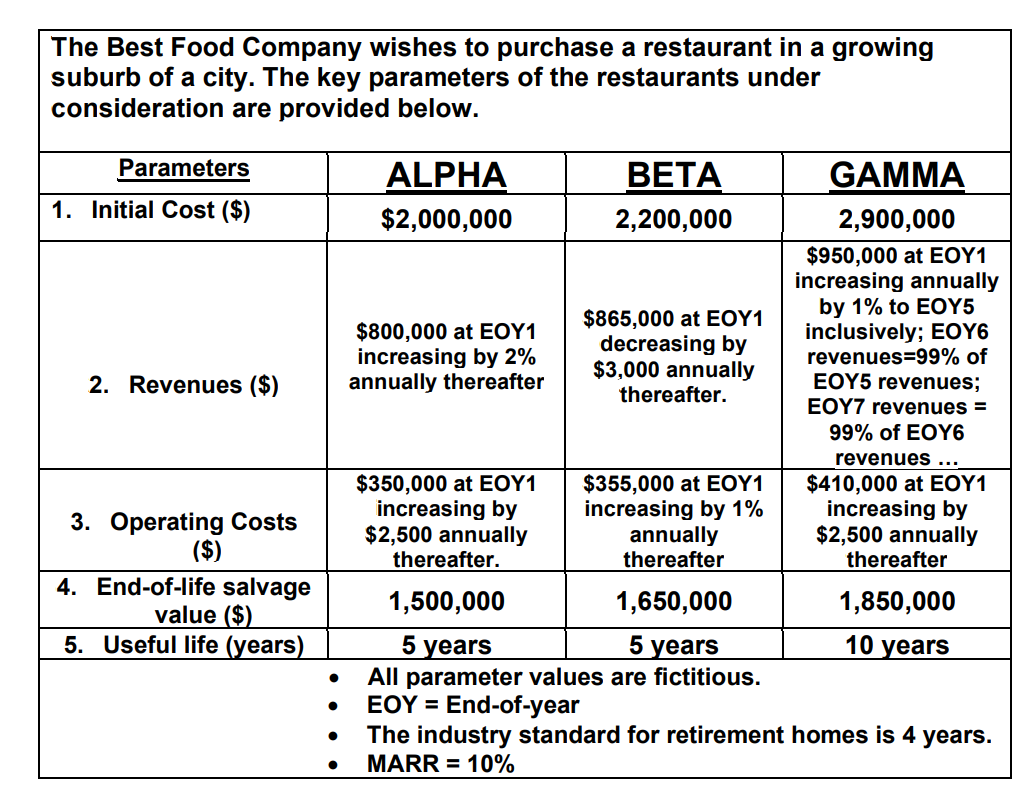

Question: Please answer the 3 questions step by step, thank you. The Best Food Company wishes to purchase a restaurant in a growing cilhrh nf a

Please answer the 3 questions step by step, thank you.

Please answer the 3 questions step by step, thank you.

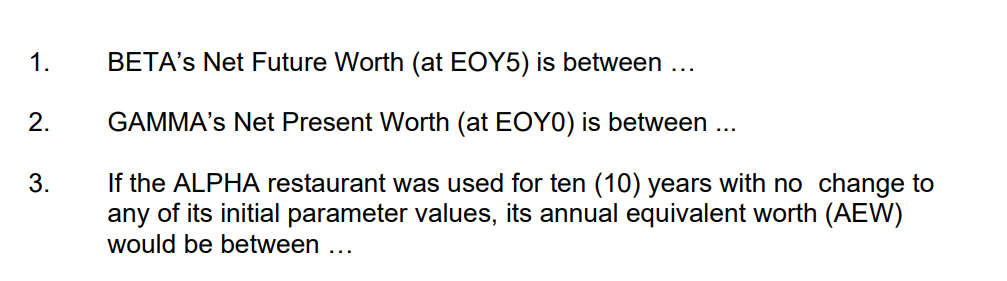

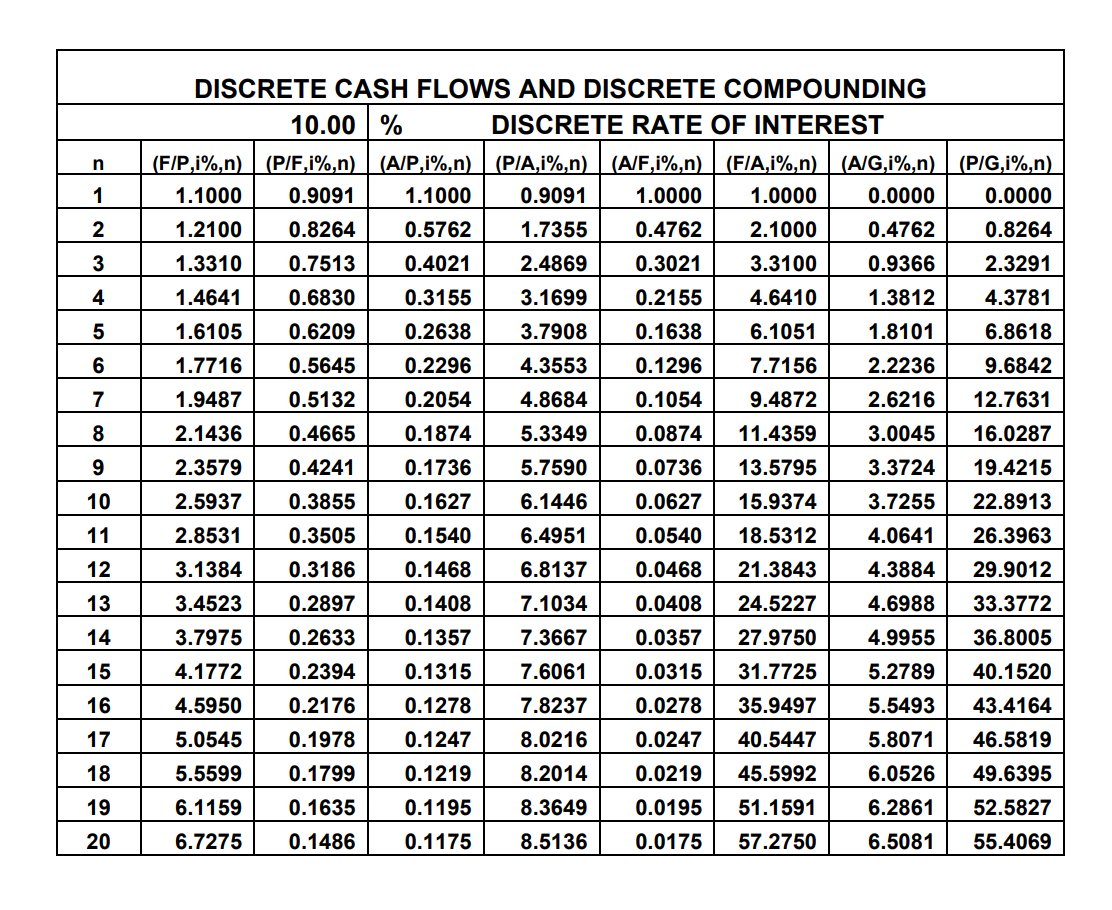

The Best Food Company wishes to purchase a restaurant in a growing cilhrh nf a rity Tho kay naramotare of tho roctarante indar 1. BETA's Net Future Worth (at EOY5) is between ... 2. GAMMA's Net Present Worth (at EOY0) is between ... 3. If the ALPHA restaurant was used for ten (10) years with no change to any of its initial parameter values, its annual equivalent worth (AEW) would be between ... DISCRETE CASH FLOWS AND DISCRETE COMPOUNDING \begin{tabular}{|r|r|r|r|r|r|r|r|r|} \hline \multicolumn{7}{|c|}{10.00} & \multicolumn{7}{l}{ DISCRETE RATE OF INTEREST } \\ \hline n & (F/P,i%,n) & (P/F,i%,n) & (A/P,i%,n) & (P/A,i%,n) & (A/F,i%,n) & (F/A,i%,n) & (A/G,i%,n) & (P/G,i%,n) \\ \hline 1 & 1.1000 & 0.9091 & 1.1000 & 0.9091 & 1.0000 & 1.0000 & 0.0000 & 0.0000 \\ \hline 2 & 1.2100 & 0.8264 & 0.5762 & 1.7355 & 0.4762 & 2.1000 & 0.4762 & 0.8264 \\ \hline 3 & 1.3310 & 0.7513 & 0.4021 & 2.4869 & 0.3021 & 3.3100 & 0.9366 & 2.3291 \\ \hline 4 & 1.4641 & 0.6830 & 0.3155 & 3.1699 & 0.2155 & 4.6410 & 1.3812 & 4.3781 \\ \hline 5 & 1.6105 & 0.6209 & 0.2638 & 3.7908 & 0.1638 & 6.1051 & 1.8101 & 6.8618 \\ \hline 6 & 1.7716 & 0.5645 & 0.2296 & 4.3553 & 0.1296 & 7.7156 & 2.2236 & 9.6842 \\ \hline 7 & 1.9487 & 0.5132 & 0.2054 & 4.8684 & 0.1054 & 9.4872 & 2.6216 & 12.7631 \\ \hline 8 & 2.1436 & 0.4665 & 0.1874 & 5.3349 & 0.0874 & 11.4359 & 3.0045 & 16.0287 \\ \hline 9 & 2.3579 & 0.4241 & 0.1736 & 5.7590 & 0.0736 & 13.5795 & 3.3724 & 19.4215 \\ \hline 10 & 2.5937 & 0.3855 & 0.1627 & 6.1446 & 0.0627 & 15.9374 & 3.7255 & 22.8913 \\ \hline 11 & 2.8531 & 0.3505 & 0.1540 & 6.4951 & 0.0540 & 18.5312 & 4.0641 & 26.3963 \\ \hline 12 & 3.1384 & 0.3186 & 0.1468 & 6.8137 & 0.0468 & 21.3843 & 4.3884 & 29.9012 \\ \hline 13 & 3.4523 & 0.2897 & 0.1408 & 7.1034 & 0.0408 & 24.5227 & 4.6988 & 33.3772 \\ \hline 14 & 3.7975 & 0.2633 & 0.1357 & 7.3667 & 0.0357 & 27.9750 & 4.9955 & 36.8005 \\ \hline 15 & 4.1772 & 0.2394 & 0.1315 & 7.6061 & 0.0315 & 31.7725 & 5.2789 & 40.1520 \\ \hline 16 & 4.5950 & 0.2176 & 0.1278 & 7.8237 & 0.0278 & 35.9497 & 5.5493 & 43.4164 \\ \hline 17 & 5.0545 & 0.1978 & 0.1247 & 8.0216 & 0.0247 & 40.5447 & 5.8071 & 46.5819 \\ \hline 18 & 5.5599 & 0.1799 & 0.1219 & 8.2014 & 0.0219 & 45.5992 & 6.0526 & 49.6395 \\ \hline 19 & 6.1159 & 0.1635 & 0.1195 & 8.3649 & 0.0195 & 51.1591 & 6.2861 & 52.5827 \\ \hline 20 & 6.7275 & 0.1486 & 0.1175 & 8.5136 & 0.0175 & 57.2750 & 6.5081 & 55.4069 \\ \hline \end{tabular} The Best Food Company wishes to purchase a restaurant in a growing cilhrh nf a rity Tho kay naramotare of tho roctarante indar 1. BETA's Net Future Worth (at EOY5) is between ... 2. GAMMA's Net Present Worth (at EOY0) is between ... 3. If the ALPHA restaurant was used for ten (10) years with no change to any of its initial parameter values, its annual equivalent worth (AEW) would be between ... DISCRETE CASH FLOWS AND DISCRETE COMPOUNDING \begin{tabular}{|r|r|r|r|r|r|r|r|r|} \hline \multicolumn{7}{|c|}{10.00} & \multicolumn{7}{l}{ DISCRETE RATE OF INTEREST } \\ \hline n & (F/P,i%,n) & (P/F,i%,n) & (A/P,i%,n) & (P/A,i%,n) & (A/F,i%,n) & (F/A,i%,n) & (A/G,i%,n) & (P/G,i%,n) \\ \hline 1 & 1.1000 & 0.9091 & 1.1000 & 0.9091 & 1.0000 & 1.0000 & 0.0000 & 0.0000 \\ \hline 2 & 1.2100 & 0.8264 & 0.5762 & 1.7355 & 0.4762 & 2.1000 & 0.4762 & 0.8264 \\ \hline 3 & 1.3310 & 0.7513 & 0.4021 & 2.4869 & 0.3021 & 3.3100 & 0.9366 & 2.3291 \\ \hline 4 & 1.4641 & 0.6830 & 0.3155 & 3.1699 & 0.2155 & 4.6410 & 1.3812 & 4.3781 \\ \hline 5 & 1.6105 & 0.6209 & 0.2638 & 3.7908 & 0.1638 & 6.1051 & 1.8101 & 6.8618 \\ \hline 6 & 1.7716 & 0.5645 & 0.2296 & 4.3553 & 0.1296 & 7.7156 & 2.2236 & 9.6842 \\ \hline 7 & 1.9487 & 0.5132 & 0.2054 & 4.8684 & 0.1054 & 9.4872 & 2.6216 & 12.7631 \\ \hline 8 & 2.1436 & 0.4665 & 0.1874 & 5.3349 & 0.0874 & 11.4359 & 3.0045 & 16.0287 \\ \hline 9 & 2.3579 & 0.4241 & 0.1736 & 5.7590 & 0.0736 & 13.5795 & 3.3724 & 19.4215 \\ \hline 10 & 2.5937 & 0.3855 & 0.1627 & 6.1446 & 0.0627 & 15.9374 & 3.7255 & 22.8913 \\ \hline 11 & 2.8531 & 0.3505 & 0.1540 & 6.4951 & 0.0540 & 18.5312 & 4.0641 & 26.3963 \\ \hline 12 & 3.1384 & 0.3186 & 0.1468 & 6.8137 & 0.0468 & 21.3843 & 4.3884 & 29.9012 \\ \hline 13 & 3.4523 & 0.2897 & 0.1408 & 7.1034 & 0.0408 & 24.5227 & 4.6988 & 33.3772 \\ \hline 14 & 3.7975 & 0.2633 & 0.1357 & 7.3667 & 0.0357 & 27.9750 & 4.9955 & 36.8005 \\ \hline 15 & 4.1772 & 0.2394 & 0.1315 & 7.6061 & 0.0315 & 31.7725 & 5.2789 & 40.1520 \\ \hline 16 & 4.5950 & 0.2176 & 0.1278 & 7.8237 & 0.0278 & 35.9497 & 5.5493 & 43.4164 \\ \hline 17 & 5.0545 & 0.1978 & 0.1247 & 8.0216 & 0.0247 & 40.5447 & 5.8071 & 46.5819 \\ \hline 18 & 5.5599 & 0.1799 & 0.1219 & 8.2014 & 0.0219 & 45.5992 & 6.0526 & 49.6395 \\ \hline 19 & 6.1159 & 0.1635 & 0.1195 & 8.3649 & 0.0195 & 51.1591 & 6.2861 & 52.5827 \\ \hline 20 & 6.7275 & 0.1486 & 0.1175 & 8.5136 & 0.0175 & 57.2750 & 6.5081 & 55.4069 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts