Question: Please answer showing each step and formula please do not use excel 2. Given the following information about a project : You know that some

Please answer showing each step and formula please do not use excel

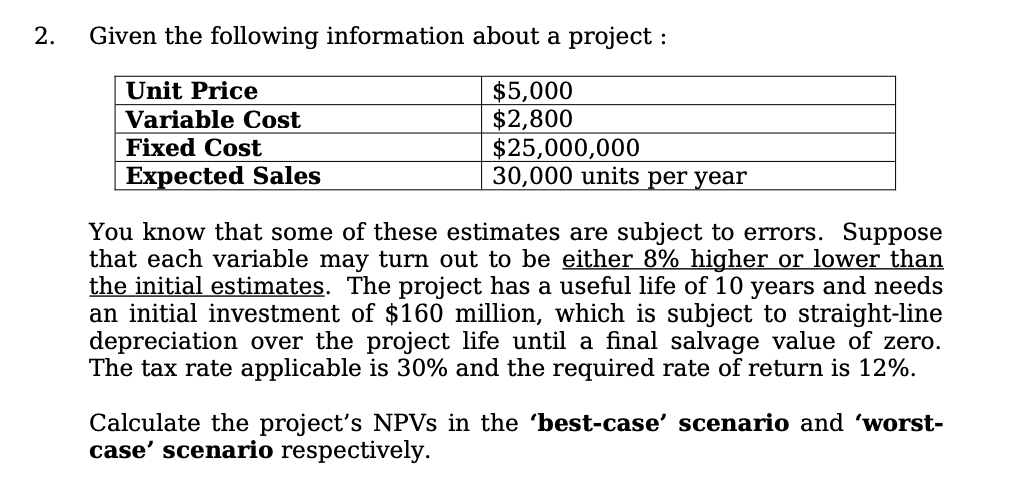

2. Given the following information about a project : You know that some of these estimates are subject to errors. Suppose that each variable may turn out to be either 8% higher or lower than the initial estimates. The project has a useful life of 10 years and needs an initial investment of $160 million, which is subject to straight-line depreciation over the project life until a final salvage value of zero. The tax rate applicable is 30% and the required rate of return is 12%. Calculate the project's NPVs in the 'best-case' scenario and 'worstcase' scenario respectively

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts