Question: Please answer step by step You have been scouring The Wall Street Journal looking for stocks that are good values and have calculated expected returns

Please answer step by step

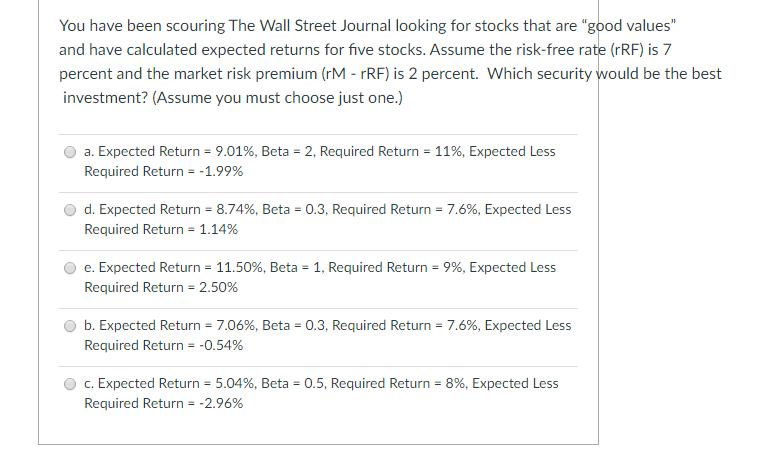

You have been scouring The Wall Street Journal looking for stocks that are "good values" and have calculated expected returns for five stocks. Assume the risk-free rate (rRF) is 7 percent and the market risk premium (rM - RF) is 2 percent. Which security would be the best investment? (Assume you must choose just one.) a. Expected Return = 9.01%, Beta = 2, Required Return = 11%, Expected Less Required Return = -1.99% d. Expected Return = 8.74%, Beta = 0.3, Required Return = 7.6%, Expected Less Required Return = 1.14% e. Expected Return = 11.50%, Beta = 1, Required Return = 9%, Expected Less Required Return = 2.50% b. Expected Return = 7.06%, Beta = 0.3, Required Return = 7.6%, Expected Less Required Return = -0.54% c. Expected Return = 5.04%, Beta = 0.5, Required Return = 8%, Expected Less Required Return = -2.96%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts