Question: Please answer the all the question. Thank you so much. Fill in the blanks The financial predictions for Company A project are as follows: .

Please answer the all the question. Thank you so much.

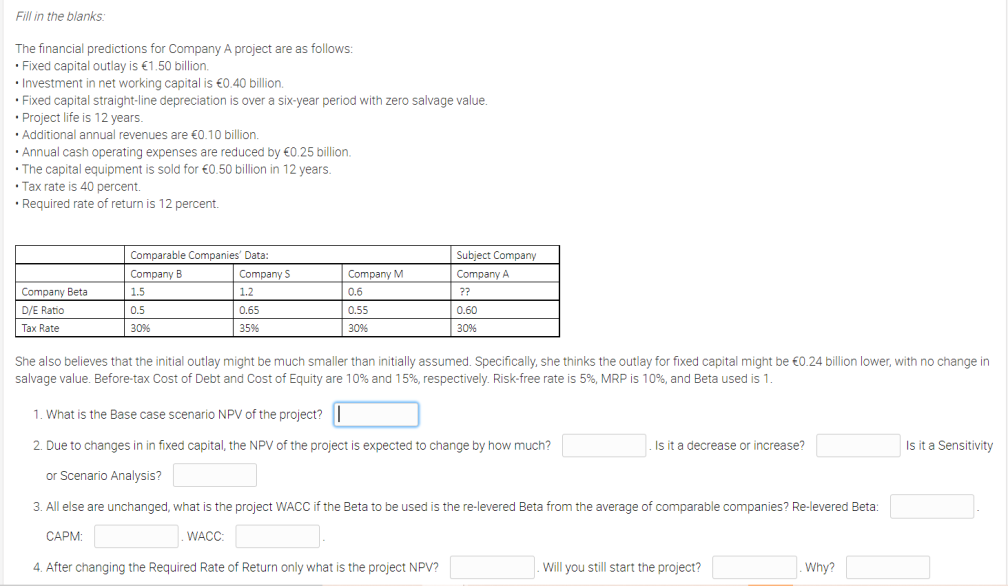

Fill in the blanks The financial predictions for Company A project are as follows: . Fixed capital outlay is 1.50 billion. Investment in net working capital is 0.40 billion . Fixed capital straight-line depreciation is over a six-year period with zero salvage value. Project life is 12 years. . Additional annual revenues are 0.10 billion. Annual cash operating expenses are reduced by 0.25 billion. The capital equipment is sold for 0.50 billion in 12 years. Tax rate is 40 percent. Required rate of return is 12 percent. Comparable Companies' Data: Company B Company S 1.5 1.2 0.5 0.65 30% 3596 Company M 0.6 Company Beta D/E Ratio Tax Rate Subject Company Company A ?? 0.60 30% 0.55 3096 She also believes that the initial outlay might be much smaller than initially assumed. Specifically, she thinks the outlay for fixed capital might be 0.24 billion lower, with no change in salvage value. Before-tax Cost of Debt and Cost of Equity are 10% and 15%, respectively. Risk-free rate is 5%, MRP is 10%, and Beta used is 1. 1. What is the Base case scenario NPV of the project? | 2. Due to changes in in fixed capital, the NPV of the project is expected to change by how much? Is it a decrease or increase? Is it a Sensitivity or Scenario Analysis? 3. All else are unchanged, what is the project WACC if the Beta to be used is the re-levered Beta from the average of comparable companies? Re-levered Beta: : WACC 4. After changing the required Rate of Return only what is the project NPV? Will you still start the project? Why? Fill in the blanks The financial predictions for Company A project are as follows: . Fixed capital outlay is 1.50 billion. Investment in net working capital is 0.40 billion . Fixed capital straight-line depreciation is over a six-year period with zero salvage value. Project life is 12 years. . Additional annual revenues are 0.10 billion. Annual cash operating expenses are reduced by 0.25 billion. The capital equipment is sold for 0.50 billion in 12 years. Tax rate is 40 percent. Required rate of return is 12 percent. Comparable Companies' Data: Company B Company S 1.5 1.2 0.5 0.65 30% 3596 Company M 0.6 Company Beta D/E Ratio Tax Rate Subject Company Company A ?? 0.60 30% 0.55 3096 She also believes that the initial outlay might be much smaller than initially assumed. Specifically, she thinks the outlay for fixed capital might be 0.24 billion lower, with no change in salvage value. Before-tax Cost of Debt and Cost of Equity are 10% and 15%, respectively. Risk-free rate is 5%, MRP is 10%, and Beta used is 1. 1. What is the Base case scenario NPV of the project? | 2. Due to changes in in fixed capital, the NPV of the project is expected to change by how much? Is it a decrease or increase? Is it a Sensitivity or Scenario Analysis? 3. All else are unchanged, what is the project WACC if the Beta to be used is the re-levered Beta from the average of comparable companies? Re-levered Beta: : WACC 4. After changing the required Rate of Return only what is the project NPV? Will you still start the project? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts