Question: Please answer the above question. The below is an incorrect answer given. Required information Problem 19-40 (LO 19-2) (Algo) [The following information applies to the

Please answer the above question. The below is an incorrect answer given.

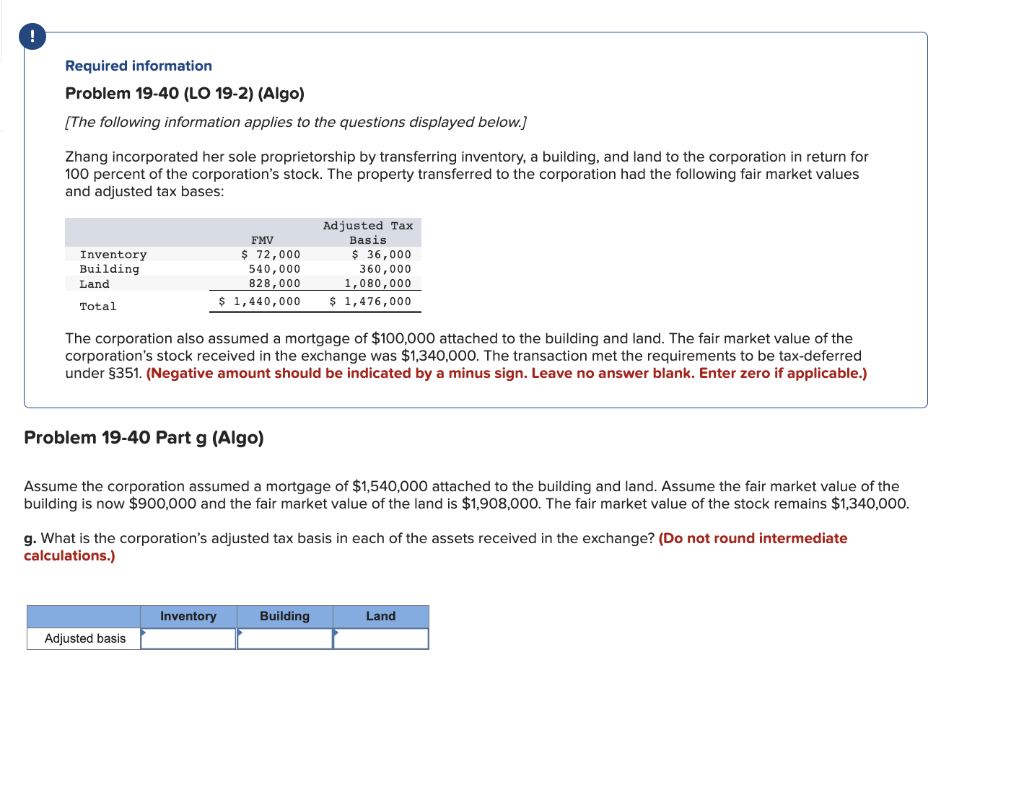

Required information Problem 19-40 (LO 19-2) (Algo) [The following information applies to the questions displayed below.] Zhang incorporated her sole proprietorship by transferring inventory, a building, and land to the corporation in return for 100 percent of the corporation's stock. The property transferred to the corporation had the following fair market values and adjusted tax bases: The corporation also assumed a mortgage of $100,000 attached to the building and land. The fair market value of the corporation's stock received in the exchange was $1,340,000. The transaction met the requirements to be tax-deferred under 351. (Negative amount should be indicated by a minus sign. Leave no answer blank. Enter zero if applicable.) Problem 19-40 Part g (Algo) Assume the corporation assumed a mortgage of $1,540,000 attached to the building and land. Assume the fair market value of the building is now $900,000 and the fair market value of the land is $1,908,000. The fair market value of the stock remains $1,340,000. g. What is the corporation's adjusted tax basis in each of the assets received in the exchange? (Do not round intermediate calculations.)Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock