex 8 7 7 7.7 =$C$19*C10+$D$19*D10 11 Medium Complex 14 5 5 11.3 12 Large Complex 20 -9 -9 11.3 13 14 (a) The management believes that the probability of strong demand is 0.7 and the probability of weak demand is 0.3. 15 Use the expected value strategy to determine an optimal decision 16 17 (b) If the probabilities are ignored, what is the recommended decision using the optimistic, conservative, and minimax regret approaches. 18 19 (a) Probabilities 0.7 0.3 20 Expected value strategy Both "Medium Complex" and "Large Complex" alternatives give the best expected payoff of $11,300,000 21 22 (b) Aggressive strategy Large Complex gives the best expected payoff of $20,000,000 23 Conservative Strategy Small Complex gives the largest min payoff of $7,000,000 24 25 Auxiliary Table Strong weak 26 Best payoff 20 7 =MAX(D10:012) 27 28 Opportunity Loss table States of Nature 29 Decision Strong weak Max regret 30 Premium Service 12 0 12 =MAX(C30:030) 31 Full Service 6 2 6 32 Discount Service o 16 16 33 =$C$26-012 $D$26-D12 34 Minimax Regret Strategy Medium Complex gives the minimal MAX REGRET of $6,000,000 4 8 An investment company estimated the stock market returns for four market segments shown in the table below. 5 The below table provides the anticipated annual return percentages for various economic conditions. 6 7 (a) A forecast predicts the improving economy with probabilty 0.4, stable economy with probabilty 0.4, and declining one with the probability 0.2 What is the best market segment to invest, and what is the expected return percentage? 9 10 (b) If the probabilities are ignored, what is the recommended decision using the aggressive, conservative, and minimax regret strategies. 11 12 Payoff table (in %) Economic condition 13 Improving Stable Declining 14 Computers 10 -4 15 Financial 5 -3 16 Manufacturing -2 17 Pharmaceuticals 5 -1 2 8 6 4 6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts