Question: please outline clear steps how to solve the problems. thank you! Company A and Company B have the same total assets, operating income (EBIT), tax

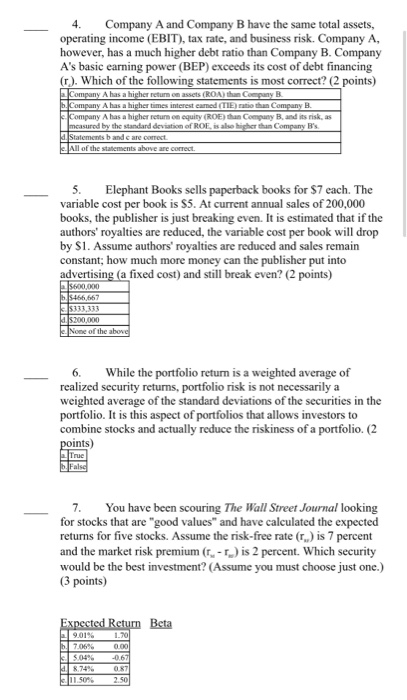

Company A and Company B have the same total assets, operating income (EBIT), tax rate, and business risk. Company A, however, has a much higher debt ratio than Company B. Company A's basic earning power (BEP) exceeds its cost of debt financing (r.). Which of the following statements is most correct? (2 points) Company A has a higher retum on assets (ROA) than Company B. bCompany A has a higher times interest eamed (TIE) ratio than Company B. Company A has a higher return on equity (ROE) than Company B, and its risk, as mcasured by the standard deviation of ROE, is also higher than Company B's 4Statements b and e are correct. All of the statements above are correct. 5. variable cost per book is $5. At current annual sales of 200,000 books, the publisher is just breaking even. It is estimated that if the authors' royalties are reduced, the variable cost per book will drop by $1. Assume authors' royalties are reduced and sales remain constant; how much more money can the publisher put into advertising (a fixed cost) and still break even? (2 points) S600,000 bS466,667 $333,333 als200,000 None of the above Elephant Books sells paperback books for $7 each. The 6. realized security returns, portfolio risk is not necessarily a weighted average of the standard deviations of the securities in the portfolio. It is this aspect of portfolios that allows investors to combine stocks and actually reduce the riskiness of a portfolio. (2 points) Truc False While the portfolio return is a weighted average of 7. You have been scouring The Wall Street Journal looking for stocks that are "good values" and have calculated the expected returns for five stocks. Assume the risk-free rate (r,) is 7 percent and the market risk premium (r. - r) is 2 percent. Which security would be the best investment? (Assume you must choose just one.) (3 points) Expected Return Beta a 9.01% 1.70 b. 7.06% 0.00 kl 504% -0.67 al 8.74% 087 e11.50% 2.50

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts